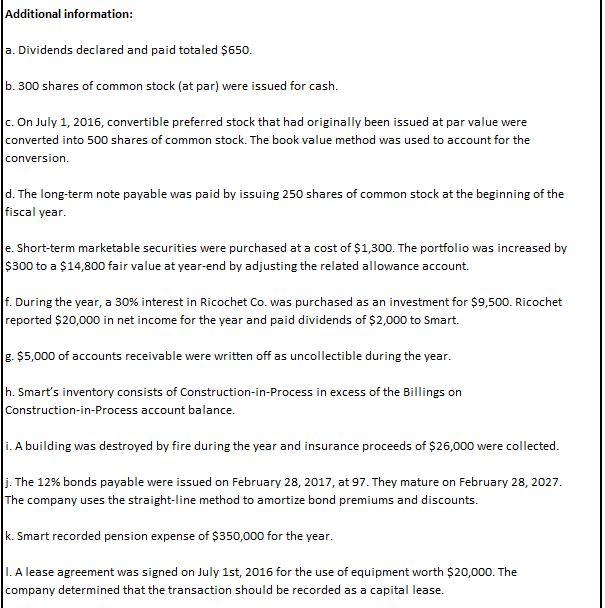

Spears Company is preparing its financial statements for the year ended June 30, 2017. The financial statements are complete except for the statement of cash flows. You have been asked to prepare a statement of cash flows for the year ended June 30, 2017.

Required:

Show in journal entry form, the entries that would be made in preparation of the statement of cash flows.

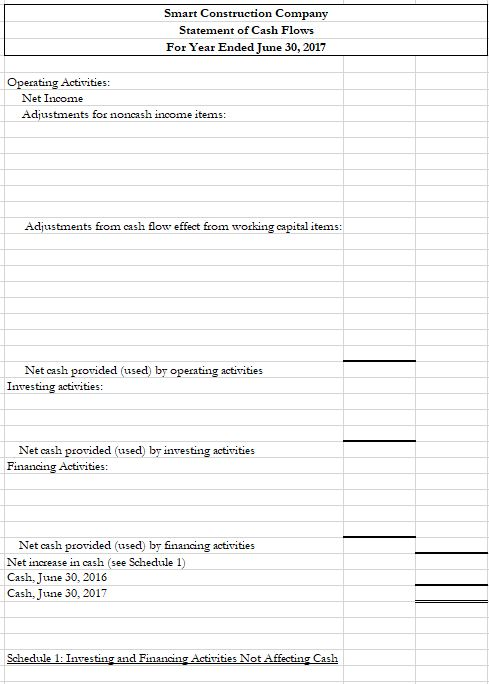

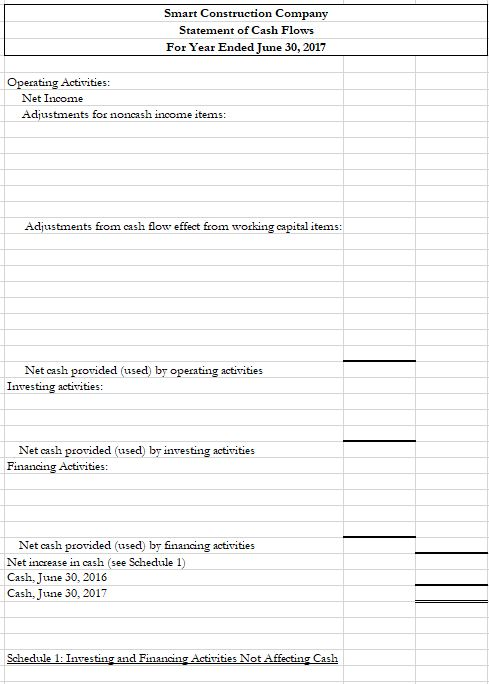

Prepare Spears Companys statement of cash flows for the year ended June 30, 2017.

Prepare the statement of cash flows using the indirect method.

(I am unable to upload the Excel spreadsheets in here, or else I would.)

Note: For full credit, you must prepare the statement of cash flow in good form with all necessary disclosures, including disclosures about noncash financing and investing activities.

