Question

Spreadsheet file below and prepare three inventory control sheets and one comparison sheet for the described transactions. Using the information in the first tab (Problem),

Spreadsheet file below and prepare three inventory control sheets and one comparison sheet for the described transactions. Using the information in the first tab ("Problem"), prepare the inventory control sheets in the tabs already labeled accordingly of the file.

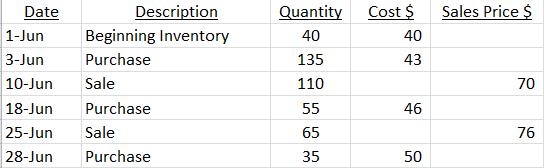

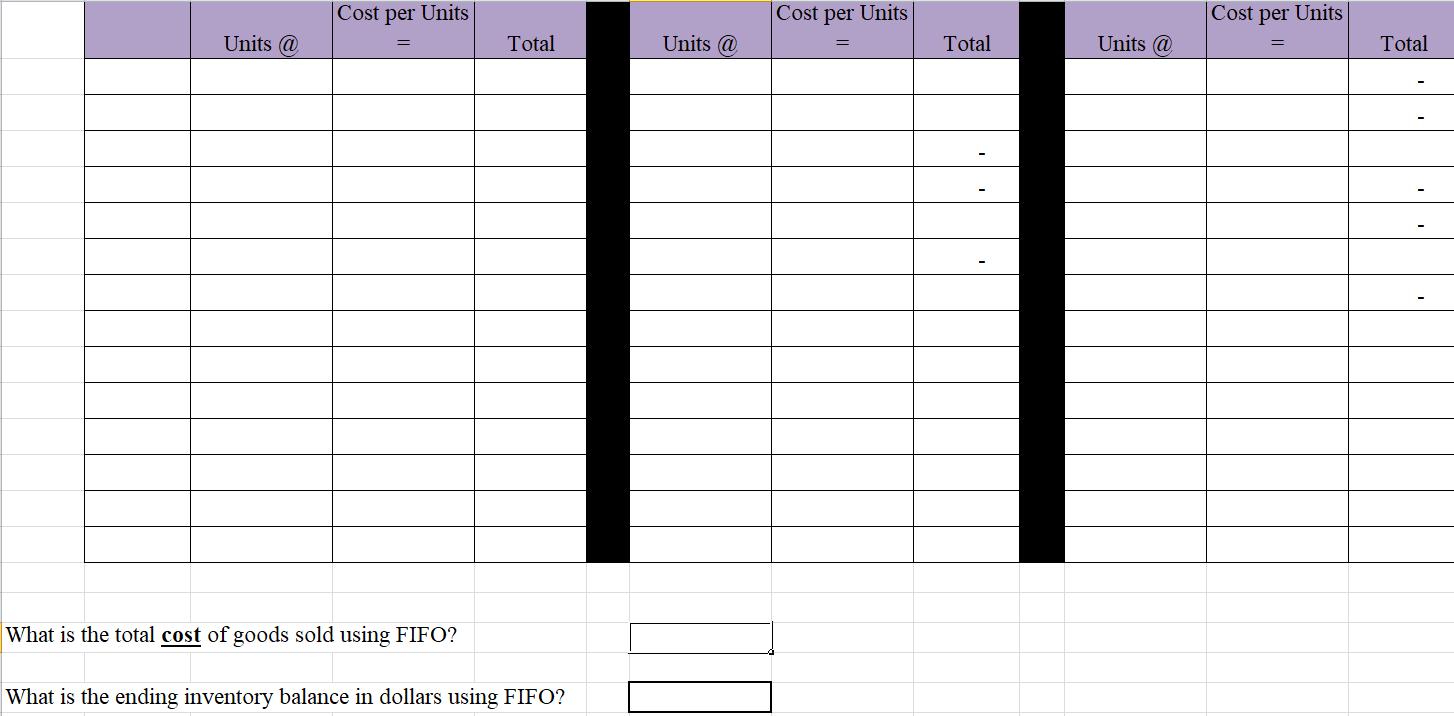

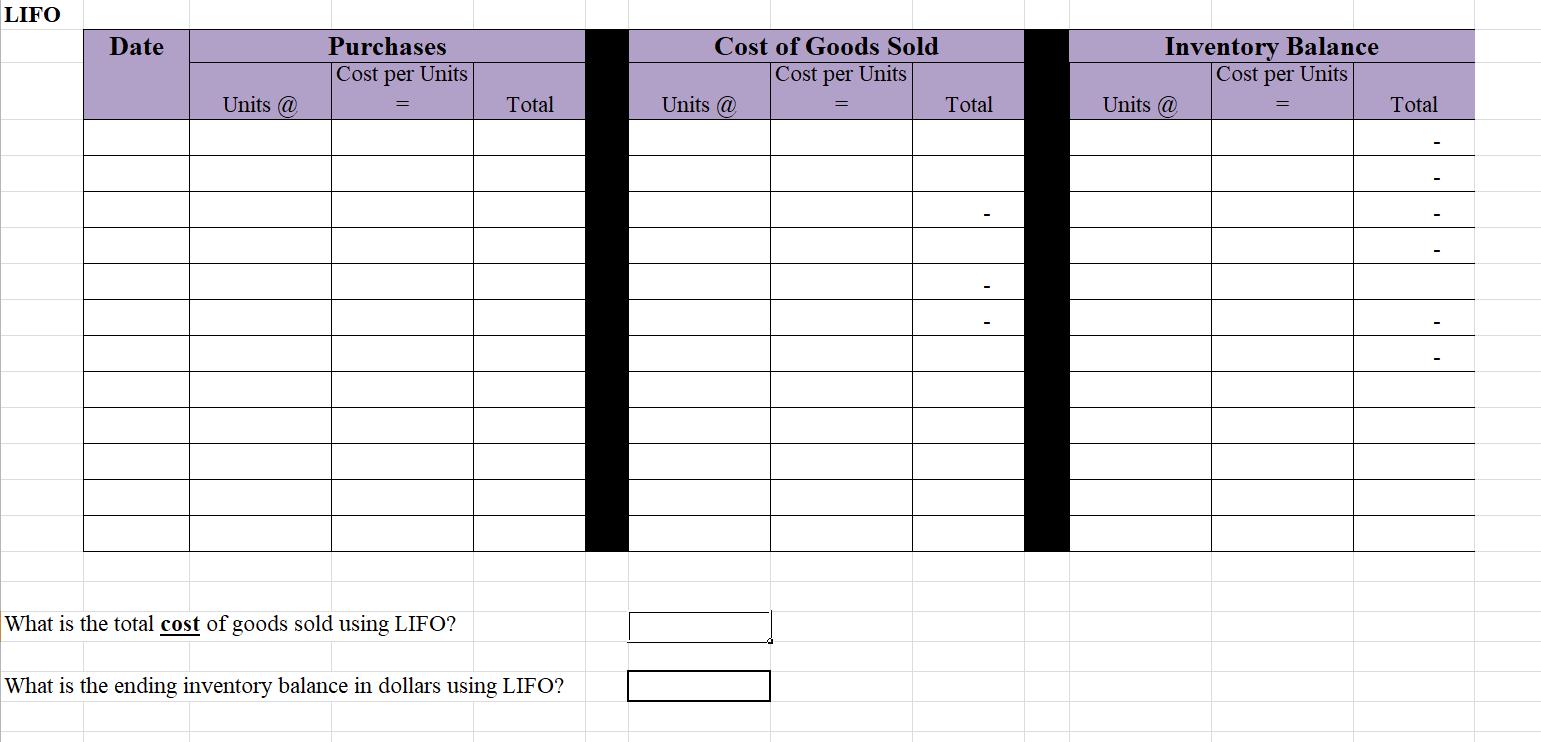

