Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Spring 2 0 2 4 - Finance 4 2 0 In - class Exercise ( 4 0 Points ) - Due: Wednesday, Apr. 1 0

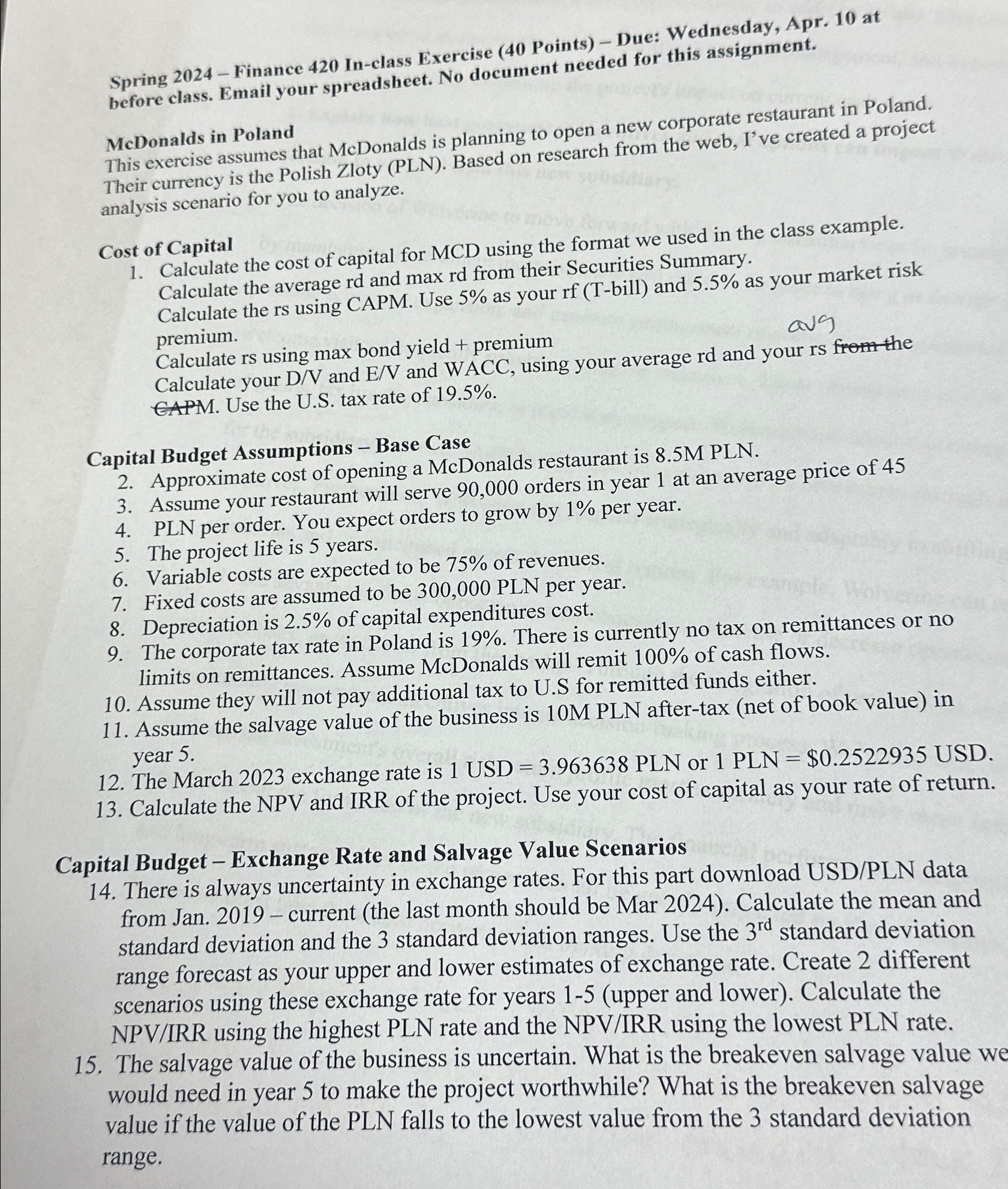

Spring Finance Inclass Exercise Points Due: Wednesday, Apr. at before class. Email your spreadsheet. No document needed for this assignment.

McDonalds in Poland

This exercise assumes that McDonalds is planning to open a new corporate restaurant in Poland. Their currency is the Polish Zloty PLN Based on research from the web, I've created a project analysis scenario for you to analyze.

Cost of Capital

Calculate the cost of capital for MCD using the format we used in the class example. Calculate the average rd and max rd from their Securities Summary.

Calculate the rs using CAPM. Use as your Tbill and as your market risk premium.

Calculate rs using max bond yield premium

Calculate your and and WACC, using your average and your CAPM. Use the US tax rate of

Capital Budget Assumptions Base Case

Approximate cost of opening a McDonalds restaurant is PLN

Assume your restaurant will serve orders in year at an average price of

PLN per order. You expect orders to grow by per year.

The project life is years.

Variable costs are expected to be of revenues.

Fixed costs are assumed to be PLN per year.

Depreciation is of capital expenditures cost.

The corporate tax rate in Poland is There is currently no tax on remittances or no limits on remittances. Assume McDonalds will remit of cash flows.

Assume they will not pay additional tax to US for remitted funds either.

Assume the salvage value of the business is PLN aftertax net of book value in year

The March exchange rate is USD or $USD.

Calculate the NPV and IRR of the project. Use your cost of capital as your rate of return.

Capital Budget Exchange Rate and Salvage Value Scenarios

There is always uncertainty in exchange rates. For this part download USDPLN data from Jan. current the last month should be Mar Calculate the mean and standard deviation and the standard deviation ranges. Use the standard deviation range forecast as your upper and lower estimates of exchange rate. Create different scenarios using these exchange rate for years upper and lower Calculate the NPVIRR using the highest PLN rate and the NPVIRR using the lowest PLN rate.

The salvage value of the business is uncertain. What is the breakeven salvage value we would need in year to make the project worthwhile? What is the breakeven salvage value if the value of the PLN falls to the lowest value from the standard deviation range.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started