Question

Spring Co a multinational company, has annual credit sales of $54 million and related cost of sales are $216 million. Approximately half of all credit

Spring Co a multinational company, has annual credit sales of $5·4 million and related cost of sales are $2·16 million. Approximately half of all credit sales are exports to a European country, which are invoiced in euros. Financial

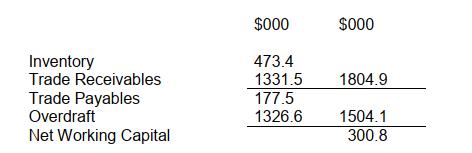

information relating to Spring Co is as follows:

Spring Co plans to change working capital policy in order to improve its profitability. This policy change will not affect the current levels of credit sales, cost of sales or net working capital. As a result of the policy change, the following working capital ratio values are expected:

Inventory days 50 days

Trade receivables days 62 days

Trade payables days 45 days

Required:

(a) For the change in working capital policy, calculate the change in the operating cycle, the effect on the current ratio and the finance cost saving. Comment on your findings

(b) Elaborate on the three motives for firms to maintain working capital balances.

$00 $000 Inventory Trade Receivables Trade Payables Overdraft 473.4 1331.5 1804.9 177.5 1326.6 1504.1 Net Working Capital 300.8

Step by Step Solution

3.25 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

Solution a i The current operating cycle is the sum of the current inventory days and trade receivab...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started