Question

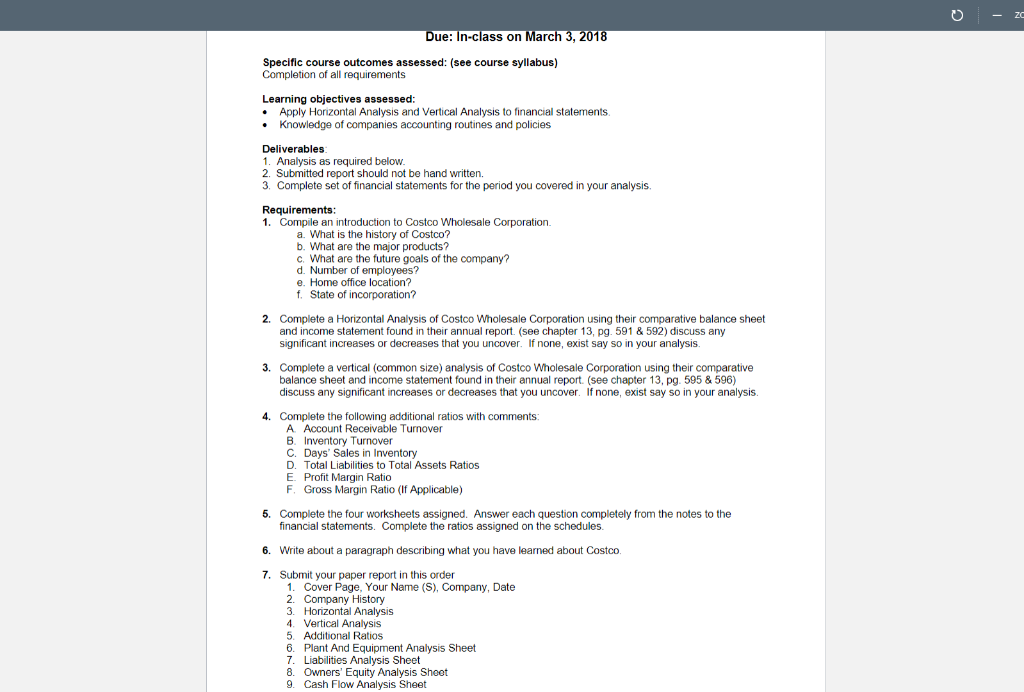

Specific course outcomes assessed: (see course syllabus)Completion of all requirementsLearning objectives assessed: Apply Horizontal Analysis and Vertical Analysis to financial statements. Knowledge of companies accounting

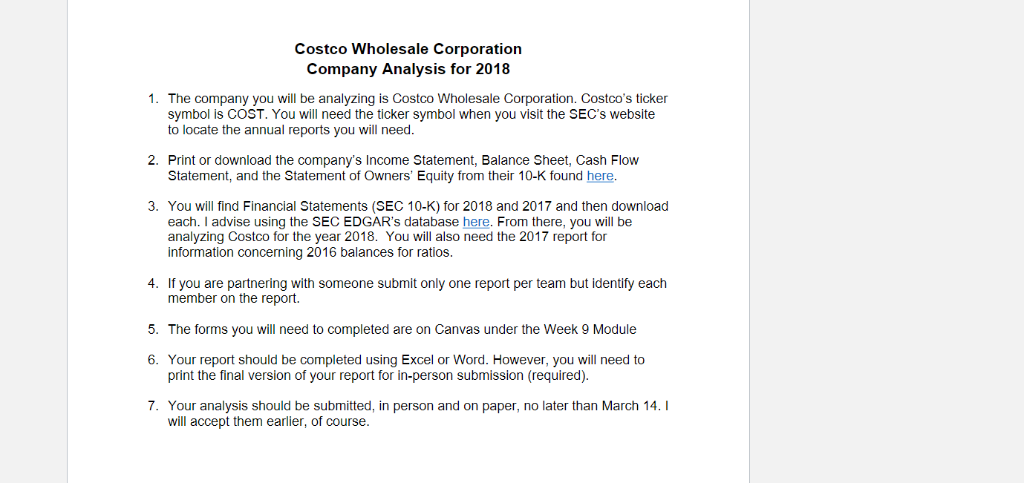

Specific course outcomes assessed: (see course syllabus)Completion of all requirementsLearning objectives assessed: Apply Horizontal Analysis and Vertical Analysis to financial statements. Knowledge of companies accounting routines and policiesDeliverables:1. Analysis as required below.2. Submitted report should not be hand written.3. Complete set of financial statements for the period you covered in your analysis.Requirements: 1. Compile an introduction to Costco Wholesale Corporation. a. What is the history of Costco? b. What are the major products? c. What are the future goals of the company? d. Number of employees? e. Home office location? f. State of incorporation? 2. Complete a Horizontal Analysis of Costco Wholesale Corporation using their comparative balance sheet and income statement found in their annual report. (see chapter 13, pg. 591 & 592) discuss any significant increases or decreases that you uncover. If none, exist say so in your analysis.3. Complete a vertical (common size) analysis of Costco Wholesale Corporation using their comparative balance sheet and income statement found in their annual report. (see chapter 13, pg. 595 & 596) discuss any significant increases or decreases that you uncover. If none, exist say so in your analysis.4. Complete the following additional ratios with comments:A. Account Receivable TurnoverB. Inventory TurnoverC. Days Sales in InventoryD. Total Liabilities to Total Assets RatiosE. Profit