Answered step by step

Verified Expert Solution

Question

1 Approved Answer

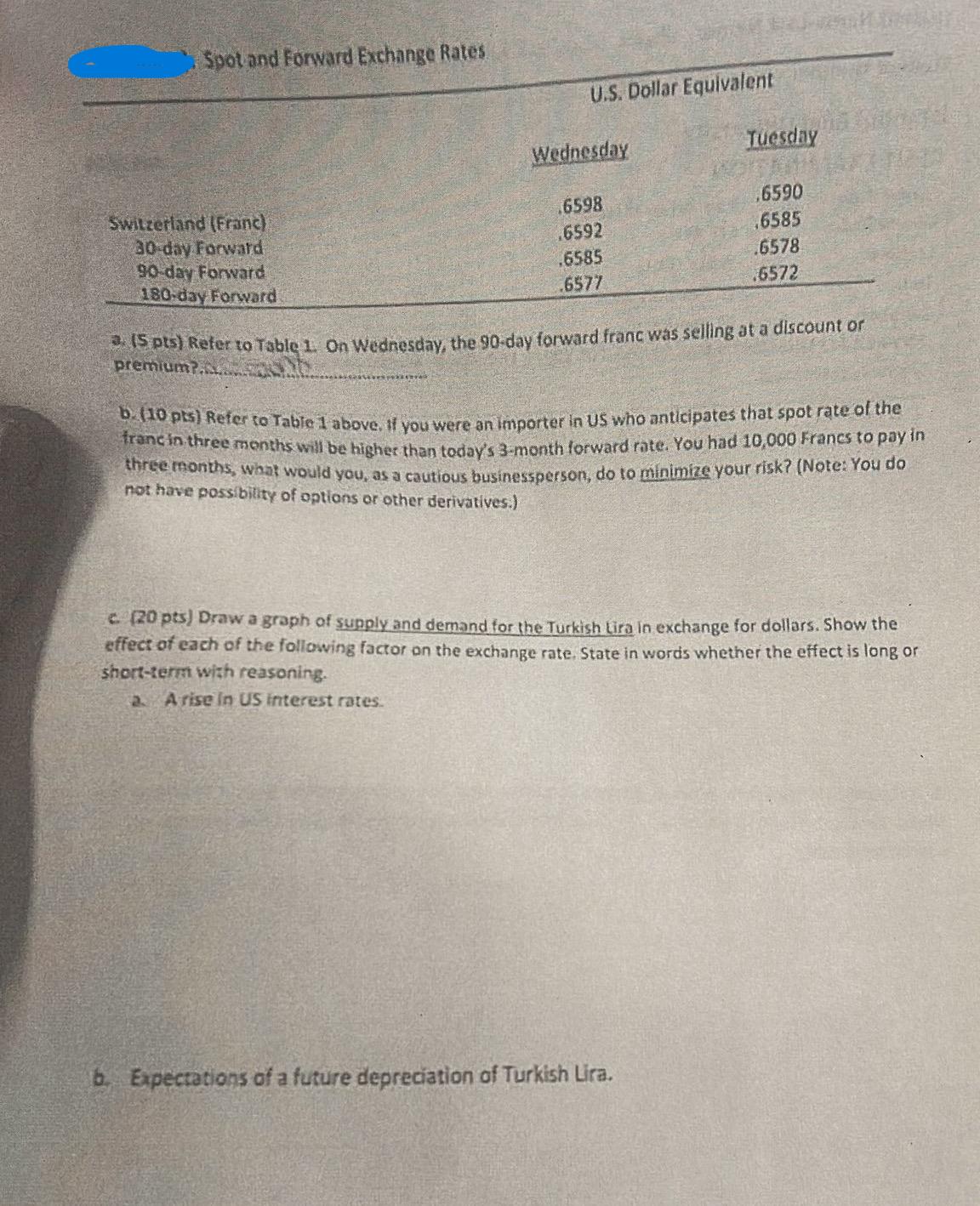

Spot and Forward Exchange Rates U.S. Dollar Equivalent Switzerland (Franc) 30-day Forward 90-day Forward 180-day Forward Wednesday Tuesday .6598 .6590 .6592 .6585 .6585 .6578

Spot and Forward Exchange Rates U.S. Dollar Equivalent Switzerland (Franc) 30-day Forward 90-day Forward 180-day Forward Wednesday Tuesday .6598 .6590 .6592 .6585 .6585 .6578 .6577 .6572 a. (5 pts) Refer to Table 1. On Wednesday, the 90-day forward franc was selling at a discount or premium?... b. (10 pts) Refer to Table 1 above. If you were an importer in US who anticipates that spot rate of the franc in three months will be higher than today's 3-month forward rate. You had 10,000 Francs to pay in three months, what would you, as a cautious businessperson, do to minimize your risk? (Note: You do not have possibility of options or other derivatives.) c. (20 pts) Draw a graph of supply and demand for the Turkish Lira in exchange for dollars. Show the effect of each of the following factor on the exchange rate. State in words whether the effect is long or short-term with reasoning. a. A rise in US interest rates. b. Expectations of a future depreciation of Turkish Lira.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a On Wednesday the 90day forward franc was selling at a discount compared to the spot rate This can ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started