Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Spare Parts Ltd manufacturers components for motor vehicle assemblers. Although new motor vehicle sales are starting to improve, Spare Parts Ltd is still operating

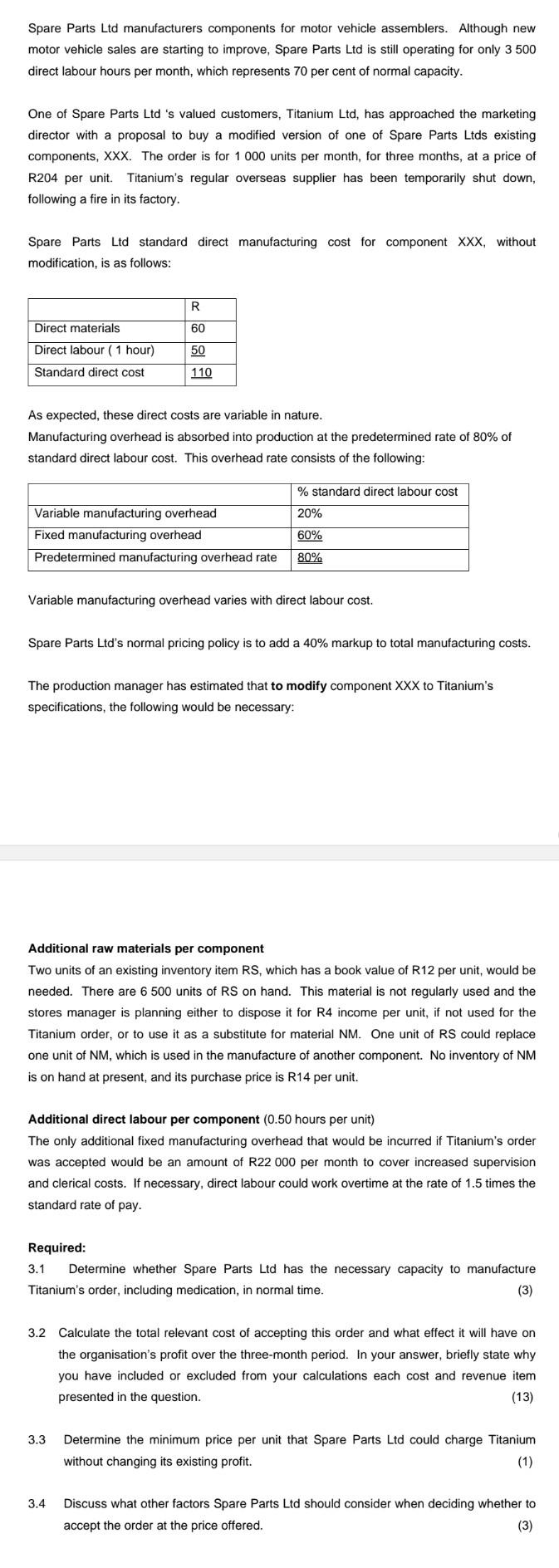

Spare Parts Ltd manufacturers components for motor vehicle assemblers. Although new motor vehicle sales are starting to improve, Spare Parts Ltd is still operating for only 3 500 direct labour hours per month, which represents 70 per cent of normal capacity. One of Spare Parts Ltd 's valued customers, Titanium Ltd, has approached the marketing director with a proposal to buy a modified version of one of Spare Parts Ltds existing components, XXX. The order is for 1000 units per month, for three months, at a price of R204 per unit. Titanium's regular overseas supplier has been temporarily shut down, following a fire in its factory. Spare Parts Ltd standard direct manufacturing cost for component XXX, without modification, is as follows: R Direct materials 60 Direct labour (1 hour) 50 Standard direct cost 110 As expected, these direct costs are variable in nature. Manufacturing overhead is absorbed into production at the predetermined rate of 80% of standard direct labour cost. This overhead rate consists of the following: % standard direct labour cost Variable manufacturing overhead 20% Fixed manufacturing overhead 60% Predetermined manufacturing overhead rate 80% Variable manufacturing overhead varies with direct labour cost. Spare Parts Ltd's normal pricing policy is to add a 40% markup to total manufacturing costs. The production manager has estimated that to modify component XXX to Titanium's specifications, the following would be necessary: Additional raw materials per component Two units of an existing inventory item RS, which has a book value of R12 per unit, would be needed. There are 6 500 units of RS on hand. This material is not regularly used and the stores manager is planning either to dispose it for R4 income per unit, if not used for the Titanium order, or to use it as a substitute for material NM. One unit of RS could replace one unit of NM, which is used in the manufacture of another component. No inventory of NM is on hand at present, and its purchase price is R14 per unit. Additional direct labour per component (0.50 hours per unit) The only additional fixed manufacturing overhead that would be incurred if Titanium's order was accepted would be an amount of R22 000 per month to cover increased supervision and clerical costs. If necessary, direct labour could work overtime at the rate of 1.5 times the standard rate of pay. Required: 3.1 Determine whether Spare Parts Ltd has the necessary capacity to manufacture Titanium's order, including medication, in normal time. (3) 3.2 Calculate the total relevant cost of accepting this order and what effect it will have on the organisation's profit over the three-month period. In your answer, briefly state why you have included or excluded from your calculations each cost and revenue item presented in the question. (13) 3.3 Determine the minimum price per unit that Spare Parts Ltd could charge Titanium without changing its existing profit. (1) 3.4 Discuss what other factors Spare Parts Ltd should consider when deciding whether to accept the order at the price offered. (3)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started