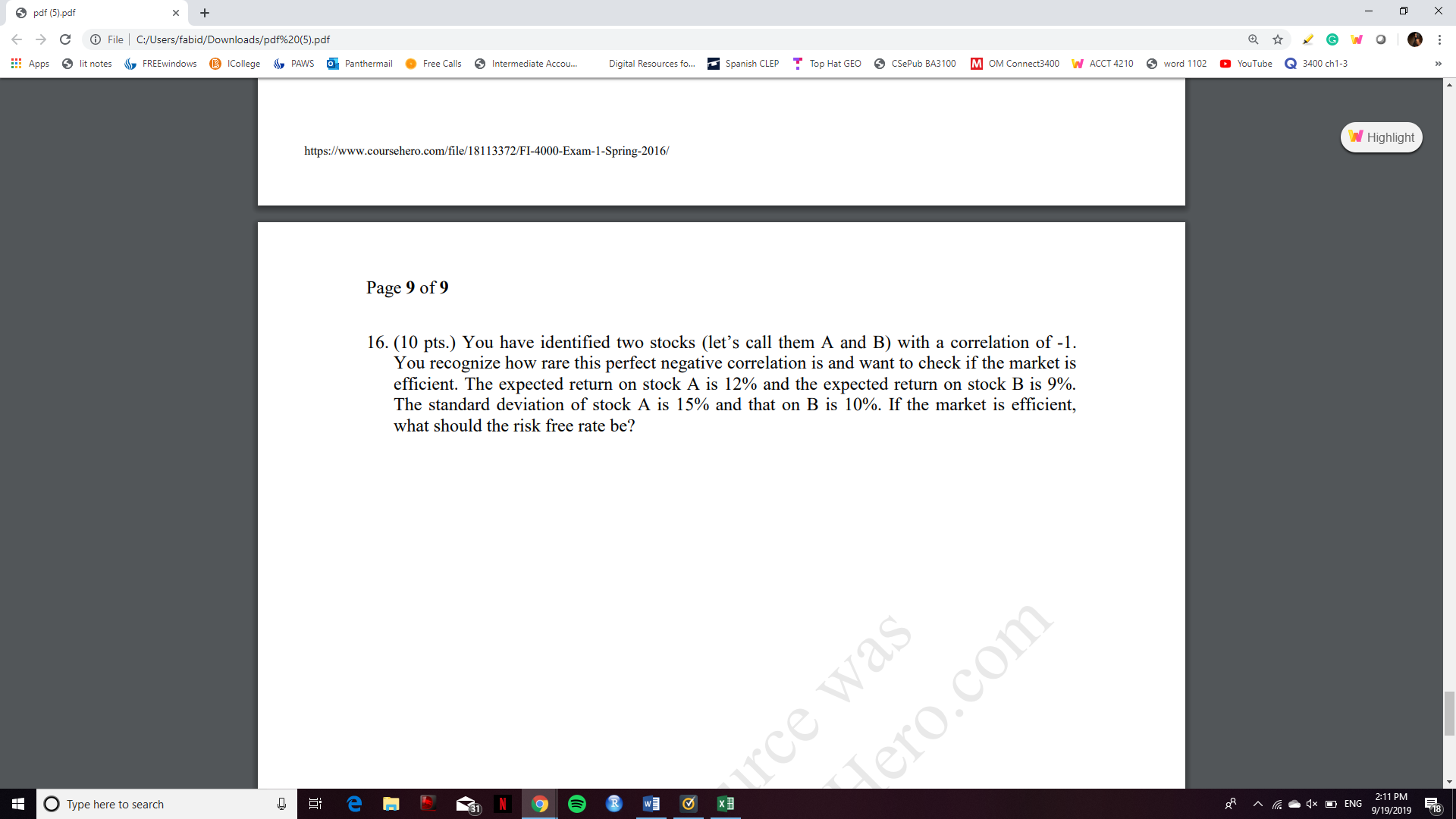

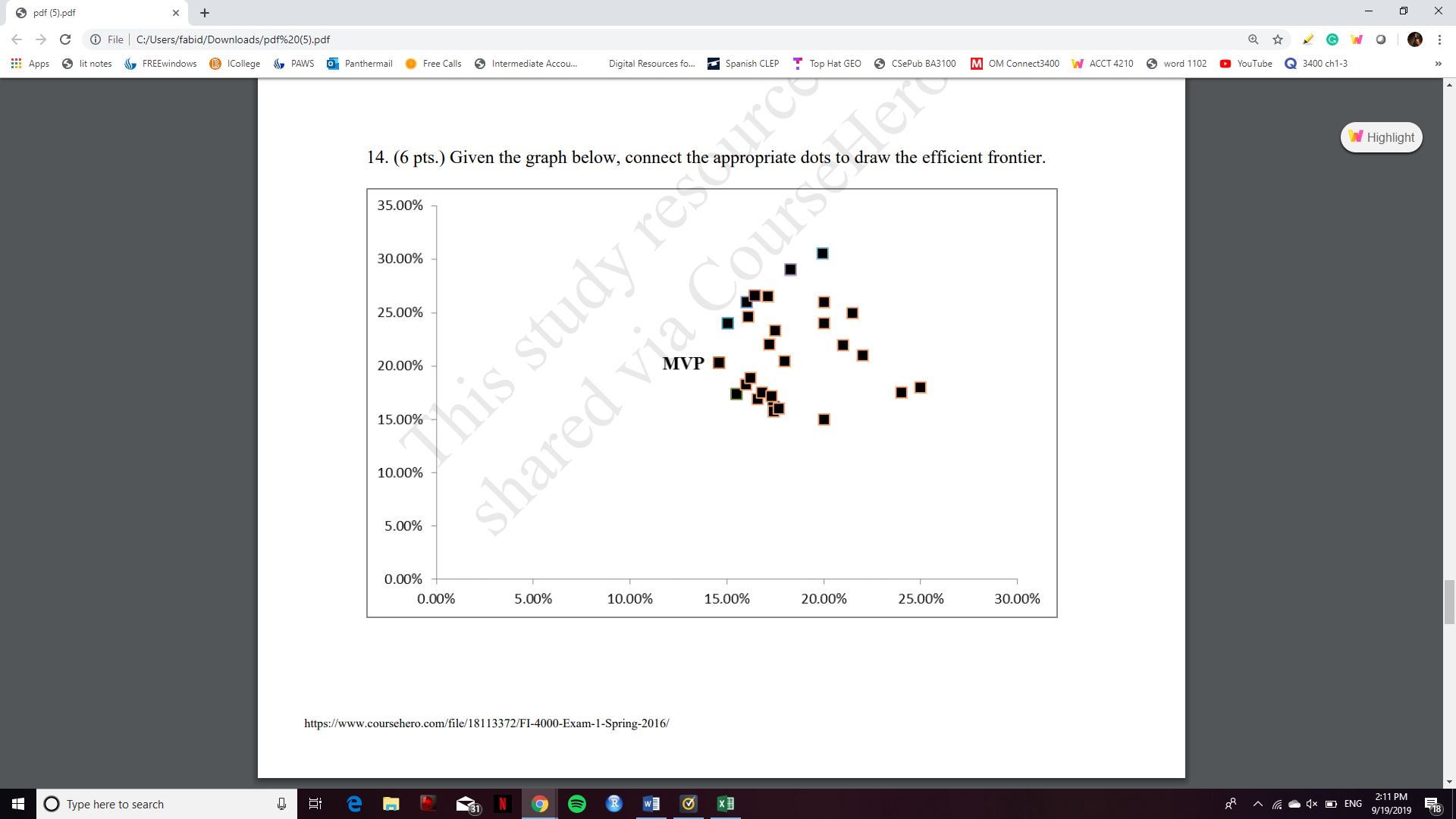

Spdf (5).pdf * + X - - C @ File | C:/Users/fabid/Downloads/pdf%20(5).pdf Q X GWO : Apps lit notes FREEwindows @ College PAWS o Panthermail @ Free Calls Intermediate Accou ... Digital Resources fo... Spanish CLEP T Top Hat GEO CSePub BA3100 M OM Connect3400 W ACCT 4210 3 word 1102 @ YouTube @ 3400 ch1-3 14. (6 pts.) Given the graph below, connect the appropriate dots to draw the efficient frontier. Highlight 35.00% 30.00% 25.00% d via Cours this study res 20.00% MVP shared 10.00% 5.00% 0.00% 0.00% 5.00% 10.00% 15.00% 20.00% 25.00% 30.00% https://www.coursehero.com/file/18113372/FI-4000-Exam-1-Spring-2016/ O Type here to search e 31 N 9 R w] ~ 4X DENG 2:11 PM 9/19/2019 186 pdf (5).de x 6 9 O (D File l CJUsers/tabid/Downloads/deEZOKSdef === Apps e litnotes i5, FREEwmdnws 0 Type hereto Search + @ lCollege 6h PAWS E Panthermail c Free Calls 5 lntermcdiate Acton" Digital Resourcesfo.. a Spanish (in: 15. (7 pts.) An investor's current portfolio of $2 million has an expected return of 133% and a standard deviation of 23.1%. This investor expects to receive an additional $2 million and plans to invest the entire amount in an index fund that best complements the current portfolio. Your job is to evaluate the four index funds shown in the following table based on their ability to produce a new portfolio that will meet two criteria relative to the current portfolio: 1) maintain or enhance