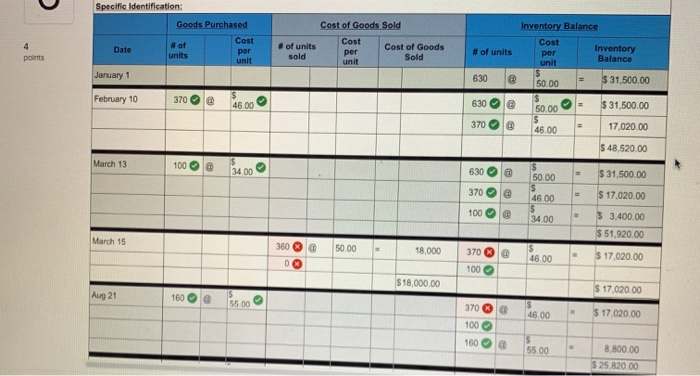

specific identification

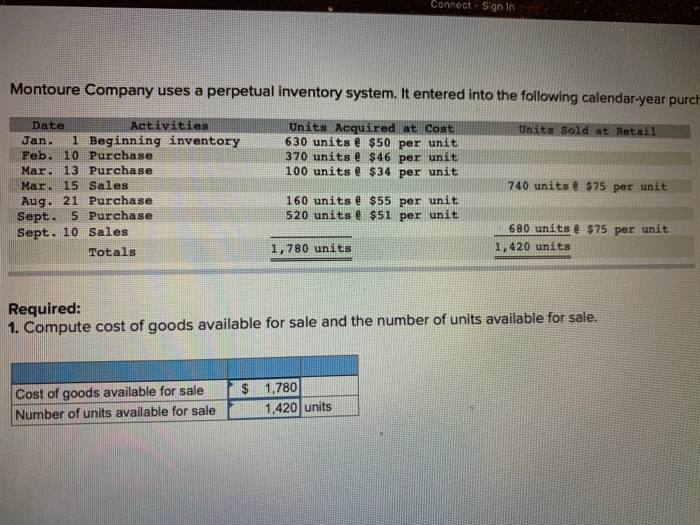

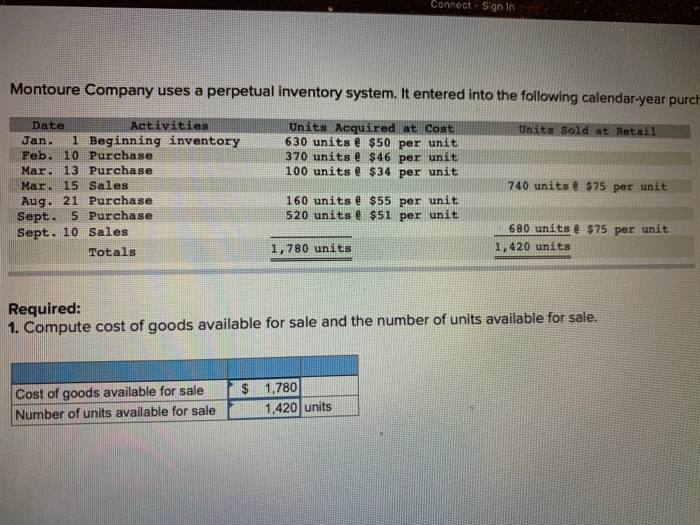

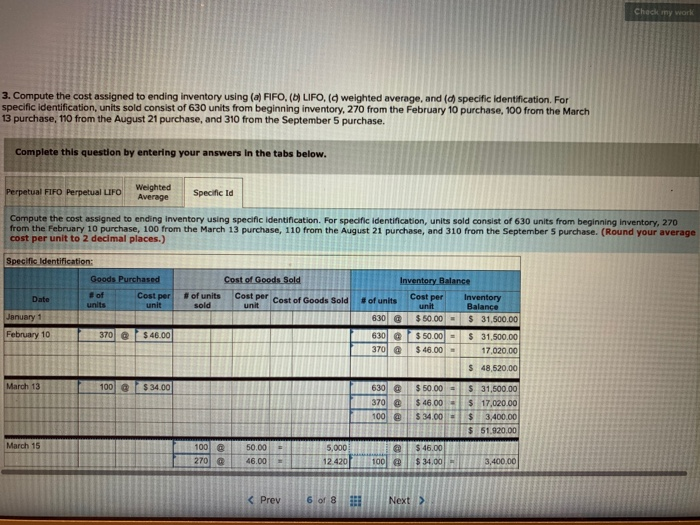

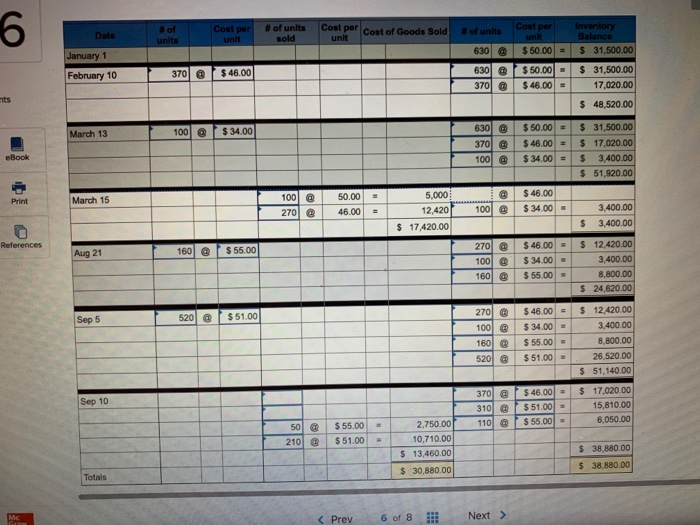

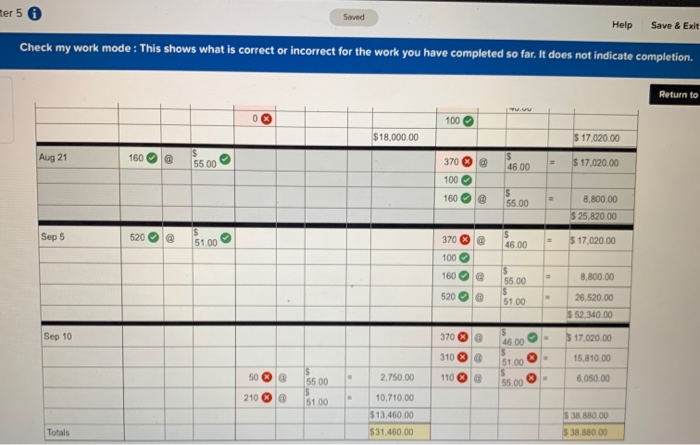

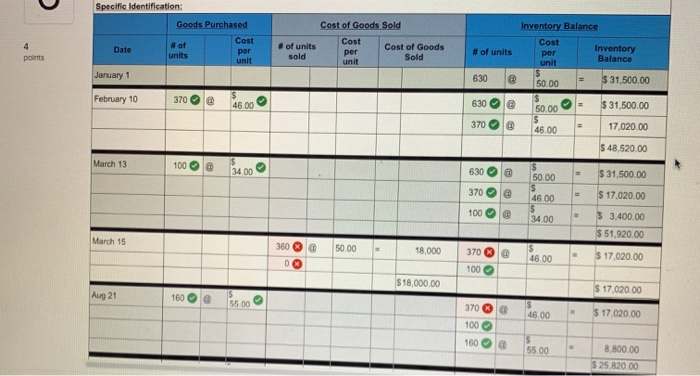

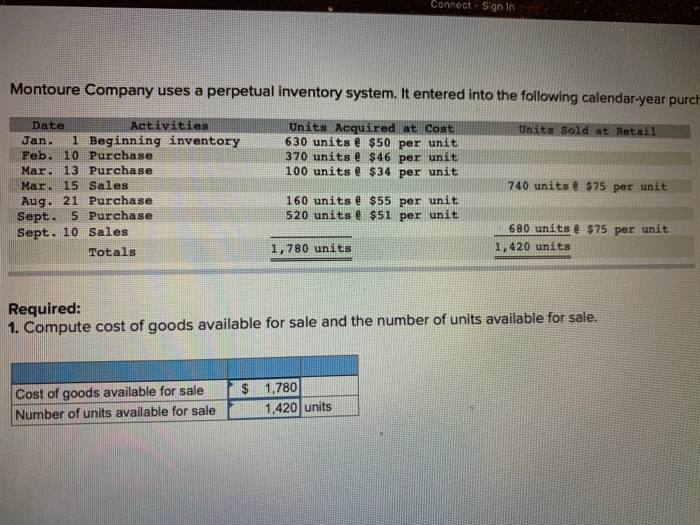

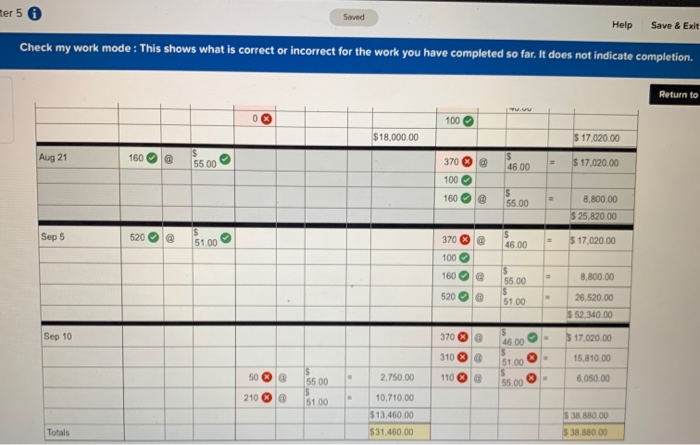

Connect Sign In Montoure Company uses a perpetual inventory system. It entered into the following calendar-year purch Units Sold at Retail Units Acquired at Cos 630 units @ $50 per unit 370 units @ $46 per unit 100 units @ $34 per unit Date Activities Jan. 1 Beginning inventory Feb. 10 Purchase Mar. 13 Purchase Mar. 15 Sales Aug. 21 Purchase Sept. 5 Purchase Sept. 10 Sales Totals 740 units @ $75 per unit 160 units @ $55 per unit 520 units @ $51 per unit 680 units @ $75 per unit 1,420 units 1,780 units Required: 1. Compute cost of goods available for sale and the number of units available for sale. $ Cost of goods available for sale Number of units available for sale 1,780 1,420 units 3. Compute the cost assigned to ending inventory using (a) FIFO.