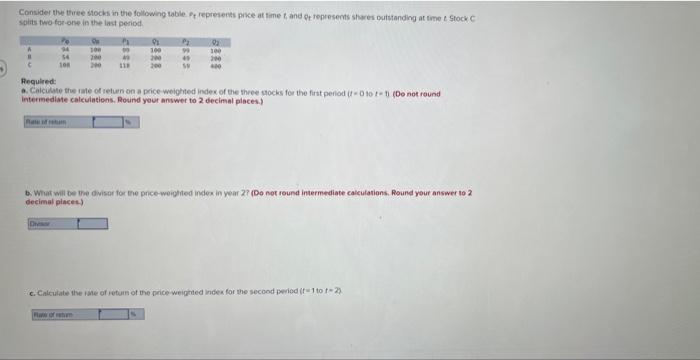

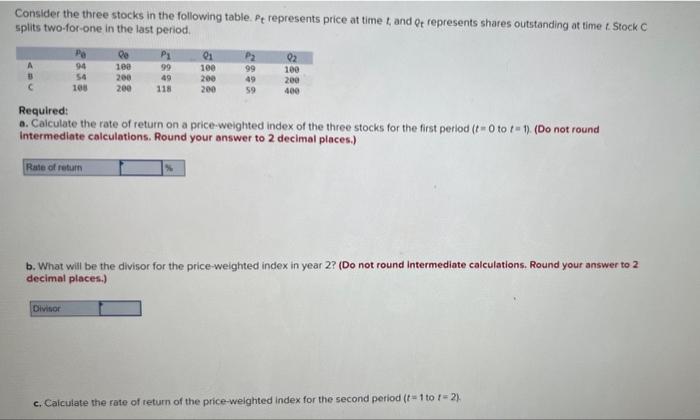

spitis two tar-one in the last peribd. Pequired: a. Calculate the rale of retun on a price- weighted indes of the three socks for the firt period if =0 to t=7 (De not reund intermediate calculations. Round yout answer to 2 decimal places.) b. What will be the divisar for the price-werghted indes in year 2? (Do not round intermediate calculations, Round your answer to 2 decimal piaces.) c. Calculate the iase of return of the price weigtited indes for the secood peried ( f=1 to t=2 ) Consider the three stocks in the following table. Pt represents price at time t and Qt represents shares outstanding at time t. Stock C splits two-for-one in the last period. Required: a. Caiculate the rate of return on a price-weighted index of the three stocks for the first period ( t=0 to t=1). (Do not round intermediate calculations. Round your answer to 2 decimal places.) b. What will be the divisor for the price-weighted index in year 2 ? (Do not round intermediate calculations. Round your answer to 2 decimal places.) c. Caiculate the rate of return of the price-welghted index for the second period ( t=1 to t=2). spitis two tar-one in the last peribd. Pequired: a. Calculate the rale of retun on a price- weighted indes of the three socks for the firt period if =0 to t=7 (De not reund intermediate calculations. Round yout answer to 2 decimal places.) b. What will be the divisar for the price-werghted indes in year 2? (Do not round intermediate calculations, Round your answer to 2 decimal piaces.) c. Calculate the iase of return of the price weigtited indes for the secood peried ( f=1 to t=2 ) Consider the three stocks in the following table. Pt represents price at time t and Qt represents shares outstanding at time t. Stock C splits two-for-one in the last period. Required: a. Caiculate the rate of return on a price-weighted index of the three stocks for the first period ( t=0 to t=1). (Do not round intermediate calculations. Round your answer to 2 decimal places.) b. What will be the divisor for the price-weighted index in year 2 ? (Do not round intermediate calculations. Round your answer to 2 decimal places.) c. Caiculate the rate of return of the price-welghted index for the second period ( t=1 to t=2)