Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Spicemup BV is a small private corporation. It imports hot sauces from around the globe and sells these to consumers and businesses in the

![]()

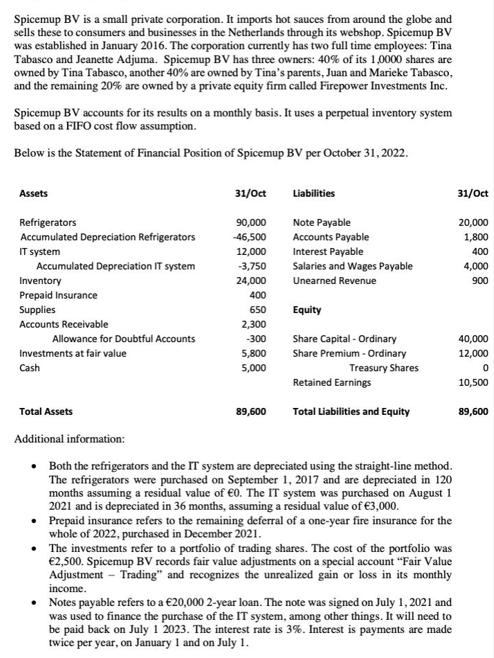

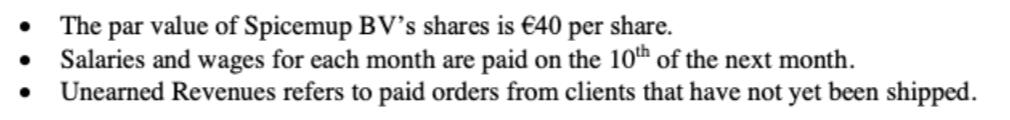

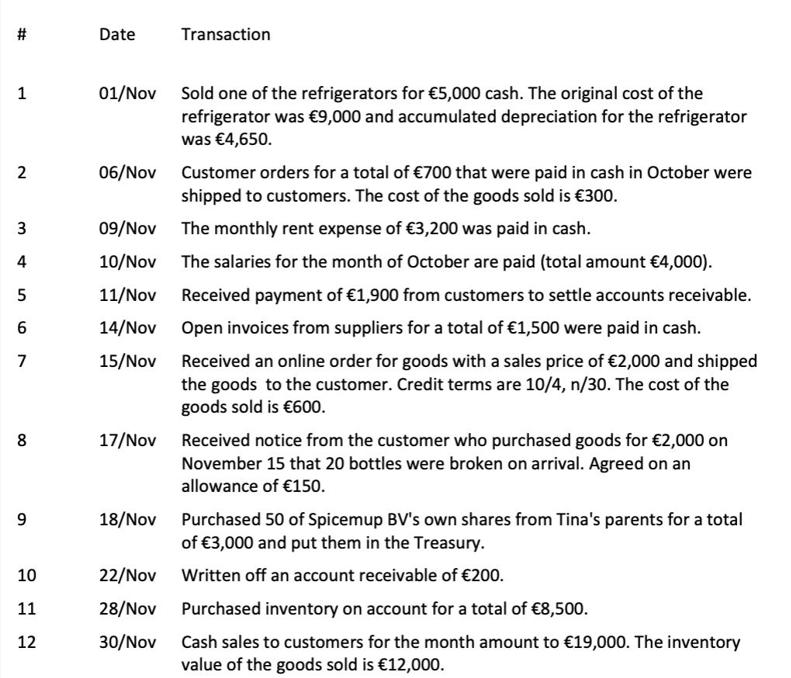

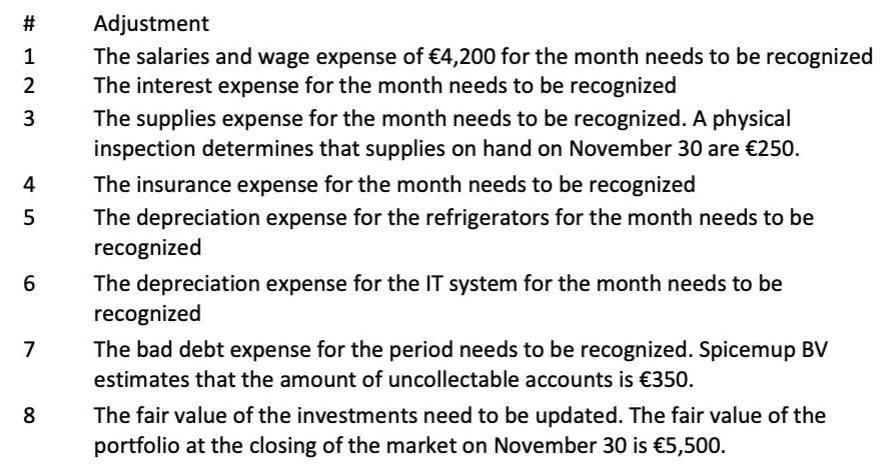

Spicemup BV is a small private corporation. It imports hot sauces from around the globe and sells these to consumers and businesses in the Netherlands through its webshop. Spicemup BV was established in January 2016. The corporation currently has two full time employees: Tina Tabasco and Jeanette Adjuma. Spicemup BV has three owners: 40% of its 1,0000 shares are owned by Tina Tabasco, another 40% are owned by Tina's parents, Juan and Marieke Tabasco, and the remaining 20% are owned by a private equity firm called Firepower Investments Inc. Spicemup BV accounts for its results on a monthly basis. It uses a perpetual inventory system based on a FIFO cost flow assumption. Below is the Statement of Financial Position of Spicemup BV per October 31, 2022. Assets Refrigerators Accumulated Depreciation Refrigerators IT system Accumulated Depreciation IT system Inventory Prepaid Insurance Supplies Accounts Receivable Allowance for Doubtful Accounts Investments at fair value Cash Total Assets 31/Oct 90,000 -46,500 12,000 -3,750 24,000 400 650 2,300 -300 5,800 5,000 89,600 Liabilities Note Payable Accounts Payable Interest Payable Salaries and Wages Payable Unearned Revenue Equity Share Capital - Ordinary Share Premium - Ordinary Treasury Shares Retained Earnings Total Liabilities and Equity Additional information: Both the refrigerators and the IT system are depreciated using the straight-line method. The refrigerators were purchased on September 1, 2017 and are depreciated in 120 months assuming a residual value of 0. The IT system was purchased on August 1 2021 and is depreciated in 36 months, assuming a residual value of 3,000. The investments refer to a portfolio of trading shares. The cost of the portfolio was 2,500. Spicemup BV records fair value adjustments on a special account "Fair Value Adjustment - Trading" and recognizes the unrealized gain or loss in its monthly income. Prepaid insurance refers to the remaining deferral of a one-year fire insurance for the whole of 2022, purchased in December 2021. Notes payable refers to a 20,000 2-year loan. The note was signed on July 1, 2021 and was used to finance the purchase of the IT system, among other things. It will need to be paid back on July 1 2023. The interest rate is 3%. Interest is payments are made twice per year, on January 1 and on July 1. 