Answered step by step

Verified Expert Solution

Question

1 Approved Answer

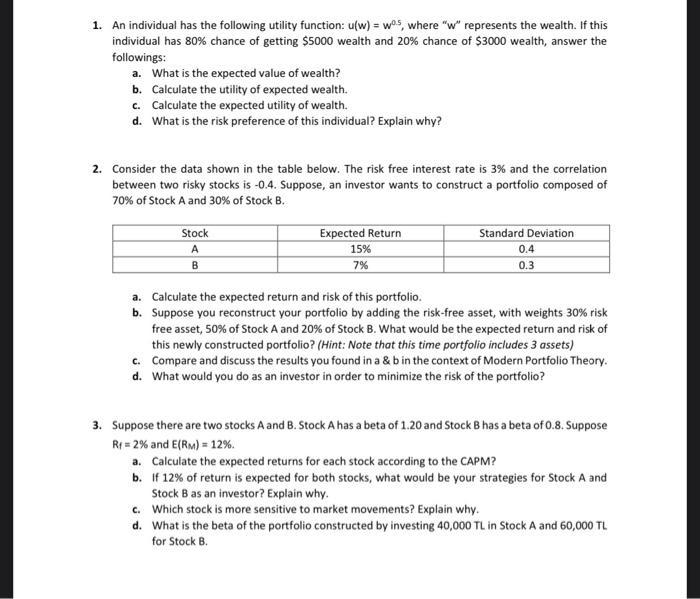

Specially, I could not answer the 2nd and 3rd questions. Can you help me? 1. An individual has the following utility function: u(w) = wos,

Specially, I could not answer the 2nd and 3rd questions. Can you help me?

1. An individual has the following utility function: u(w) = wos, where "w" represents the wealth. If this individual has 80% chance of getting $5000 wealth and 20% chance of $3000 wealth, answer the followings: a. What is the expected value of wealth? b. Calculate the utility of expected wealth. C. Calculate the expected utility of wealth. d. What is the risk preference of this individual? Explain why? 2. Consider the data shown in the table below. The risk free interest rate is 3% and the correlation between two risky stocks is -0.4. Suppose, an investor wants to construct a portfolio composed of 70% of Stock A and 30% of Stock B. Stock A Expected Return 15% 7% Standard Deviation 0.4 0.3 B a. Calculate the expected return and risk of this portfolio. b. Suppose you reconstruct your portfolio by adding the risk-free asset, with weights 30% risk free asset, 50% of Stock A and 20% of Stock B. What would be the expected return and risk of this newly constructed portfolio? (Hint: Note that this time portfolio includes 3 assets) c. Compare and discuss the results you found in a & b in the context of Modern Portfolio Theory. d. What would you do as an investor in order to minimize the risk of the portfolio? 3. Suppose there are two stocks A and B. Stock A has a beta of 1.20 and Stock Bhas a beta of 0.8. Suppose Rp = 2% and E(Rm) = 12%. a. Calculate the expected returns for each stock according to the CAPM? b. If 12% of return is expected for both stocks, what would be your strategies for Stock A and Stock B as an investor? Explain why. c. Which stock is more sensitive to market movements? Explain why. d. What is the beta of the portfolio constructed by investing 40,000 TL in Stock A and 60,000 TL for Stock BStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started