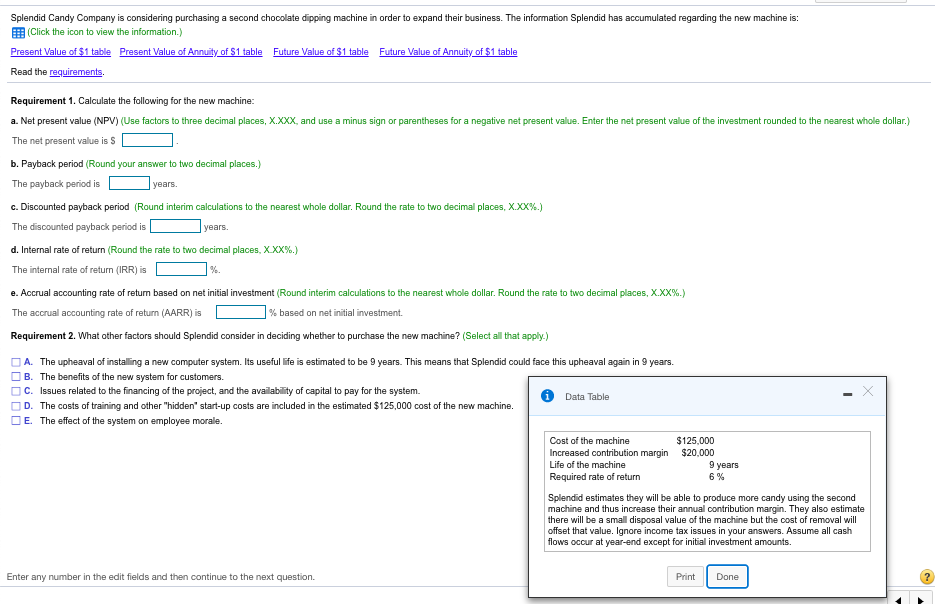

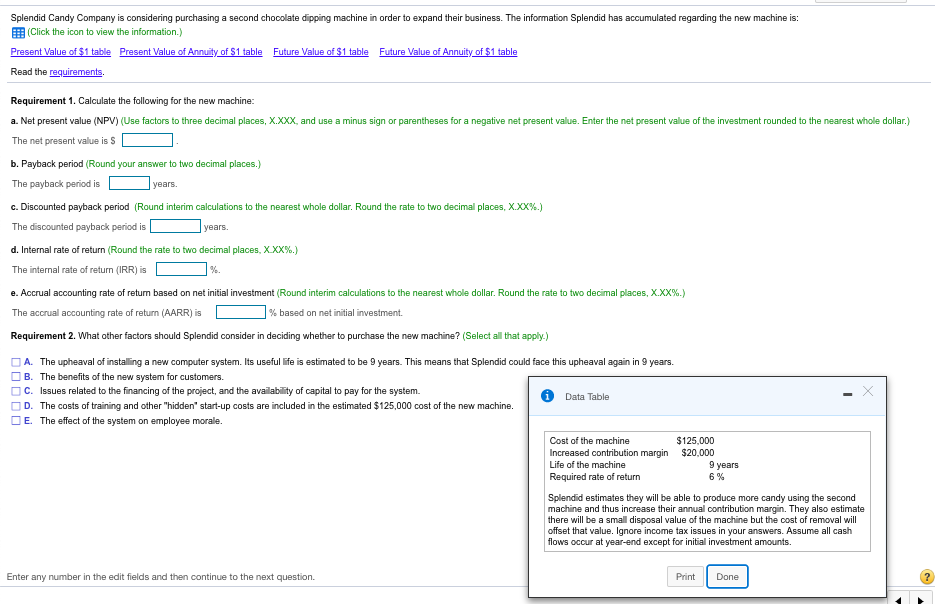

Splendid Candy Company is considering purchasing a second chocolate dipping machine in order to expand their business. The information Splendid has accumulated regarding the new machine is: EEB (Click the icon to view the information.) Read the requirements. Requirement 1. Calculate the following for the new machine: a. Net present value (NPV) (Use factors to three decimal places, X.XXX, and use a minus sign or parentheses for a negative net present value. Enter the net present value of the investment rounded to the nearest whole dollar.) The net present value is S b. Payback period (Round your answer to two decimal places.) The payback period is years c. Discounted payback period (Round interim calculations to the nearest whole dollar. Round the rate to two decimal places, XXX%.) The discounted payback period is d. Internal rate of return Round the rate to two decimal places, XXX%.) The internal rate of return (IRR) is e. Accrual accounting rate of return based on net initial investment Round interim calculations to the nearest whole dollar. Round the rate to two dec mal places, XXX% The accrual accounting rate of return (AARR) is Requirement 2. What other factors should Splendid consider in deciding whether to purchase the new machine? (Select al that apply.) years. 1% % based on net initial investment. A. The upheaval of instaling a new computer system. Its useful life is estimated to be 9 years. This means that Splendid could face this upheaval again n 9 years. The benefits of the new system for customers. B. C. Issues related to the financing of the project, and the availability of capital to pay for the system. Data Table D. E. The costs of training and other "hidden" start-up costs are included in the estimated $125,000 cost of the new machine. The effect of the system on employee morale. 125,000 $20.000 Cost of the machine Increased contribution margin Life of the machine 9 years Required rate of return Splendid estimates they will be able to produce more candy using the second machine and thus increase their annual contribution margin. They also estimate there will be a smal disposal value of the machine but the cost of removal will offset that value. Ignore income tax issues in your answers. Assume all cash flows occur at year-end except for initial investment amounts. Enter any number in the edit fields and then continue to the next question. Print Done