expected return and 2) maintain or reduce volatility (e.g., standard deviation). Each index fund is invested in an asset class that is not substantially represented in the current portfolio. Index Fund Characteristics Index Fund Expected Return Expected Standard Deviation Correlation of Returns with Current Portfolio 15% 25% +080 11% 22% +0.60 16% 25% +0.90 14% 22% +0.65 Which index fund shou Without showing any cc uations/mathematics. d you add to your portfolio? Briey describe why you made your choice 1:}61005 1' Top HatGEO e CSePub ammo m OM Connection .1 ACCMEW a word 1102 n VuuTube Q moms rl Highlight Spdf (5).pdf * + X - - C @ File | C:/Users/fabid/Downloads/pdf%20(5).pdf Q X GWO ... : Apps lit notes FREEwindows @ ICollege > PAWS o Panthermail @ Free Calls Intermediate Accou Digital Resources fo.. Spanish CLEP T Top Hat GEO CSePub BA3100 M OM Connect3400 W ACCT 4210 3 word 1102 @ YouTube @ 3400 ch1-3 https://www.coursehero.com/file/18113372/FI-4000-Exam-1-Spring-2016/ Highlight Page 9 of 9 16. (10 pts.) You have identified two stocks (let's call them A and B) with a correlation of -1. You recognize how rare this perfect negative correlation is and want to check if the market is efficient. The expected return on stock A is 12% and the expected return on stock B is 9%. The standard deviation of stock A is 15% and that on B is 10%. If the market is efficient, what should the risk free rate be? rce was Tero.com O Type here to search R Wi ~ x DENG 2:11 PM 9/19/2019 18