31/Oct 20,000 1,800 400 4,000 900 40,000 12,000 0 10,500 89,600 The par value of Spicemup BV's shares is 40 per share. Salaries and wages for each month are paid on the 10th of the next month. Unearned Revenues refers to paid orders from clients that have not yet been shipped. # 1 2 3 4 5 6 7 8 9 10 11 12 Date 01/Nov Sold one of the refrigerators for 5,000 cash. The original cost of the refrigerator was 9,000 and accumulated depreciation for the refrigerator was 4,650. 06/Nov Customer orders for a total of 700 that were paid in cash in October were shipped to customers. The cost of the goods sold is 300. 09/Nov The monthly rent expense of 3,200 was paid in cash. 10/Nov The salaries for the month of October are paid (total amount 4,000). 11/Nov Received payment of 1,900 from customers to settle accounts receivable. Open invoices from suppliers for a total of 1,500 were paid in cash. 14/Nov 15/Nov Received an online order for goods with a sales price of 2,000 and shipped the goods to the customer. Credit terms are 10/4, n/30. The cost of the goods sold is 600. 17/Nov Transaction 18/Nov 22/Nov 28/Nov 30/Nov Received notice from the customer who purchased goods for 2,000 on November 15 that 20 bottles were broken on arrival. Agreed on an allowance of 150. Purchased 50 of Spicemup BV's own shares from Tina's parents for a total of 3,000 and put them in the Treasury. Written off an account receivable of 200. Purchased inventory on account for a total of 8,500. Cash sales to customers for the month amount to 19,000. The inventory value of the goods sold is 12,000. #12 3 4 5 6 7 8 Adjustment The salaries and wage expense of 4,200 for the month needs to be recognized The interest expense for the month needs to be recognized The supplies expense for the month needs to be recognized. A physical inspection determines that supplies on hand on November 30 are 250. The insurance expense for the month needs to be recognized The depreciation expense for the refrigerators for the month needs to be recognized The depreciation expense for the IT system for the month needs to be recognized The bad debt expense for the period needs to be recognized. Spicemup BV estimates that the amount of uncollectable accounts is 350. The fair value of the investments need to be updated. The fair value of the portfolio at the closing of the market on November 30 is 5,500. Make all the required closing entries to close the books at the end of the month.

Step by Step Solution

★★★★★

3.38 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

To close the books at the end of November we need to make the required closing entries Based on the information provided here are the closing entries ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started