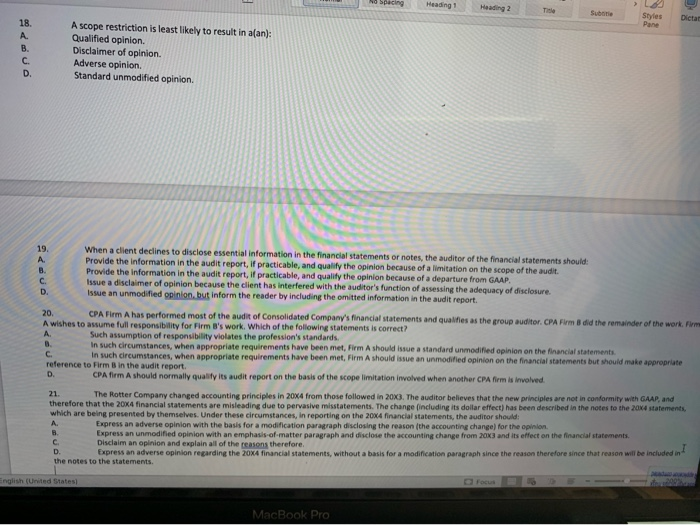

Spacing Heading Heading 2 Sunt Styles Pane Dictar 18 A B C. D. A scope restriction is least likely to result in alan): Qualified opinion. Disclaimer of opinion. Adverse opinion. Standard unmodified opinion 19 When a client declines to disclose essential information in the financial statements or notes, the auditor of the financial statements should A. Provide the information in the audit report, if practicable, and qualify the opinion because of a limitation on the scope of the audit. Provide the information in the audit report, if practicable, and qualify the opinion because of a departure from GAAP. C. Issue a disclaimer of opinion because the client has interfered with the auditor's function of assessing the adequacy of disclosure. D Issue an unmodified opinion, but inform the reader by including the omitted information in the audit report. 20 CPA Firm A has performed most of the audit of Consolidated Company's financial statements and qualifies as the proup auditor. CPA Firm did the remainder of the work. Firm A wishes to assume full responsibility for Firm B's work. Which of the following statements is correct? A Such assumption of responsibility violates the profession's standards B In such circumstances, when appropriate requirements have been met, Firm A should issue a standard unmodified opinion on the financial statements C. In such circumstances, when appropriate requirements have been met, Firm Ashould issue an unmodified opinion on the financial statements but should make appropriate reference to Firm Bin the audit report D. CPA firm A should normally qualify its audit report on the basis of the scope limitation involved when another CPA firm is involved 21 The Rotter Company changed accounting principles in 2004 from those followed in 20X3. The auditor believes that the new principles are not in conformity with GAAP, and therefore that the 20x4 financial statements are misleading due to pervasive misstatements. The change including its dollar effect) has been described in the notes to the 204 statements, which are being presented by themselves. Under these circumstances, in reporting on the 20/4 financial statements, the auditor should A. Express an adverse opinion with the basis for a modification paragraph disclosing the reason (the accounting change) for the opinion B Express an unmodified opinion with an emphasis of matter paragraph and disclose the accounting change from 20x3 and its effect on the financial statements C D Express an adverse opinion regarding the 20% financial statements, without a basis for a modification paragraph since the reason therefore since that reason will be included in the notes to the statements English (United States MacBook Pro