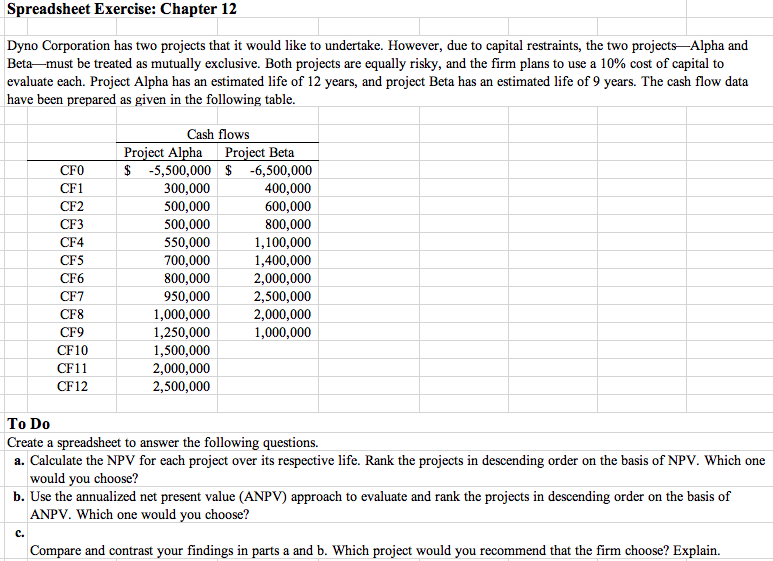

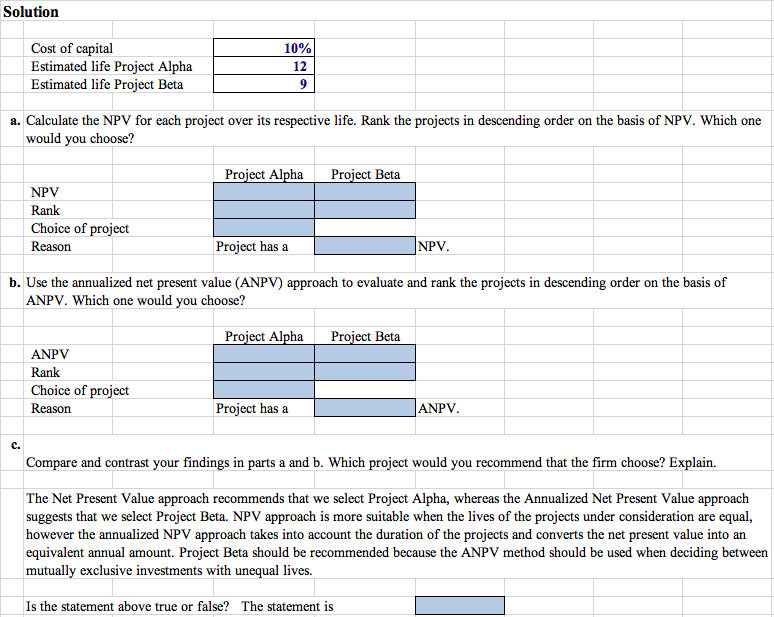

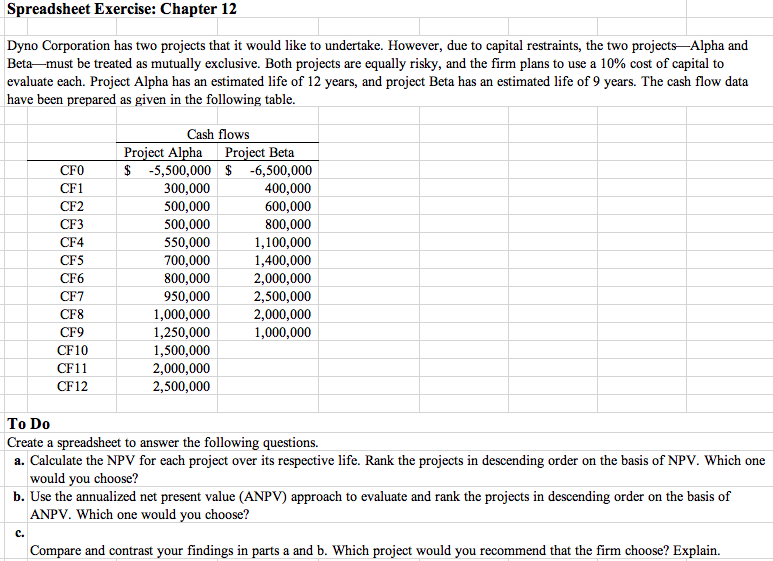

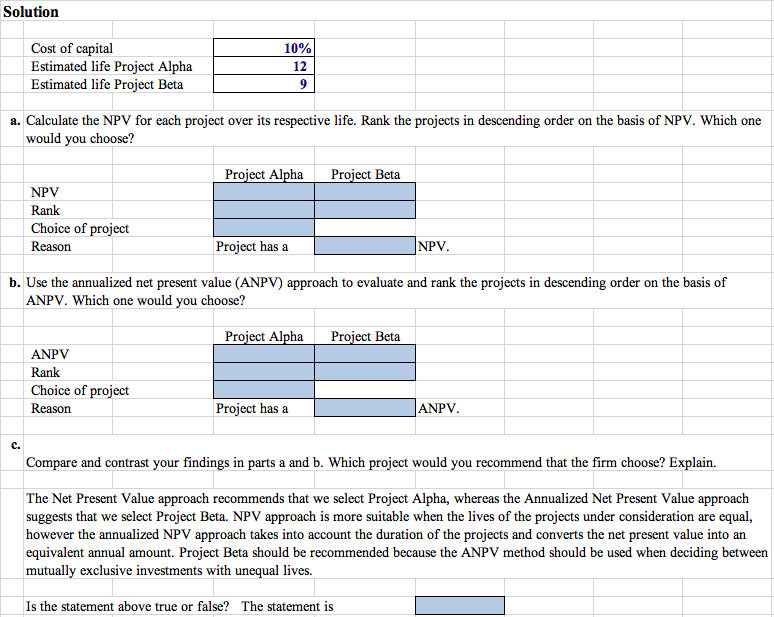

Spreadsheet Exercise: Chapter 12 Dyno Corporation has two projects that it would like to undertake. However, due to capital restraints, the two projects-Alpha and Betamust be treated as mutually exclusive. Both projects are equally risky, and the firm plans to use a 10% cost of capital to evaluate each. Project Alpha has an estimated life of 12 years, and project Beta has an estimated life of 9 years. The cash flow data have been prepared as given in the following table. CFO CF1 CF2 CF3 CF4 CF5 CF6 CF7 CF8 CF9 CF10 CF11 CF12 Cash flows Project Alpha Project Beta $ -5,500,000 $ -6,500,000 300,000 400,000 500,000 600,000 500,000 800,000 550,000 1,100,000 700,000 1,400,000 800,000 2,000,000 950,000 2,500,000 1,000,000 2,000,000 1,250,000 1,000,000 1,500,000 2,000,000 2,500,000 To Do Create a spreadsheet to answer the following questions. a. Calculate the NPV for each project over its respective life. Rank the projects in descending order on the basis of NPV. Which one would you choose? b. Use the annualized net present value (ANPV) approach to evaluate and rank the projects in descending order on the basis of ANPV. Which one would you choose? Compare and contrast your findings in parts a and b. Which project would you recommend that the firm choose? Explain. Solution 10% Cost of capital Estimated life Project Alpha Estimated life Project Beta a. Calculate the NPV for each project over its respective life. Rank the projects in descending order on the basis of NPV. Which one would you choose? Project Alpha Project Beta NPV Rank Choice of project Reason Project has a NPV. b. Use the annualized net present value (ANPV) approach to evaluate and rank the projects in descending order on the basis of ANPV. Which one would you choose? Project Alpha Project Beta ANPV Rank Choice of project Reason Project has a ANPV. Compare and contrast your findings in parts a and b. Which project would you recommend that the firm choose? Explain. The Net Present Value approach recommends that we select Project Alpha, whereas the Annualized Net Present Value approach suggests that we select Project Beta. NPV approach is more suitable when the lives of the projects under consideration are equal, however the annualized NPV approach takes into account the duration of the projects and converts the net present value into an equivalent annual amount. Project Beta should be recommended because the ANPV method should be used when deciding between mutually exclusive investments with unequal lives. Is the statement above true or false? The statement is