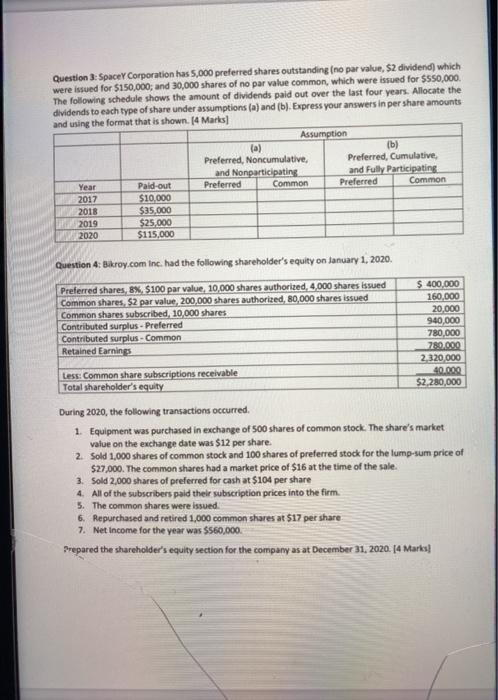

SpaceY Corporation has 5,000 preferred shares outstanding (no par value, $2 dividend) which were issued for $150,000; and 30,000 shares of no par value common, which were issued for $550,000. The following schedule shows the amount of dividends paid out over the last four years. Allocate the dividends to each type of share under assumptions (a) and (b). Express your answers in per share amounts and using the format that is shown. [4 Marks]

(a)

Preferred, Noncumulative, and Nonparticipating

(b) Preferred, Cumulative, and Fully Participating

Year 2017 2018 2019 2020

Paid-out $10,000 $35,000 $25,000 $115,000

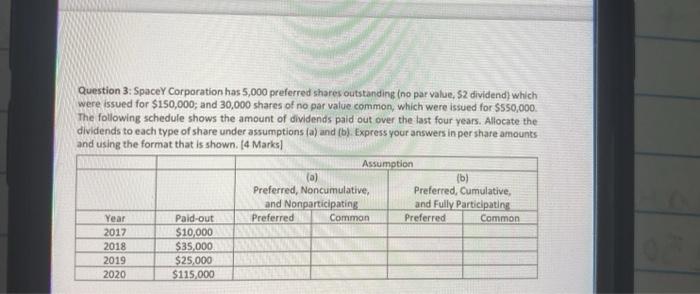

Question 3: Space Corporation has 5,000 preferred shares outstanding Ino par value, $2 dividend) which were issued for $150,000, and 30,000 shares of no par value common, which were issued for $550.000 The following schedule shows the amount of dividends paid out over the last four years. Allocate the dividends to each type of share under assumptions (a) and (b). Express your answers in per share amounts and using the format that is shown. [4 Marks] Assumption (a) (b) Preferred, Noncumulative, Preferred, Cumulative and Nonparticipating and Fully Participating Year Paid-out Preferred Common Preferred Common 2017 $10,000 2018 $35,000 2019 $25,000 2020 $115,000 Question 4: Bikroy.com Inc. had the following shareholder's equity on January 1, 2020. Preferred shares, 8%, $100 par value, 10,000 shares authorized, 4,000 shares issued Common shares. $2 par value, 200,000 shares authorized, 80,000 shares issued Common shares subscribed, 10,000 shares Contributed surplus - Preferred Contributed surplus - Common Retained Earnings $ 400,000 160.000 20,000 940,000 780,000 780.000 2.320,000 40.000 $2.280,000 Less: Common share subscriptions receivable Total shareholder's equity During 2020, the following transactions occurred. 1. Equipment was purchased in exchange of 500 shares of common stock. The share's market value on the exchange date was $12 per share. 2. Sold 1,000 shares of common stock and 100 shares of preferred stock for the lump-sum price of $27,000. The common shares had a market price of $16 at the time of the sale. 3. Sold 2,000 shares of preferred for cash at $104 per share 4. All of the subscribers paid their subscription prices into the firm. 5. The common shares were issued 6. Repurchased and retired 1,000 common shares at $17 per share 7. Net Income for the year was $560,000 Prepared the shareholder's equity section for the company as at December 31, 2020. (4 Marks] Question 3: Spacey Corporation has 5,000 preferred shares outstanding (no par value 52 dividend) which were issued for $150,000; and 30,000 shares of no par value common, which were issued for S550,000 The following schedule shows the amount of dividends paid out over the last four years. Allocate the dividends to each type of share under assumptions (a) and (b). Express your answers in per share amounts and using the format that is shown (4 Marks Assumption (0) (b) Preferred, Noncumulative, Preferred, Cumulative, and Nonparticipating and Fully Participating Year Pald-out Preferred Comman Preferred Common 2017 $10,000 2018 $35.000 2019 $25,000 2020 $115,000 Question 3: Space Corporation has 5,000 preferred shares outstanding Ino par value, $2 dividend) which were issued for $150,000, and 30,000 shares of no par value common, which were issued for $550.000 The following schedule shows the amount of dividends paid out over the last four years. Allocate the dividends to each type of share under assumptions (a) and (b). Express your answers in per share amounts and using the format that is shown. [4 Marks] Assumption (a) (b) Preferred, Noncumulative, Preferred, Cumulative and Nonparticipating and Fully Participating Year Paid-out Preferred Common Preferred Common 2017 $10,000 2018 $35,000 2019 $25,000 2020 $115,000 Question 4: Bikroy.com Inc. had the following shareholder's equity on January 1, 2020. Preferred shares, 8%, $100 par value, 10,000 shares authorized, 4,000 shares issued Common shares. $2 par value, 200,000 shares authorized, 80,000 shares issued Common shares subscribed, 10,000 shares Contributed surplus - Preferred Contributed surplus - Common Retained Earnings $ 400,000 160.000 20,000 940,000 780,000 780.000 2.320,000 40.000 $2.280,000 Less: Common share subscriptions receivable Total shareholder's equity During 2020, the following transactions occurred. 1. Equipment was purchased in exchange of 500 shares of common stock. The share's market value on the exchange date was $12 per share. 2. Sold 1,000 shares of common stock and 100 shares of preferred stock for the lump-sum price of $27,000. The common shares had a market price of $16 at the time of the sale. 3. Sold 2,000 shares of preferred for cash at $104 per share 4. All of the subscribers paid their subscription prices into the firm. 5. The common shares were issued 6. Repurchased and retired 1,000 common shares at $17 per share 7. Net Income for the year was $560,000 Prepared the shareholder's equity section for the company as at December 31, 2020. (4 Marks] Question 3: Spacey Corporation has 5,000 preferred shares outstanding (no par value 52 dividend) which were issued for $150,000; and 30,000 shares of no par value common, which were issued for S550,000 The following schedule shows the amount of dividends paid out over the last four years. Allocate the dividends to each type of share under assumptions (a) and (b). Express your answers in per share amounts and using the format that is shown (4 Marks Assumption (0) (b) Preferred, Noncumulative, Preferred, Cumulative, and Nonparticipating and Fully Participating Year Pald-out Preferred Comman Preferred Common 2017 $10,000 2018 $35.000 2019 $25,000 2020 $115,000