Question

Outline the mechanics of a letter of credit arrangement. Examine the bank's exposure to risk should it accept time drafts. In GMMC's case what additional

Outline the mechanics of a letter of credit arrangement. Examine the bank's exposure to risk should it accept time drafts. In GMMC's case what additional collateral should Motor City National Bank then obtain?

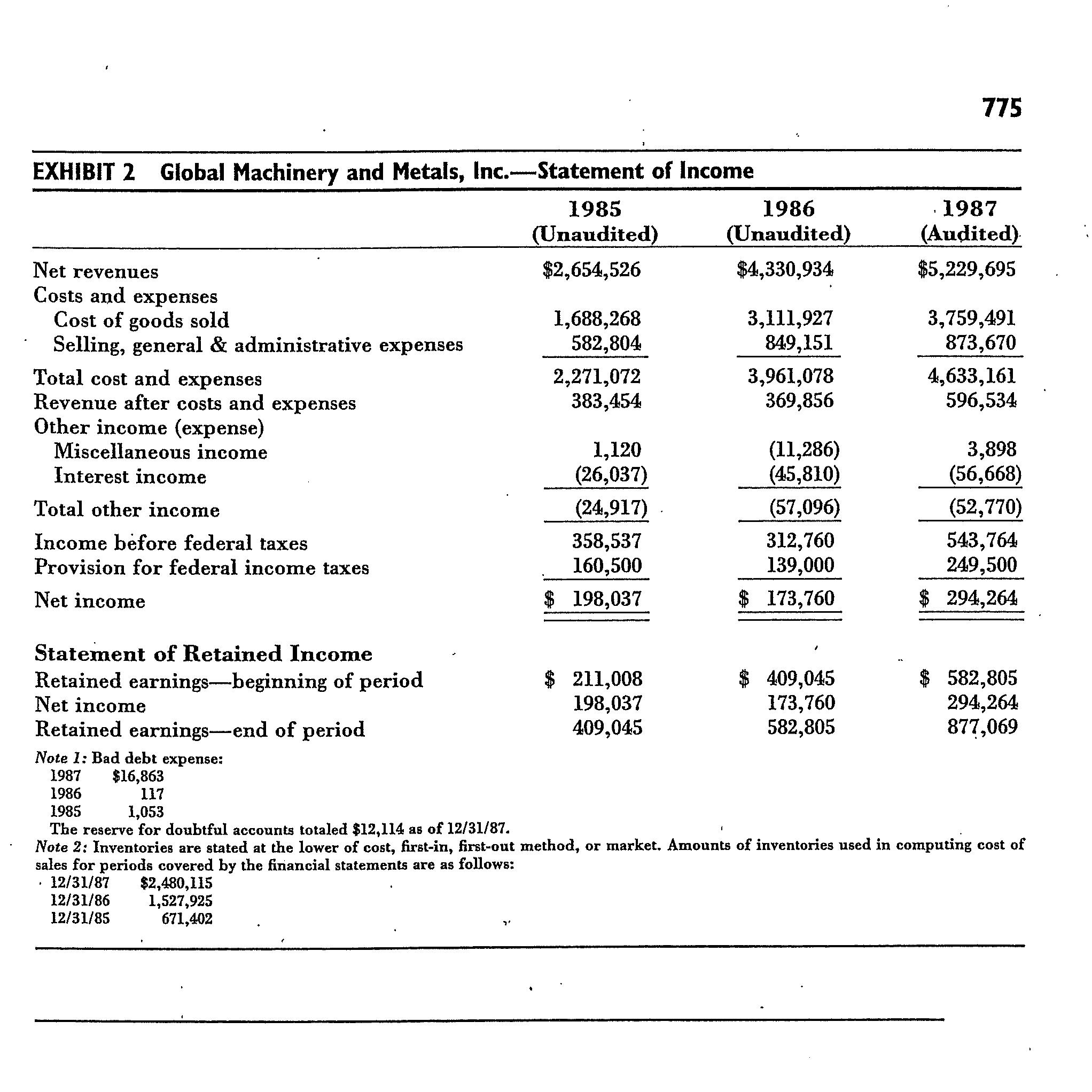

Examine GMMC's financial statements and then conduct a financial ratio analysis. Does the firm have adequate collateral in receivables and inventory?