() LIFO, (weighted average, and (c) specific identification. For specific identification, units sold consist of 630 units from beginning inventory, 270 from the February 10 purchase, 100 from the March 13 purchase, 110 from the August 21 purchase, and 310 from the September 5 purchase. Complete this question by entering your answers in the tabs below. Perpetual FIFO Perpetual LIFO Weighted Average Specific Id Compute the cost assigned to ending inventory using specific identification. For specific identification, units sold consist of 630 units from beginning inventory, 270 from the February 10 purchase, 100 from the March 13 purchase, 110 from the August 21 purchase, and 310 from the September 5 purchase. (Round your average cost per unit to 2 decimal places.) Specific Identification: Goods Purchased Inventory Balance of Date Cost of Goods Sold of units Cost per Cost of Goods Sold Cost per unit of units 6:30 @ 630 @ 370 @ Cost per ult $50.00 - $50.00 - $ 46.00 Inventory Balance $ 31,500.00 $ 31,500.00 17.020.00 February 10 370 @ $ 46.00 $ 48 520.00 100 $34.00 @ 630 370 100 $50.00 - $ 46.00 - $ 34,00 $ 31,500.00 $ 17,020.00 $ 3,400.00 $ 51.920.00 @ 46.00 er 5 6 Saved Help Save & Exit Check my work mode: This shows what is correct or incorrect for the work you have completed so far. It does not indicate completion Return to 100 $18,000.00 $ 17,020.00 Aug 21 160 5500 370 45.00 - $17,020,00 55.00 8,800.00 $ 25,820.00 520 @ 3701 5100 5 17.020.00 46.00 8.800.00 55 00 151.00 25,520.00 $ 52,340.00 370 @ 18.00 3 17.020.00 15.810.00 2.750.00 5500 110 6,050.00 5500 210 X 10.71000 51.00 $ 1 0 .00 $31.460.00 SO DO Specific Identification Goods Purchased Inventory Balance Cost Cost of Goods Sold of units Cost of Goods sold Sold # of units per Inventory Balance Date of units per unit 630 @ = $ 31,500.00 January 1 February 10 370 45.00 630 370 @ @ $ 31,500.00 17,020.00 46.00 - $ 48,520.00 March 13 100 @ 50.00 $ 31,500.00 630 370 100 @ @ @ 48.00 $ 17,020.00 3400 $ 3.400.00 $51.920.00 March 15 360 @ 50.00 18,000 46.00 $ 17,020,00 370 100 $18,000.00 $ 17,020,00 Aug 21 160 370 @ 16.00 - 17.020.00 100 1600 55.00 8,800.00 525 2000