Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Speedy Access Services Inc. leases access to high-speed computers to small businesses. It provides the following information for the year: Overhead cost Computer hours

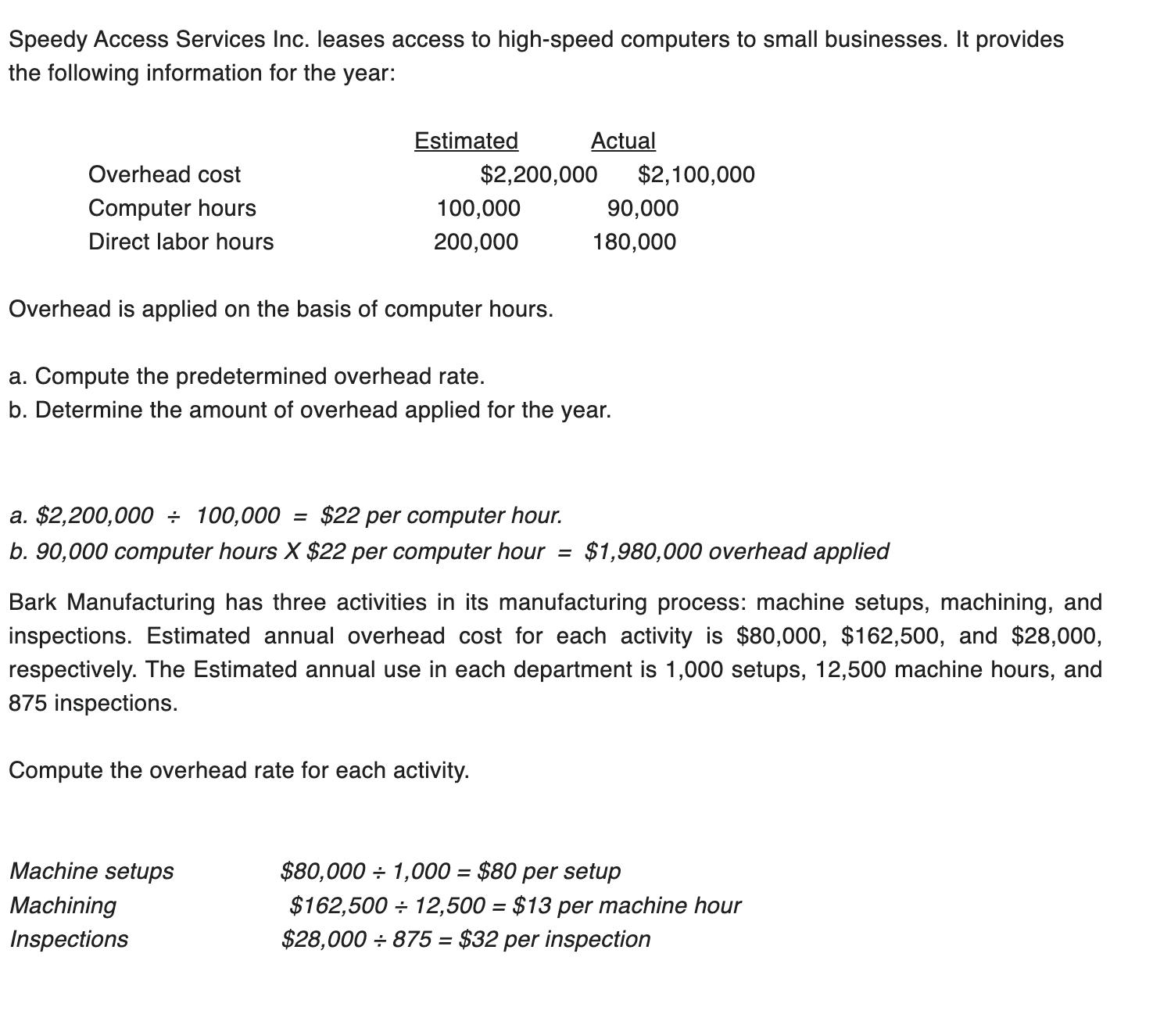

Speedy Access Services Inc. leases access to high-speed computers to small businesses. It provides the following information for the year: Overhead cost Computer hours Direct labor hours Estimated Actual $2,200,000 $2,100,000 100,000 90,000 200,000 180,000 Overhead is applied on the basis of computer hours. a. Compute the predetermined overhead rate. b. Determine the amount of overhead applied for the year. a. $2,200,000 100,000 = $22 per computer hour. b. 90,000 computer hours X $22 per computer hour = $1,980,000 overhead applied Bark Manufacturing has three activities in its manufacturing process: machine setups, machining, and inspections. Estimated annual overhead cost for each activity is $80,000, $162,500, and $28,000, respectively. The Estimated annual use in each department is 1,000 setups, 12,500 machine hours, and 875 inspections. Compute the overhead rate for each activity. Machine setups $80,000 1,000 = $80 per setup Machining Inspections $162,500 12,500 = $13 per machine hour $28,000 875 = $32 per inspection

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started