GMMC is requesting increases in its lines of credit to meet its sales growth. Should Motor City National Bank approve it increases in both the line of credit and the letter of credit? What special risks do you see in this situation:

To the Bank ?

To the company?

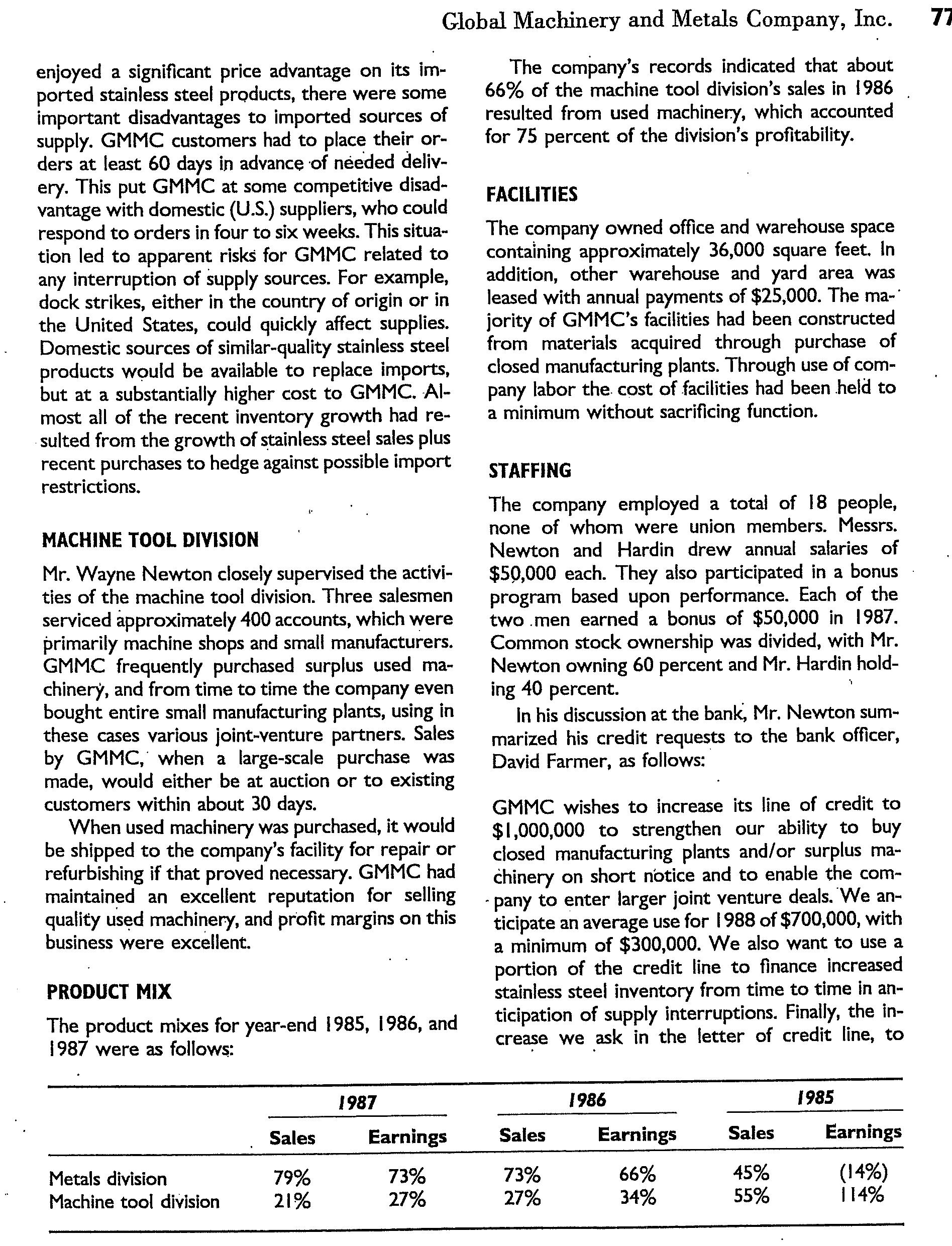

GLOBAL MACHINERY AND METALS COMPANY, INC. Mr. David Farmer, assistant vice- president at Motor City National Bank, Detroit, Michigan, was con- sidering in early 1988 an expanded loan request from one of the bank's established customers-Global Machinery and Metals Com- pany, Inc. (GMMC). David Farmer had only re- cently joined the Motor City Bank after two years of credit analysis and lending experience at a nearby competing institution. The GMMC account, which was established at the Motor City Bank about four years ago, had been brought to the bank by the officer whom Farmer had re- cently replaced; hence he had no prior contact or experience with the managers at GMMC, be- yond his understanding that the account had been a satisfactory and profitable one for the bank since the relationship began in 1984. David Farmer was approached by Wayne. Newton, one of the principals of GMMC, with a request for a material expansion in the company's -credit facilities. Newton was asking for an in- -creased line of credit to $1 million and an increase in the letter of credit (L/C) line to $1 million. The GMMC credits currently approved were as follows: 1. Line of credit: $500,000 at prime plus 2 percent. 2. L/C: $750,000 at prime plus 2 percent, with a fee of 1 percent per annum at issue plus 1 percent at funding. The preceding authorized credit lines, which had been increased in 1985, were secured by all accounts receivable and inventory. Advances against those lines were based on 50 percent of eligible accounts receivable and 40 percent of in- ventory in amounts not to exceed the total credit approved. The L/C line had been in constant use since its establishment in 1984 at or near the autho- rized limit. The line of credit was zeroed out in 1985 for about 60 days, for about 30 days in 1986, and was paid down to a low of $265,000 in 1987. Average usage in 1987 totaled $470,000. Mr. Newton told David Farmer that his