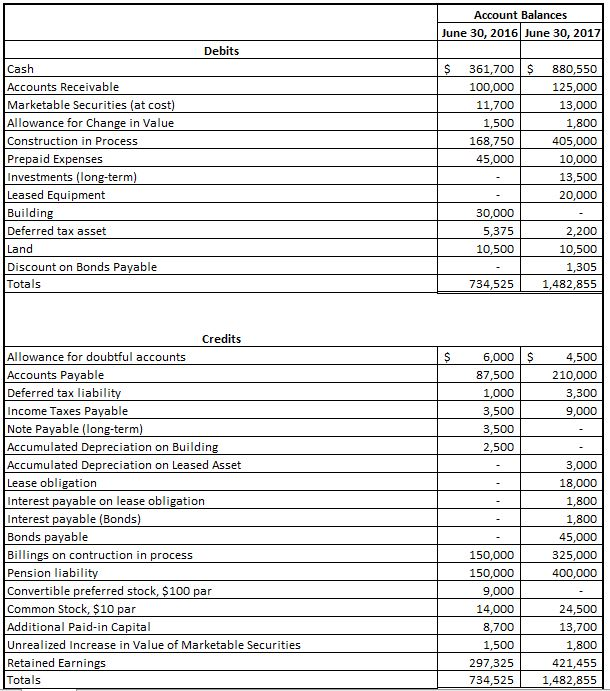

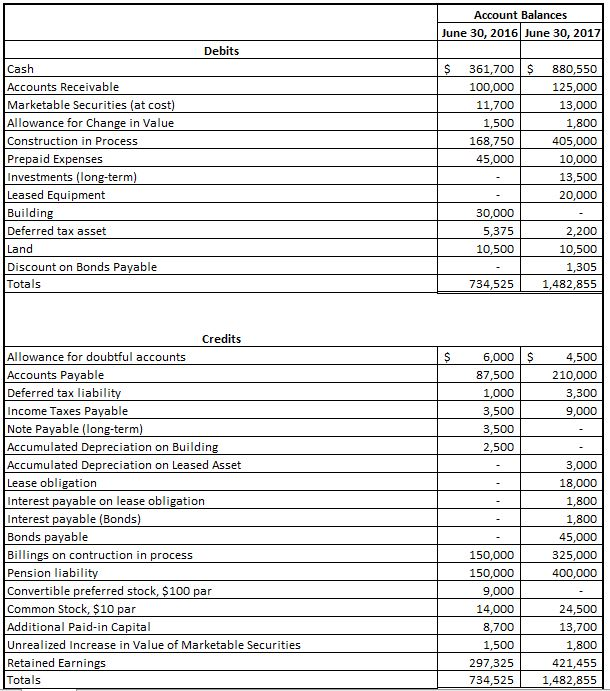

Account Balances June 30, 2016 June 30, 2017 Debits Cash Accounts Receivable Marketable Securities(at cost Allowance or Change in Value Construction in Process Prepaid Expenses Investments (long-term) Leased Equipment Buildin Deferred tax asset Land Discount on Bonds Payable Totals 361,700 100,000 11,700 1,500 168,750 45,000 880,550 125,000 13,000 1,800 405,000 10,000 13,500 20,000 30,000 5,375 10,500 2,200 10,500 1,305 1,482,855 734,525 Credits Allowance for doubtful accounts Accounts Payable Deferred tax liabili Income Taxes Payable Note Payable (long-term) Accumulated Depreciation on Building Accumulated Depreciation on Leased Asset Lease obligation Interest payable on lease obligatiorn Interest payable (Bonds) Bonds payable Billings on contruction in process Pension liabili Convertible preferred stock, $100 par Common Stock, $10 par Additional Paid-in Capital Unrealized Increase in Value of Marketable Securities Retained Earnings Totals 6,000 87,500 1,000 3,500 3,500 2,500 4,500 210,000 3,300 9,000 3,000 18,000 1,800 1,800 45,000 325,000 400,000 150,000 150,000 9,000 14,000 8,700 1,500 297,325 734,525 24,500 13,700 1,800 421,455 1,482,855 Account Balances June 30, 2016 June 30, 2017 Debits Cash Accounts Receivable Marketable Securities(at cost Allowance or Change in Value Construction in Process Prepaid Expenses Investments (long-term) Leased Equipment Buildin Deferred tax asset Land Discount on Bonds Payable Totals 361,700 100,000 11,700 1,500 168,750 45,000 880,550 125,000 13,000 1,800 405,000 10,000 13,500 20,000 30,000 5,375 10,500 2,200 10,500 1,305 1,482,855 734,525 Credits Allowance for doubtful accounts Accounts Payable Deferred tax liabili Income Taxes Payable Note Payable (long-term) Accumulated Depreciation on Building Accumulated Depreciation on Leased Asset Lease obligation Interest payable on lease obligatiorn Interest payable (Bonds) Bonds payable Billings on contruction in process Pension liabili Convertible preferred stock, $100 par Common Stock, $10 par Additional Paid-in Capital Unrealized Increase in Value of Marketable Securities Retained Earnings Totals 6,000 87,500 1,000 3,500 3,500 2,500 4,500 210,000 3,300 9,000 3,000 18,000 1,800 1,800 45,000 325,000 400,000 150,000 150,000 9,000 14,000 8,700 1,500 297,325 734,525 24,500 13,700 1,800 421,455 1,482,855