Speedy Delivery Service, Inc. has always rented their delivery truck. Speedy decided to replace the rented delivery truck by purchasing a new truck. The

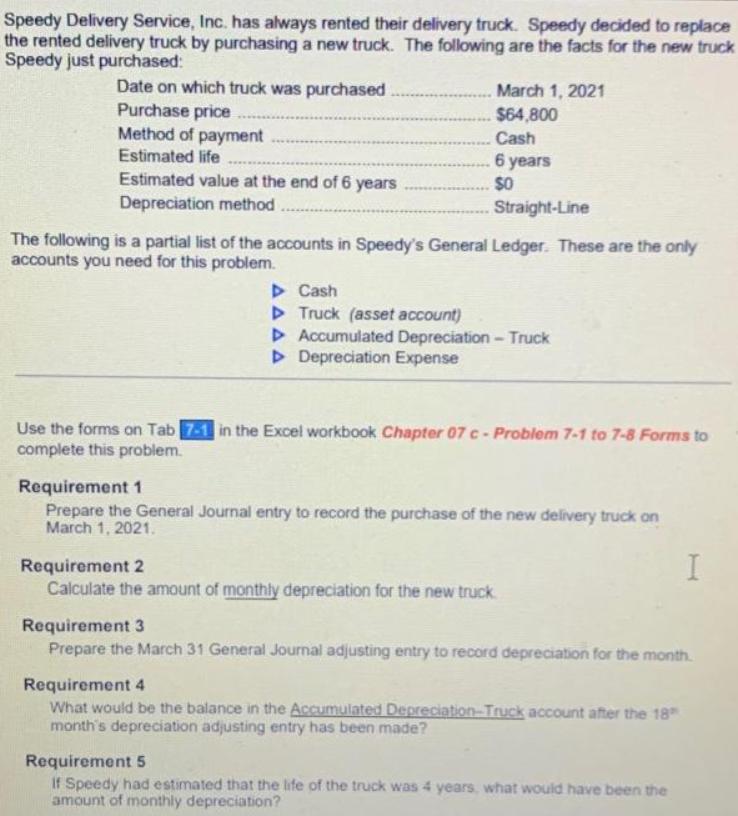

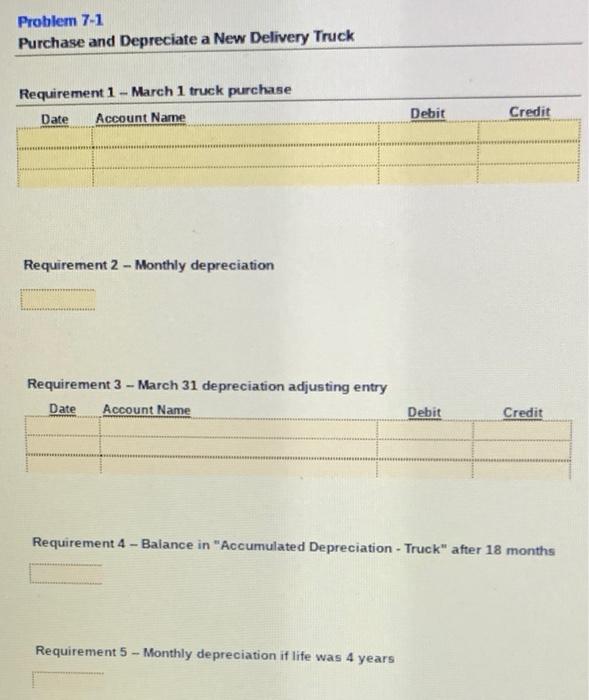

Speedy Delivery Service, Inc. has always rented their delivery truck. Speedy decided to replace the rented delivery truck by purchasing a new truck. The following are the facts for the new truck Speedy just purchased: Date on which truck was purchased Purchase price Method of payment Estimated life Estimated value at the end of 6 years Depreciation method March 1, 2021 $64,800 Cash 6 years $0 Straight-Line The following is a partial list of the accounts in Speedy's General Ledger. These are the only accounts you need for this problem. > Cash > Truck (asset account) D Accumulated Depreciation - Truck D Depreciation Expense Use the forms on Tab 7-1 in the Excel workbook Chapter 07 c - Problem 7-1 to 7-8 Forms to complete this problem. Requirement 1 Prepare the General Journal entry to record the purchase of the new delivery truck on March 1, 2021. Requirement 2 Calculate the amount of monthly depreciation for the new truck Requirement 3 Prepare the March 31 General Journal adjusting entry to record depreciation for the month. Requirement 4 What would be the balance in the Accumulated Depreciation-Truck account after the 18 month's depreciation adjusting entry has been made? Requirement 5 If Speedy had estimated that the life of the truck was 4 years, what would have been the amount of monthly depreciation? Problem 7-1 Purchase and Depreciate a New Delivery Truck Requirement 1 - March 1 truck purchase Date Account Name Debit Credit Requirement 2 - Monthly depreciation Requirement 3 - March 31 depreciation adjusting entry Date Account Name Debit Credit Requirement 4 - Balance in "Accumulated Depreciation - Truck" after 18 months Requirement 5 - Monthly depreciation if life was 4 years

Step by Step Solution

There are 3 Steps involved in it

Step: 1

my answer is as done below 1 DATE PARTICULARS AMT AMT 132...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started