Question

Sports Plus is a sporting goods retail store. They want to use Excel to help them decide the best way to fund a major building

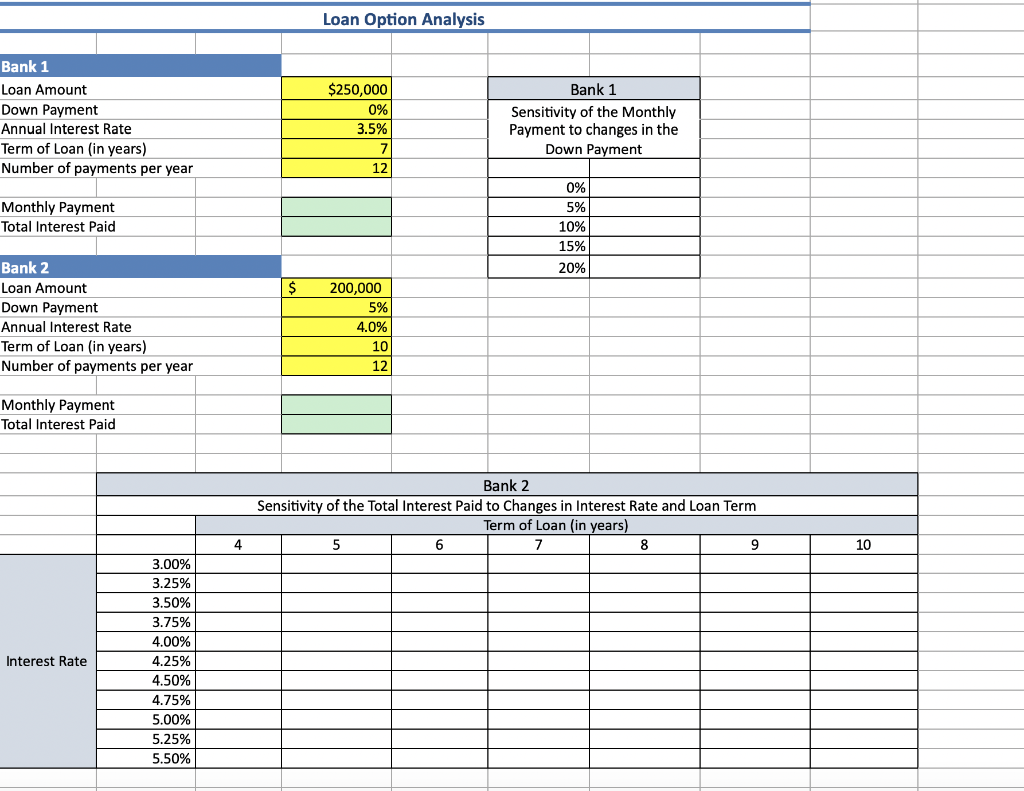

Sports Plus is a sporting goods retail store. They want to use Excel to help them decide the best way to fund a major building expansion. They have found two banks that will lend them the money for the expansion. The terms from each bank are listed in the start file. 1. Calculate the monthly payment amount and the total amount of interest paid for each option in the green cells. Be sure the amounts in the calculated cells will change if the input values change. (Notes: For the terms offered by Bank 1, you must consider that the 0% Down Payment is an input and may change, so it should be included in the subsequent calculations of the monthly payment and total interest paid. Also be sure that the Bank 1 Annual Interest Rate is 3.5% and the Bank 2 Annual Interest Rate is 4.0%) 2. For the terms offered by Bank 1 complete the one-variable data table to show the impact of changes in the Down Payment on the Monthly Payment. 3. For the terms offered by Bank 2 complete the two-variable data table to show the sensitivity of the total interest paid amount to changes in interest rates and changes in loan terms. Format the results of the two-variable data table to currency and round to the nearest dollar. 4. Assume Sports Plus can negotiate the interest rate from Bank 2. What interest rate should they request to make the total interest paid in the loan from Bank 2 equal to the total interest paid in the loan from Bank 1? Sports Plus Loan Option Analysis Bank 1 $250,000 Bank 1 Loan Amount 0% Sensitivity of the Monthly Down Payment 3.5% Annual Interest rate. Term of loan (In years) 7. Number of payments per year 12.

Loan Option Analysis Bank 1 Loan Amount Down Payment Annual Interest Rate Term of Loan (in years) Number of payments per year $250,000 0% 3.5% 7 12 Bank 1 Sensitivity of the Monthly Payment to changes in the Down Payment Monthly Payment Total Interest Paid 0% 5% 10% 15% 20% $ Bank 2 Loan Amount Down Payment Annual Interest Rate Term of Loan (in years) Number of payments per year 200,000 5% 4.0% 10 12 Monthly Payment Total Interest Paid Bank 2 Sensitivity of the Total Interest Paid to Changes in Interest Rate and Loan Term Term of Loan (in years) 5 6 7 8 9 4 10 Interest Rate 3.00% 3.25% 3.50% 3.75% 4.00% 4.25% 4.50% 4.75% 5.00% 5.25% 5.50%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started