Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Sports Betting. Consider the following passage from Levitt (2004): The second reason that the bookmaker cannot distort prices too much is that if some

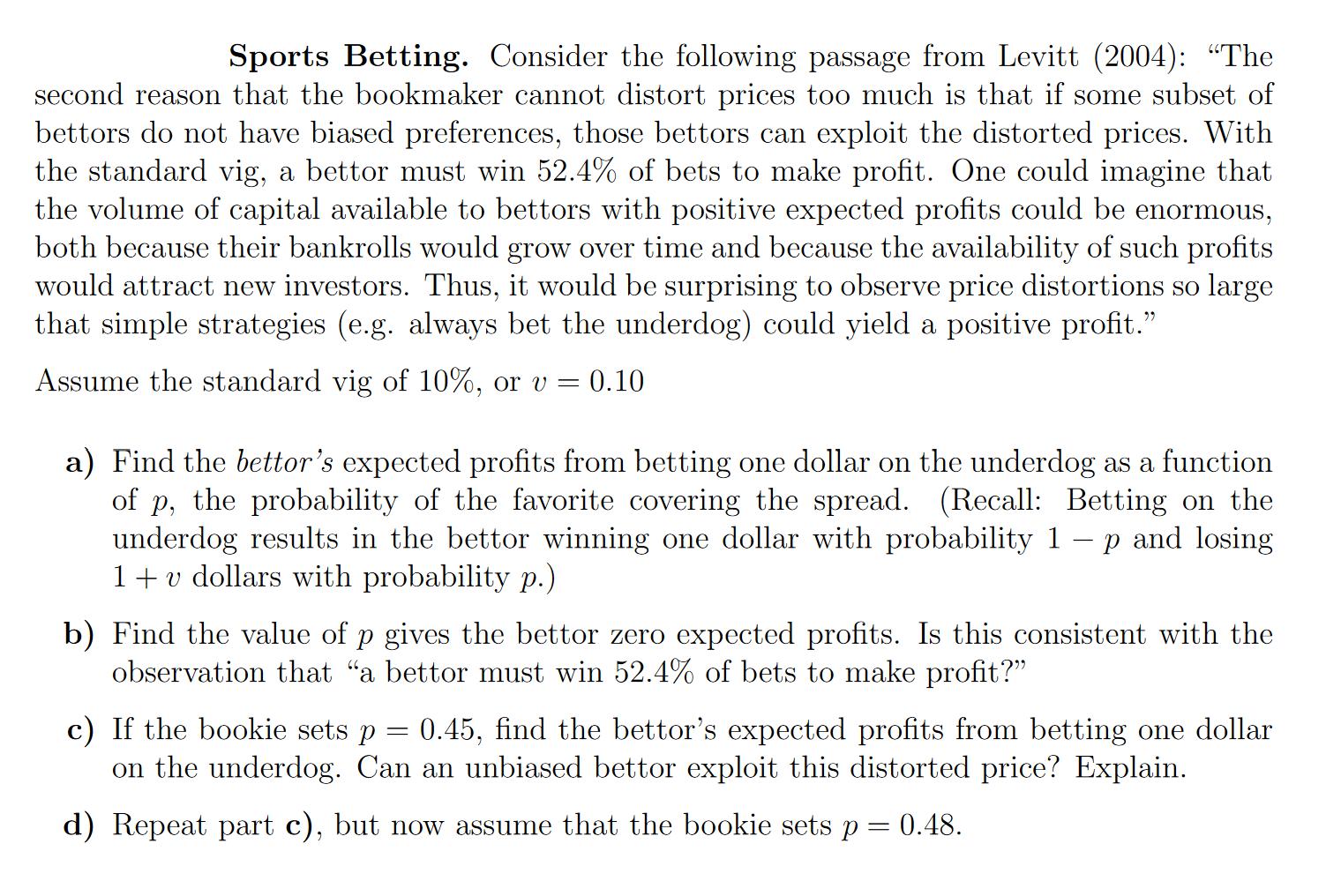

Sports Betting. Consider the following passage from Levitt (2004): "The second reason that the bookmaker cannot distort prices too much is that if some subset of bettors do not have biased preferences, those bettors can exploit the distorted prices. With the standard vig, a bettor must win 52.4% of bets to make profit. One could imagine that the volume of capital available to bettors with positive expected profits could be enormous, both because their bankrolls would grow over time and because the availability of such profits would attract new investors. Thus, it would be surprising to observe price distortions so large that simple strategies (e.g. always bet the underdog) could yield a positive profit." Assume the standard vig of 10%, or v = 0.10 a) Find the bettor's expected profits from betting one dollar on the underdog as a function of p, the probability of the favorite covering the spread. (Recall: Betting on the underdog results in the bettor winning one dollar with probability 1 p and losing 1+ v dollars with probability p.) b) Find the value of p gives the bettor zero expected profits. Is this consistent with the observation that "a bettor must win 52.4% of bets to make profit?" c) If the bookie sets p = 0.45, find the bettor's expected profits from betting one dollar on the underdog. Can an unbiased bettor exploit this distorted price? Explain. d) Repeat part c), but now assume that the bookie sets p = 0.48.

Step by Step Solution

★★★★★

3.40 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

a The bettors expected profits from betting 1 on the underdog as a funct...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started