Margin RatioF. Gross Margin Ratio (If Applicable)5. Complete the four worksheets assigned. Answer each question completely from the notes to the financial statements. Complete the ratios assigned on the schedules.6. Write about a paragraph describing what you have learned about Costco.7. Submit your paper report in this order1. Cover Page, Your Name (S), Company, Date2. Company History3. Horizontal Analysis4. Vertical Analysis5. Additional Ratios6. Plant And Equipment Analysis Sheet7. Liabilities Analysis Sheet8. Owners Equity Analysis Sheet9. Cash Flow Analysis Sheet10. What You Have Learned. Costco Wholesale CorporationCompany Analysis for 20181. The company you will be analyzing is Costco Wholesale Corporation. Costcos ticker symbol is COST. You will need the ticker symbol when you visit the SECs website to locate the annual reports you will need. 2. Print or download the companys Income Statement, Balance Sheet, Cash Flow Statement, and the Statement of Owners Equity from their 10-K found here.3. You will find Financial Statements (SEC 10-K) for 2018 and 2017 and then download each. I advise using the SEC EDGARs database here. From there, you will be analyzing Costco for the year 2018. You will also need the 2017 report for information concerning 2016 balances for ratios.4. If you are partnering with someone submit only one report per team but identify each member on the report.5. The forms you will need to completed are on Canvas under the Week 9 Module6. Your report should be completed using Excel or Word. However, you will need to print the final version of your report for in-person submission (required). 7. Your analysis should be submitted, in person and on paper, no later than March 14. I will accept them earlier, of course.