current re- quest for increased credit facilities resulted from the continued rapid expansion of GMMC sales. Newton indicated that he would appreciate prompt consideration and approval by the bank of his request for increased credit. (See Exhibits I and 2). GMMC was organized in 1965 as a sole propri- etorship, owned and operated by Wayne New- ton, who was 54 years of age.. GMMC operated as a dealer for new and used machine tools. In 1980 Newton converted the firm to a corpora- tion. At about the same time, he concluded that some diversification of product and activity would serve to reduce the firm's risk as well as increase its profitability. Accordingly, GMMC began im- porting finished steel products such as stainless steel rounds, angles, pipes, sheets, and plates, principally from Japan and, to a lesser extent, from Spain and Korea. METALS DIVISION The metals division, whose sales had shown rapid growth in recent years, sold stainless steel prod- ucts to about 450 customers in the South and Southwest. One client accounted for about 10 percent of total division sales; nearly all other buyers were significantly smaller, with no other customer accounting for as much as 3 percent of volume. Sales were managed through five sales- men, primarily to small and medium-sized distrib- utors and fabricators. Mr. William Hardin, 46, di- rected the metals division and its sales staff. He operated in GMMC with a great deal of au- tonomy. The GMMC metals division worked with three Japanese suppliers and one each in Spain and South Korea. The company could sell to its cus- tomers at prices approximately 20 percent less than competitors who offered equivalent U.S.- made products. This price advantage had allowed GMMC to expand its metals division sales volume quite rapidly. Recently the company had begun building its inventory of stainless steel products in anticipa- tion of voluntary industry import restrictions on supplies from Japan and Korea. Although GMMC

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Mechanics of a Letter of Credit LC Arrangement A letter of credit is a financial instrument issued by a bank on behalf of a buyer importer to guarante...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started