Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Speedy Mouse Inc, makes a special mouse for computers. Each mouse sells for P25 and annual production and sales are 120,000 units. Costs for

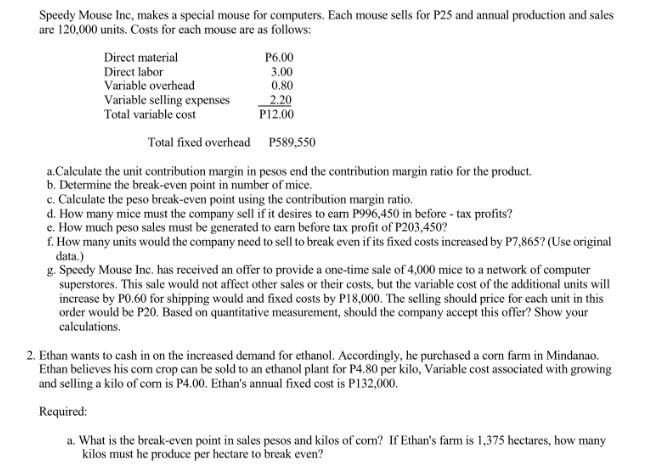

Speedy Mouse Inc, makes a special mouse for computers. Each mouse sells for P25 and annual production and sales are 120,000 units. Costs for each mouse are as follows: Direct material Direct labor Variable overhead Variable selling expenses Total variable cost P6.00 3.00 0.80 2.20 P12.00 Total fixed overhead P589,550 a.Calculate the unit contribution margin in pesos end the contribution margin ratio for the product. b. Determine the break-even point in number of mice. c. Calculate the peso break-even point using the contribution margin ratio. d. How many mice must the company sell if it desires to earn P996,450 in before-tax profits? e. How much peso sales must be generated to earn before tax profit of P203,450? f. How many units would the company need to sell to break even if its fixed costs increased by P7,865? (Use original data.) g. Speedy Mouse Inc. has received an offer to provide a one-time sale of 4,000 mice to a network of computer superstores. This sale would not affect other sales or their costs, but the variable cost of the additional units will increase by P0.60 for shipping would and fixed costs by P18,000. The selling should price for each unit in this order would be P20. Based on quantitative measurement, should the company accept this offer? Show your calculations. 2. Ethan wants to cash in on the increased demand for ethanol. Accordingly, he purchased a corn farm in Mindanao. Ethan believes his com crop can be sold to an ethanol plant for P4.80 per kilo, Variable cost associated with growing and selling a kilo of com is P4.00. Ethan's annual fixed cost is P132,000. Required: a. What is the break-even point in sales pesos and kilos of com? If Ethan's farm is 1,375 hectares, how many kilos must he produce per hectare to break even?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Calculations Unit Contribution Margin Selling Price Total Variable Cost per unit Total Variable Cost per unit Direct Material Direct Labor Variable ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started