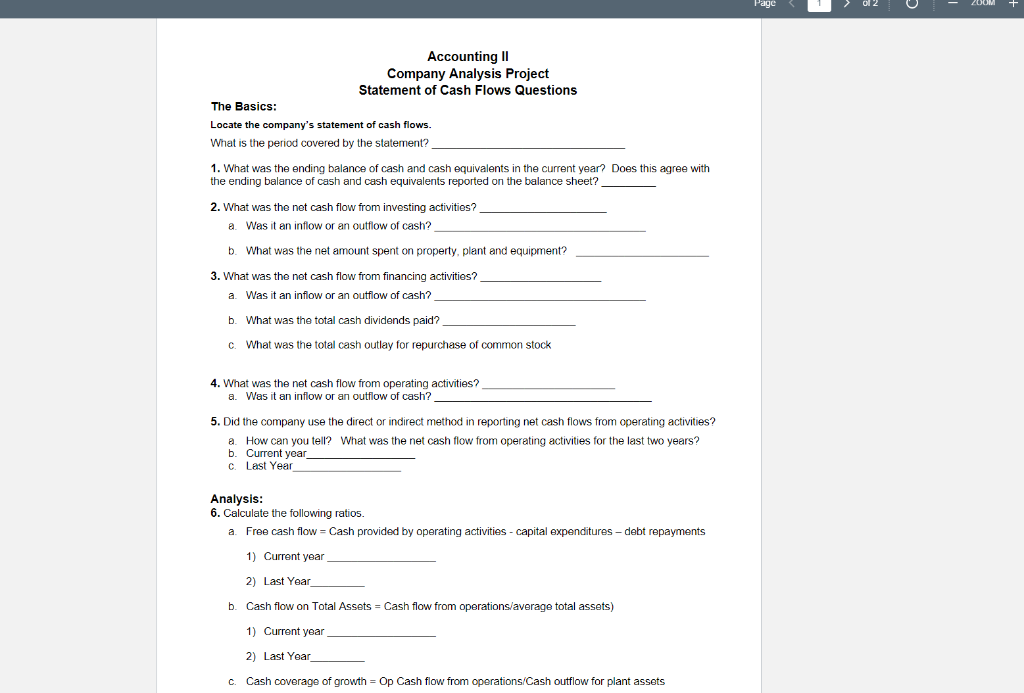

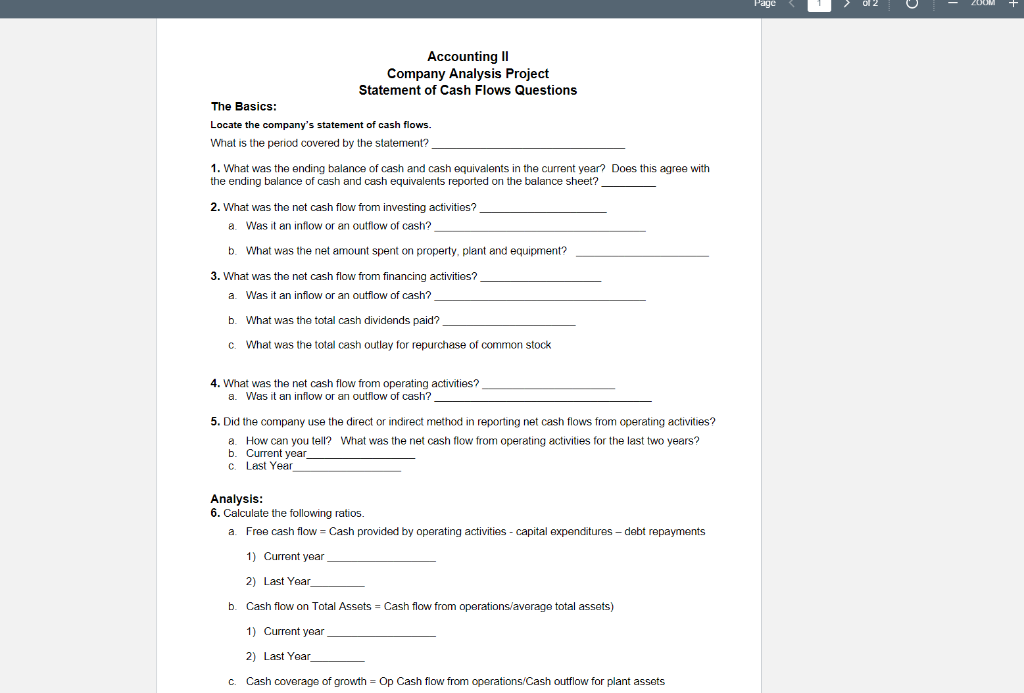

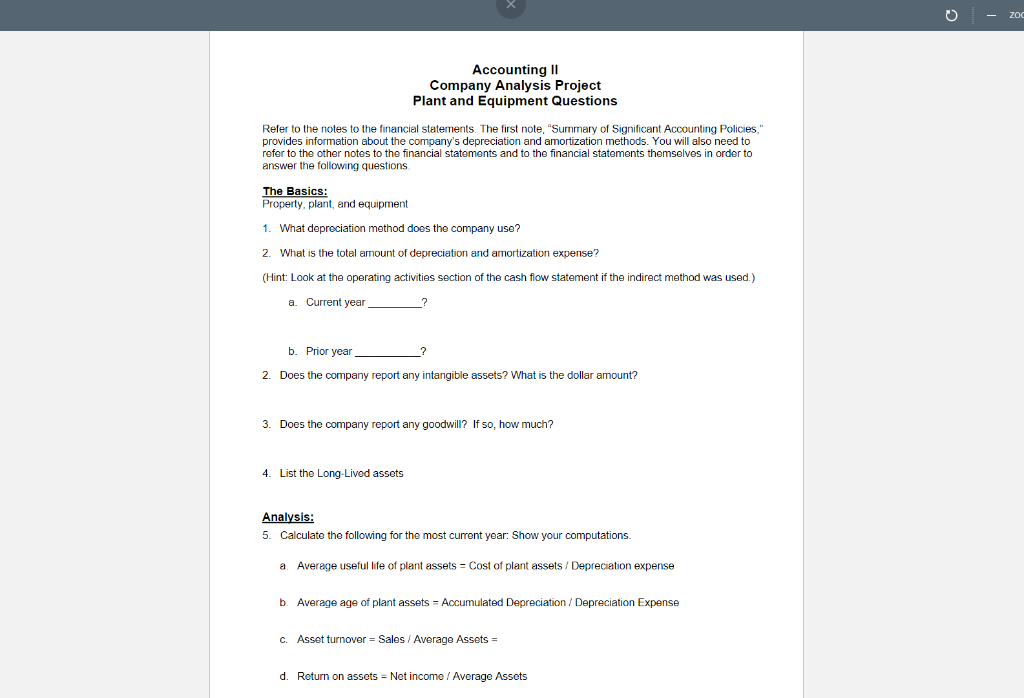

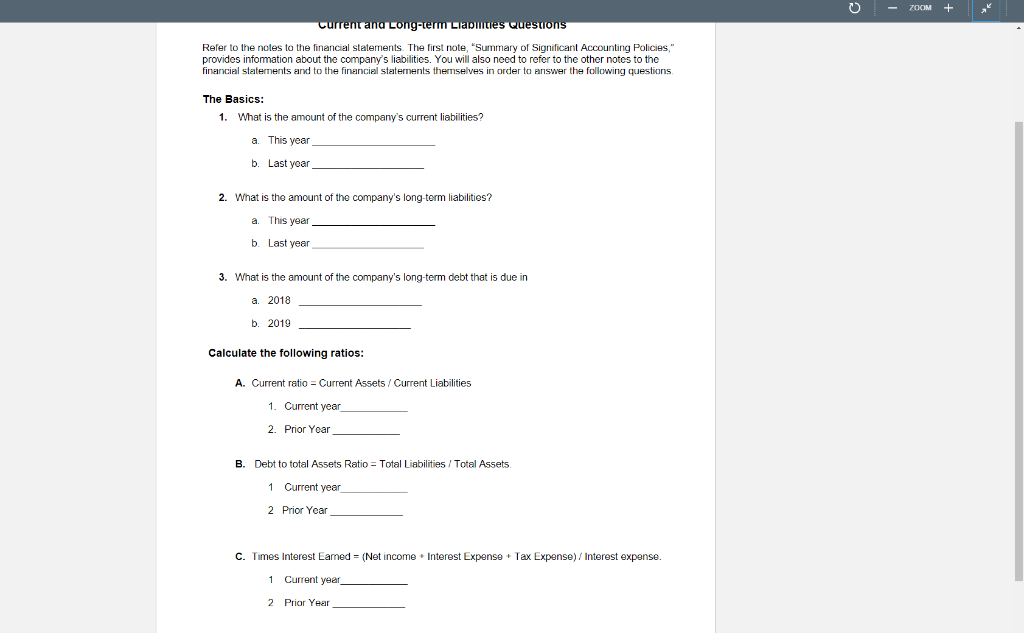

Pagc ol2 Accounting lI Company Analysis Project Statement of Cash Flows Questions The Basics: Locate the company's statement of cash flows. What is the period covered by the statement? 1. What was the ending balance of cash and cash equivalents in the current year Does this agree with the ending balance of cash and cash equivalents reported on the balance sheet? 2. What was the net cash flow from investing activities? a. Was it an inflow or an outflow of cash? b. What was the net amount spent on property, plant and equipment? 3. What was the net cash flow from financing activities? a. Was it an inflow or an outflow of cash? b. What was the total cash dividends paid? c. What was the total cash outlay for repurchase of common stock 4. What was the net cash flow from operating activities? a. Was it an inflow or an outflow of cash? 5. Did the company use the direct or indirect method in reporting net cash flows from operating activities? a. How can you tell? What was the net cash flow from operating activities for the last two years? b. Current year c. Last Year Analysis: 6. Calculate the following ratios. a. Free cash flow Cash provided by operating activities capital expenditures- debt repayments 1) Current year 2) Last Year_ Cash flow on Total Assets Cash flow from operations/average total assets) 1) Current year 2) Last Year b. c. Cash coverage of growth- Op Cash flow from operations Cash outflow for plant assets Pagc ol2 Accounting lI Company Analysis Project Statement of Cash Flows Questions The Basics: Locate the company's statement of cash flows. What is the period covered by the statement? 1. What was the ending balance of cash and cash equivalents in the current year Does this agree with the ending balance of cash and cash equivalents reported on the balance sheet? 2. What was the net cash flow from investing activities? a. Was it an inflow or an outflow of cash? b. What was the net amount spent on property, plant and equipment? 3. What was the net cash flow from financing activities? a. Was it an inflow or an outflow of cash? b. What was the total cash dividends paid? c. What was the total cash outlay for repurchase of common stock 4. What was the net cash flow from operating activities? a. Was it an inflow or an outflow of cash? 5. Did the company use the direct or indirect method in reporting net cash flows from operating activities? a. How