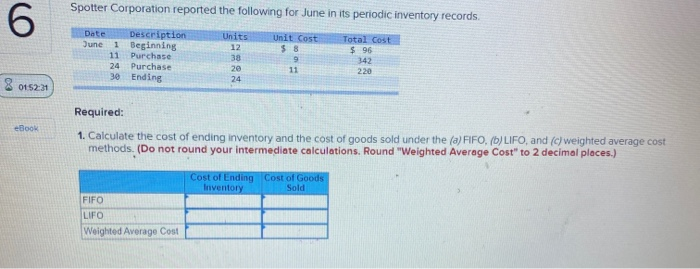

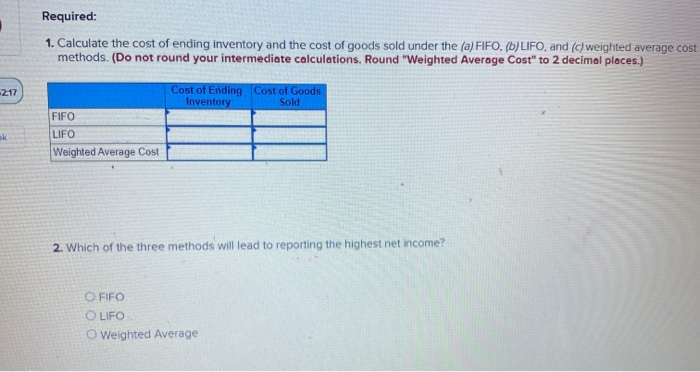

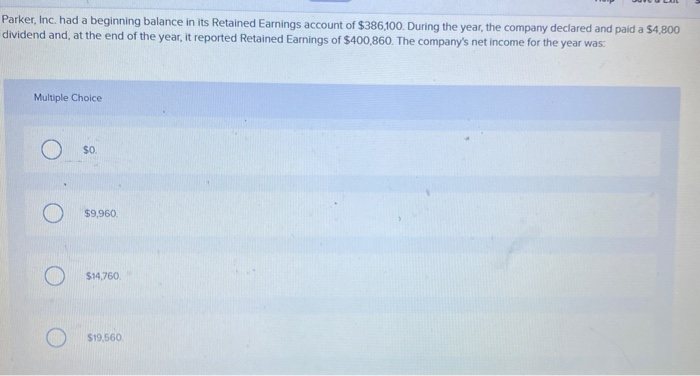

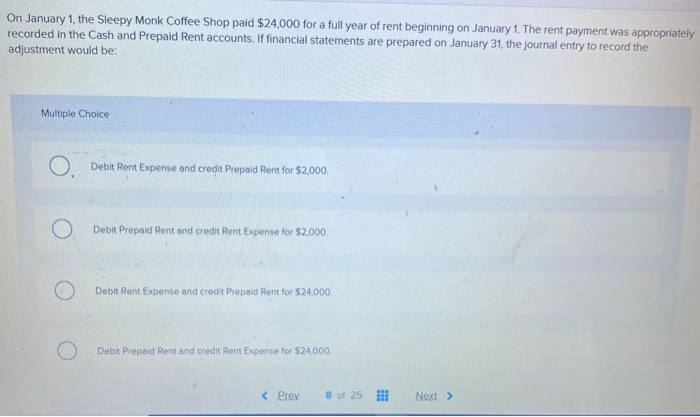

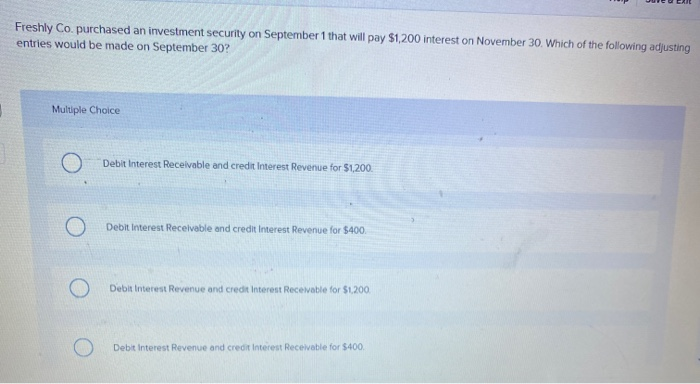

Spotter Corporation reported the following for June in its periodic inventory records. 6 Date Description June 1 Beginning 11 Purchase 24 Purchase 30 Ending Units 12 38 20 24 Unit Cost $8 9 11 Total Cost $ 96 342 220 0152:31 eBook Required: 1. Calculate the cost of ending inventory and the cost of goods sold under the (a) FIFO, (b) LIFO, and (c) weighted average cost methods, (Do not round your intermediate calculations. Round "Weighted Average Cost" to 2 decimal places.) Cost of Ending Cost of Goods Inventory Sold FIFO LIFO Weighted Average Cost Required: 1. Calculate the cost of ending inventory and the cost of goods sold under the (a) FIFO, (D) LIFO, and (c) weighted average cost methods. (Do not round your intermediate calculations. Round "Weighted Average Cost" to 2 decimal places.) 2:17 Cost of Ending Cost of Goods Inventory Sold ok FIFO LIFO Weighted Average Cost 2. Which of the three methods will lead to reporting the highest net income? O FIFO OLIFO Weighted Average Parker, Inc. had a beginning balance in its Retained Earnings account of $386,100. During the year, the company declared and paid a 54,800 dividend and, at the end of the year, it reported Retained Earnings of $400,860. The company's net income for the year was: Multiple Choice O $0. $9,960. $14,760 $19,560 On January 1, the Sleepy Monk Coffee Shop paid $24,000 for a full year of rent beginning on January 1. The rent payment was appropriately recorded in the Cash and Prepaid Rent accounts. If financial statements are prepared on January 31, the journal entry to record the adjustment would be: Multiple Choice Debit Rent Expense and credit Prepaid Rent for $2,000, Debit Prepaid Rent and credit Rent Expense for $2,000 Debit Rent Expense and credit Prepaid Rent for $24,000 Debit Prepaid Rent and credit Rent Expense for $24,000 Freshly Co. purchased an investment security on September 1 that will pay $1,200 interest on November 30. Which of the following adjusting entries would be made on September 30? Multiple Choice Debit Interest Receivable and credit Interest Revenue for $1.200 Debit interest Receivable and credit Interest Revenue for $400. O Debin interest Revenue and credit Interest Recewable for $1.200, Debit interest Revenue and credit Interest Receivable for $400