Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Sport Fashions Ltd (SFL) is a Hong Kong (HK) based company which designs and manufactures casual sport outfits and accessories for the international markets.

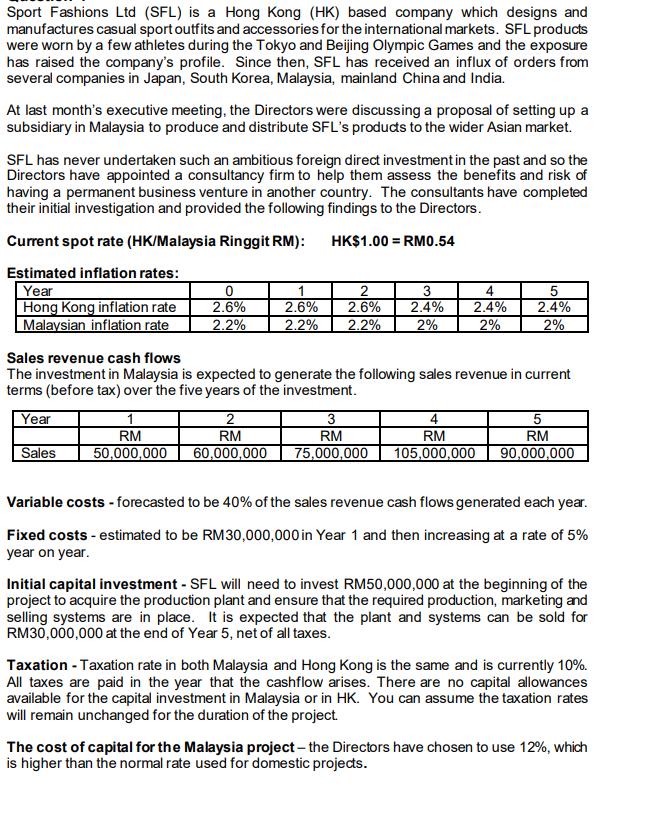

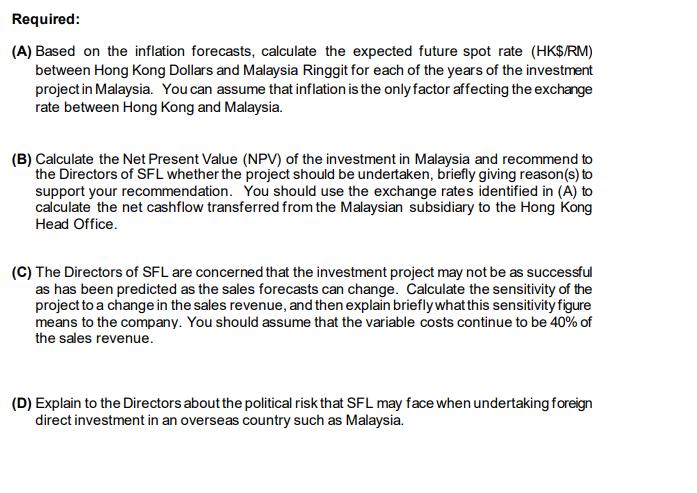

Sport Fashions Ltd (SFL) is a Hong Kong (HK) based company which designs and manufactures casual sport outfits and accessories for the international markets. SFL products were worn by a few athletes during the Tokyo and Beijing Olympic Games and the exposure has raised the company's profile. Since then, SFL has received an influx of orders from several companies in Japan, South Korea, Malaysia, mainland China and India. At last month's executive meeting, the Directors were discussing a proposal of setting up a subsidiary in Malaysia to produce and distribute SFL's produds to the wider Asian market. SFL has never undertaken such an ambitious foreign direct investment in the past and so the Directors have appointed a consultancy firm to help them assess the benefits and risk of having a permanent business venture in another country. The consultants have completed their initial investigation and provided the following findings to the Directors. Current spot rate (HK/Malaysia Ringgit RM): HK$1.00 = RM0.54 %3D Estimated inflation rates: Year Hong Kong inflation rate Malaysian inflation rate 1. 2.6% 2 3 4 2.4% 2% 2.6% 2.4% 2.4% 2% 2.6% 2.2% 2.2% 2.2% 2% Sales revenue cash flows The investment in Malaysia is expected to generate the following sales revenue in current terms (before tax) over the five years of the investment. Year 4 RM 50,000,000 RM 60,000,000 RM RM RM Sales 75,000,000 105,000,000 90,000,000 Variable costs - forecasted to be 40% of the sales revenue cash flows generated each year. Fixed costs - estimated to be RM30,000,000 in Year 1 and then increasing at a rate of 5% year on year. Initial capital investment - SFL will need to invest RM50,000,000 at the beginning of the project to acquire the production plant and ensure that the required production, marketing and selling systems are in place. It is expected that the plant and systems can be sold for RM30,000,000 at the end of Year 5, net of all taxes. Taxation - Taxation rate in both Malaysia and Hong Kong is the same and is currently 10%. All taxes are paid in the year that the cashflow arises. There are no capital allowances available for the capital investment in Malaysia or in HK. You can assume the taxation rates will remain unchanged for the duration of the project. The cost of capital for the Malaysia project - the Directors have chosen to use 12%, which is higher than the normal rate used for domestic projeds. Required: (A) Based on the inflation forecasts, calculate the expected future spot rate (HKS/RM) between Hong Kong Dollars and Malaysia Ringgit for each of the years of the investment project in Malaysia. You can assume that inflation is the only factor affecting the exchange rate between Hong Kong and Malaysia. (B) Calculate the Net Present Value (NPV) of the investment in Malaysia and recommend to the Directors of SFL whether the project should be undertaken, briefly giving reason(s) to support your recommendation. You should use the exchange rates identified in (A) to calculate the net cashflow transferred from the Malaysian subsidiary to the Hong Kong Head Office. (C) The Directors of SFL are concerned that the investment project may not be as successful as has been predicted as the sales forecasts can change. Calculate the sensitivity of the project to a change in the sales revenue, and then explain briefly what this sensitivity figure means to the company. You should assume that the variable costs continue to be 40% of the sales revenue. (D) Explain to the Directors about the political risk that SFL may face when undertaking foreign direct investment in an overseas country such as Malaysia.

Step by Step Solution

★★★★★

3.55 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

A Year 0 1 3 4 5 Hong Kong inflation rate 26 28 26 24 24 Malaysian inflation rate 22 22 22 2 2 Future spot rate Current spot rate x 1Inflation rate of HK1Inflation rate of Malaysia Year 0 1 3 4 5 Futu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started