can you tell? What was the net cash flow from operating activities for the last two years? b. Current year c. Last Year Analysis: 6. Calculate the following ratios. a. Free cash flow Cash provided by operating activities capital expenditures- debt repayments 1) Current year 2) Last Year_ Cash flow on Total Assets Cash flow from operations/average total assets) 1) Current year 2) Last Year b. c. Cash coverage of growth- Op Cash flow from operations Cash outflow for plant assets Accounting II Company Analysis Project Plant and Equipent Questions Refer to the notes to the financial statements. The first note, "Summary of Significant Accounting Policies," provides information about the company's depreciation and amortization methods. You will also need to refer to the other notes to the financial statements and to the financial statements themselves in order to answer the following questions The Basics: Property, plant, and equipment 1. What depreciation method does the company use? 2. What is the total amount of depreciation and amortization expense? (Hint: Look at the operating activities section of the cash fow statement if the indirect method was used.) a. Current year b. Prior year 2. Does the company report any intangible assets? What is the dollar amount? 3. Does the company report any goodwill? If so, how much? 4. List the Long-Lived assets Analysis: 5. Calculate the following for the most current year: Show your computations. a Average useful life of plant assets = Cost of plant assets / Depreciation expense b. Average age of plant assets Accumulated Depreciation Depreciation Expense c. Asset turnover-Sales Average Assets d. Return on assets Net income/ Average Assets Refer to the notes to the financial statements. The first note, "Summary of Significant Accounting Policies," provides infomation about the company's liabilities. You will also need to refer to the other notes to the financial staterments and to the financial staterments themselves in order to answer the following questions The Basics: 1. What is the amount of the company's current liabilities? a. This year b. Last year 2. What is the amount of the company's long-term liabilities? a. This year b. Last year 3. What is the amount of the company's long-term debt that is due in a. 2018 b. 2019 Calculate the following ratios A. Current ratio Current Assets/Current Liabilities 1. Current year 2. Prior Yoar B. Debt to total Assets Ratio Total Liabilities Total Assets 1 Current year 2 Prior Year C. Times Interest Eamed (Net income Interest ExpenseTax Expense) Interest expense. 