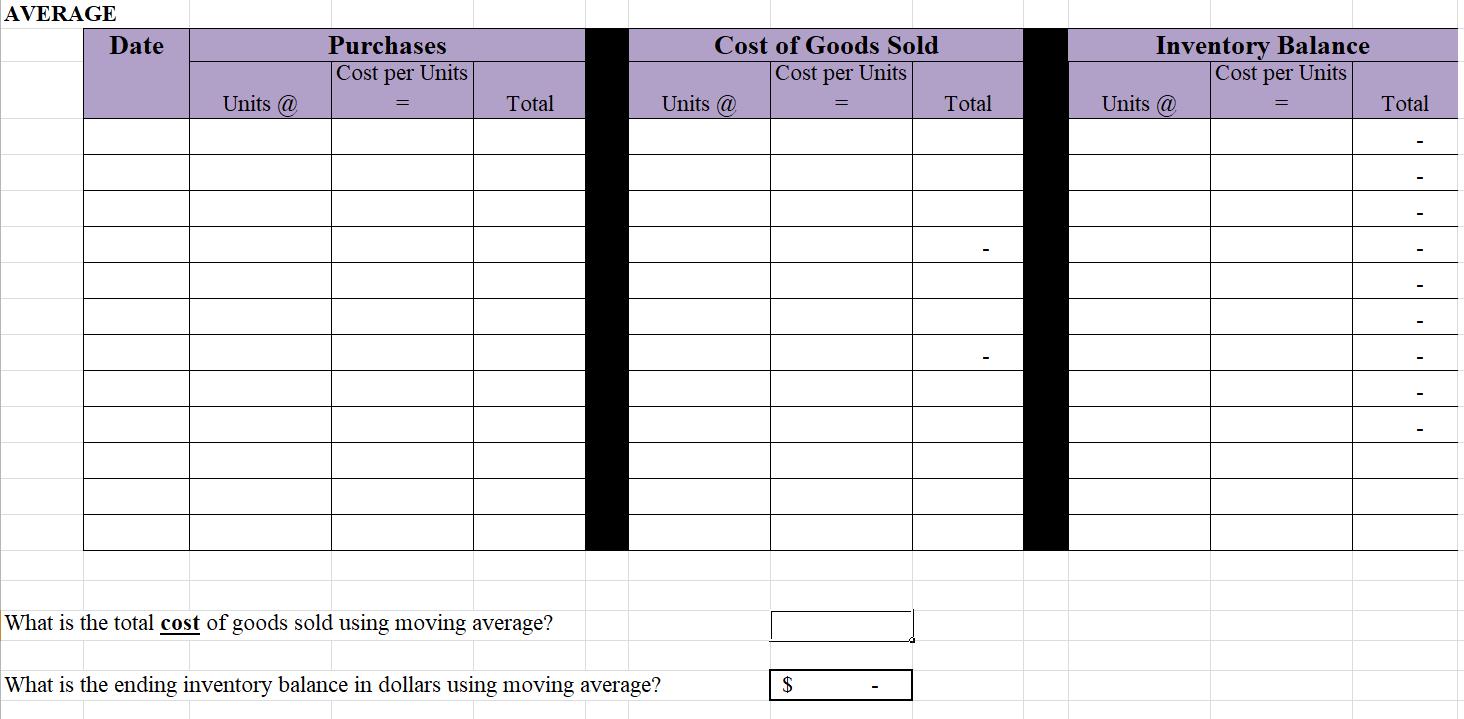

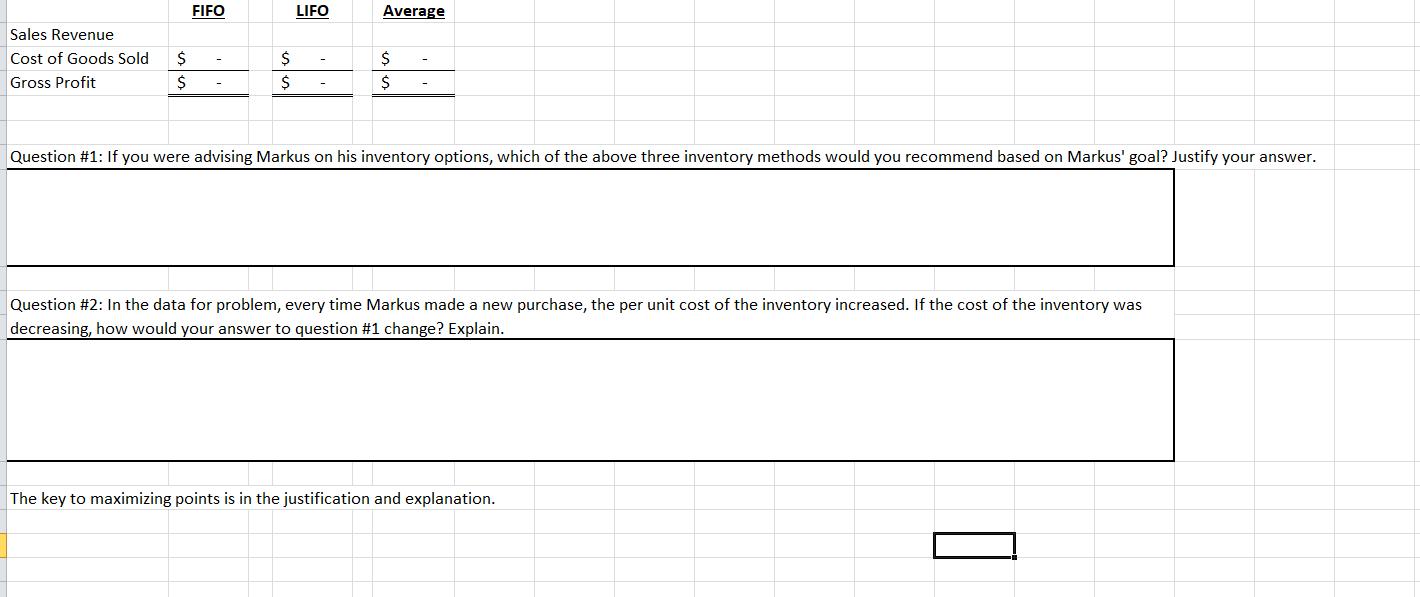

Markus Mrotek is the owner of Mrotek Co., a sole proprietorship. Mrotek is a wholesaler which buys ceiling fans from manufacturers and then resells them to retailers. Mrotek took an introductory accounting course in college and remembers that there are multiple methods for carrying inventory costs. He remembers FIFO, LIFO, and moving average. He has hired you as a consultant to help him determine which method is most beneficial for his business. Mrotek struggles with cash management and his goals are to increase cash inflows. The purchase and sales data for one month are listed below. Mrotek uses perpetual inventory. You must complete the inventory control sheets for the three inventory methods listed above. The worksheet tabs are labeled according to each method. At the bottom of each control sheet is an answer box for the total questions needed to make your final decision. If you fill in each of those answer boxes, the Cost of Goods Sold will transfer to the final comparison worksheet. On the Comparison worksheet, enter the sales revenue. Gross profit will automatically be calculated.

If you were advising Markus on his inventory options, which of the above three inventory methods would you recommend based on Markus' goal?

In the data for problem, every time Markus made a new purchase, the per unit cost of the inventory increased. If the cost of the inventory was decreasing, how would your answer to question #1 change? Explain.

Date Description Quantity Cost $ Sales Price $ 1-Jun Beginning Inventory 40 40 3-Jun Purchase 135 43 10-Jun Sale 110 70 18-Jun Purchase 55 46 25-Jun Sale 65 76 28-Jun Purchase 35 50

Step by Step Solution

3.39 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started