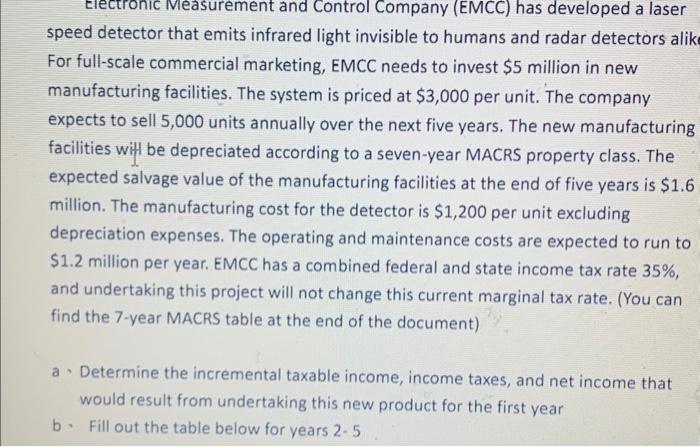

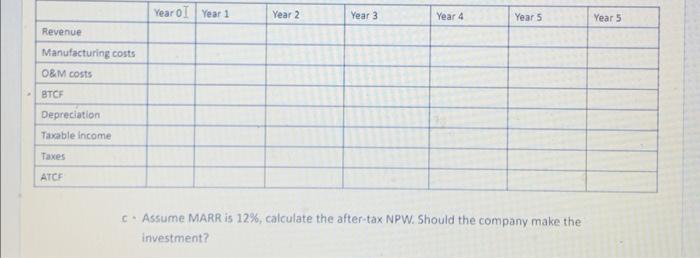

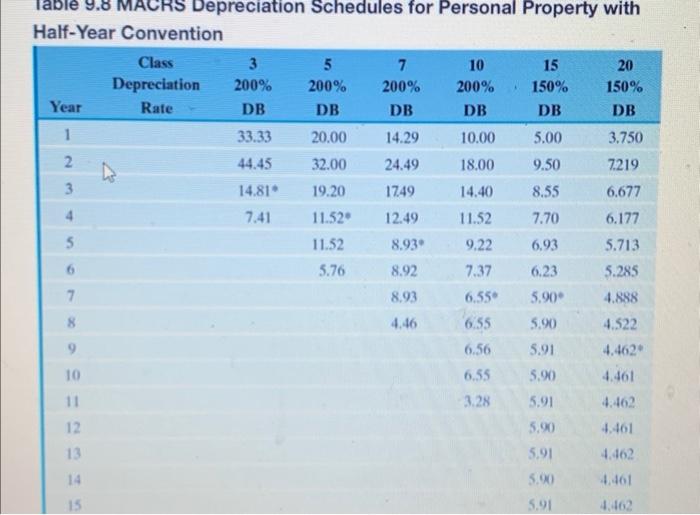

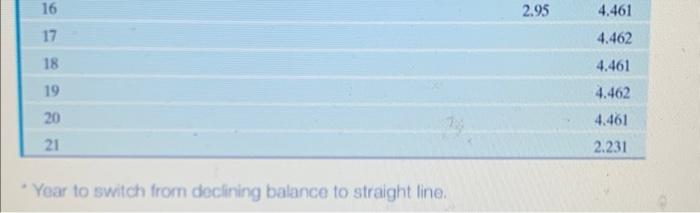

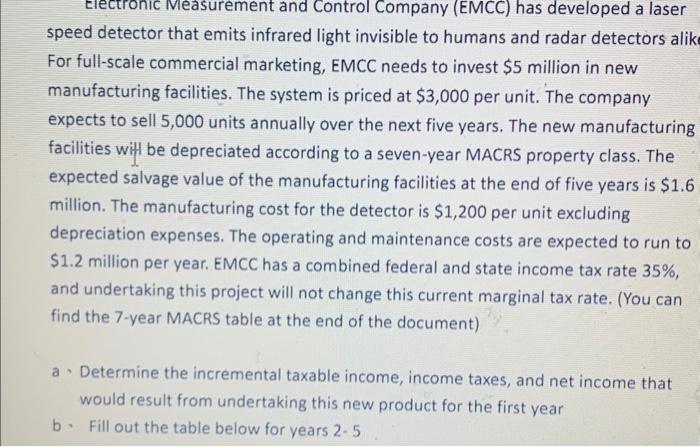

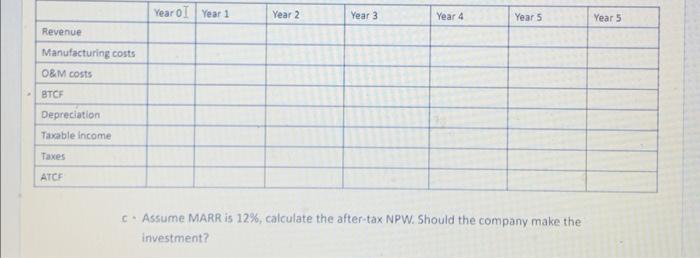

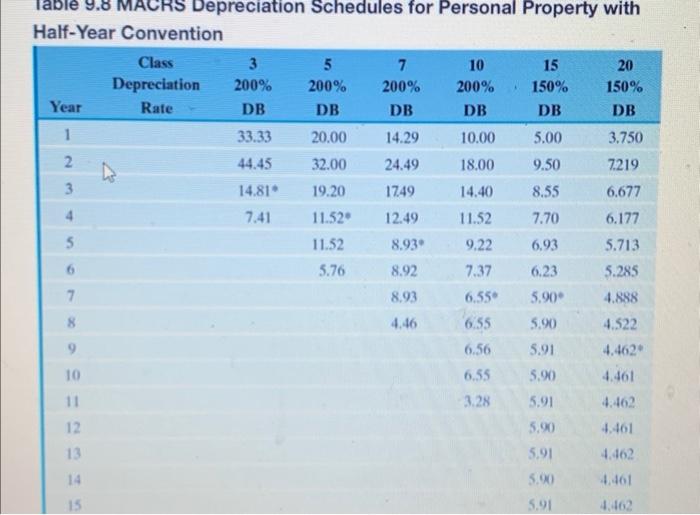

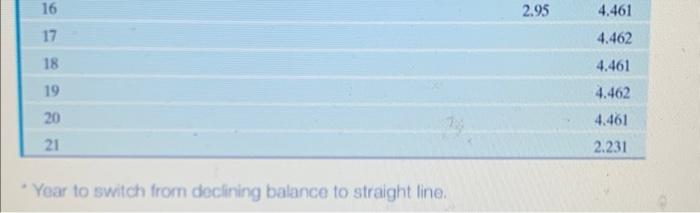

speed detector that emits infrared light invisible to humans and radar detectors alik For full-scale commercial marketing, EMCC needs to invest $5 million in new manufacturing facilities. The system is priced at $3,000 per unit. The company expects to sell 5,000 units annually over the next five years. The new manufacturing facilities witl be depreciated according to a seven-year MACRS property class. The expected salvage value of the manufacturing facilities at the end of five years is $1.6 million. The manufacturing cost for the detector is $1,200 per unit excluding depreciation expenses. The operating and maintenance costs are expected to run to \$1.2 million per year. EMCC has a combined federal and state income tax rate 35%, and undertaking this project will not change this current marginal tax rate. (You can find the 7-year MACRS table at the end of the document) a - Determine the incremental taxable income, income taxes, and net income that would result from undertaking this new product for the first year b. Fill out the table below for years 2.5 c- Assume MARR is 12\%, calculate the after-tax NPW. Should the company make the investment? Iable 9.8 MACRS Depreciation Schedules for Personal Property with * Year to switch from doclining balance to straight line. speed detector that emits infrared light invisible to humans and radar detectors alik For full-scale commercial marketing, EMCC needs to invest $5 million in new manufacturing facilities. The system is priced at $3,000 per unit. The company expects to sell 5,000 units annually over the next five years. The new manufacturing facilities witl be depreciated according to a seven-year MACRS property class. The expected salvage value of the manufacturing facilities at the end of five years is $1.6 million. The manufacturing cost for the detector is $1,200 per unit excluding depreciation expenses. The operating and maintenance costs are expected to run to \$1.2 million per year. EMCC has a combined federal and state income tax rate 35%, and undertaking this project will not change this current marginal tax rate. (You can find the 7-year MACRS table at the end of the document) a - Determine the incremental taxable income, income taxes, and net income that would result from undertaking this new product for the first year b. Fill out the table below for years 2.5 c- Assume MARR is 12\%, calculate the after-tax NPW. Should the company make the investment? Iable 9.8 MACRS Depreciation Schedules for Personal Property with * Year to switch from doclining balance to straight line