1 Current year 2 Prior Year Pagc ol2 Accounting lI Company Analysis Project Statement of Cash Flows Questions The Basics: Locate the company's statement of cash flows. What is the period covered by the statement? 1. What was the ending balance of cash and cash equivalents in the current year Does this agree with the ending balance of cash and cash equivalents reported on the balance sheet? 2. What was the net cash flow from investing activities? a. Was it an inflow or an outflow of cash? b. What was the net amount spent on property, plant and equipment? 3. What was the net cash flow from financing activities? a. Was it an inflow or an outflow of cash? b. What was the total cash dividends paid? c. What was the total cash outlay for repurchase of common stock 4. What was the net cash flow from operating activities? a. Was it an inflow or an outflow of cash? 5. Did the company use the direct or indirect method in reporting net cash flows from operating activities? a. How can you tell? What was the net cash flow from operating activities for the last two years? b. Current year c. Last Year Analysis: 6. Calculate the following ratios. a. Free cash flow Cash provided by operating activities capital expenditures- debt repayments 1) Current year 2) Last Year_ Cash flow on Total Assets Cash flow from operations/average total assets) 1) Current year 2) Last Year b. c. Cash coverage of growth- Op Cash flow from operations Cash outflow for plant assets Pagc ol2 Accounting lI Company Analysis Project Statement of Cash Flows Questions The Basics: Locate the company's statement of cash flows. What is the period covered by the statement? 1. What was the ending balance of cash and cash equivalents in the current year Does this agree with the ending balance of cash and cash equivalents reported on the balance sheet? 2. What was the net cash flow from investing activities? a. Was it an inflow or an outflow of cash? b. What was the net amount spent on property, plant and equipment? 3. What was the net cash flow from financing activities? a. Was it an inflow or an outflow of cash? b. What was the total cash dividends paid? c. What was the total cash outlay for repurchase of common stock 4. What was the net cash flow from operating activities? a. Was it an inflow or an outflow of cash? 5. Did the company use the direct or indirect method in reporting net cash flows from operating activities? a. How can you tell? What was the net cash flow from operating activities for the last two years? b. Current year c. Last Year Analysis: 6. Calculate the following ratios. a. Free cash flow Cash provided by operating activities capital expenditures- debt repayments 1) Current year 2) Last Year_ Cash flow on Total Assets Cash flow from operations/average total assets) 1) Current year 2) Last Year b. c. Cash coverage of growth- Op Cash flow from operations Cash outflow for plant assets Accounting II Company Analysis Project Plant and Equipent Questions Refer to the notes to the financial statements. The first note, "Summary of Significant Accounting Policies," provides information about the company's depreciation and amortization methods. You will also need to refer to the other notes to the financial statements and to the financial statements themselves in order to answer the following questions The Basics: Property, plant, and equipment 1. What depreciation method does the company use? 2. What is the total amount of depreciation and amortization expense? (Hint: Look at the operating activities section of the cash fow statement if the indirect method was used.) a. Current year b. Prior year 2. Does the company report any intangible assets? What is the dollar amount? 3. Does the company report any goodwill? If so, how much? 4. List the Long-Lived assets Analysis: 5. Calculate the following for the most current year: Show your computations. a Average useful life of plant assets = Cost of plant assets / Depreciation expense b. Average age of plant assets Accumulated Depreciation Depreciation Expense c. Asset turnover-Sales Average Assets d. Return on assets Net income/ Average Assets Refer to the notes to the financial statements. The first note, "Summary of Significant Accounting Policies," provides infomation about the company's liabilities. You will also need to refer to the other notes to the financial staterments and to the financial staterments themselves in order to answer the following questions The Basics: 1. What is the amount of the company's current liabilities? a. This year b. Last year 2. What is the amount of the company's long-term liabilities? a. This year b. Last year 3. What is the amount of the company's long-term debt that is due in a. 2018 b. 2019 Calculate the following ratios A. Current ratio Current Assets/Current Liabilities 1. Current year 2. Prior Yoar B. Debt to total Assets Ratio Total Liabilities Total Assets 1 Current year 2 Prior Year C. Times Interest Eamed (Net income Interest ExpenseTax Expense) Interest expense. 1 Current year 2 Prior YearStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started