Question

Sprinkles Ice Cream Shoppe Please read the instructions carefully. A new client of yours, Lilly Waters wants to open an ice cream shop near the

Sprinkles Ice Cream Shoppe

Please read the instructions carefully.

A new client of yours, Lilly Waters wants to open an ice cream shop near the downtown shopping center. She will sell ice cream cones or in a cup, shakes, sundaes, and soda. Her grand opening will be September 30, 2020. The name of her business is Sprinkles!

You, as an independent consultant, have been hired to develop a cash pro forma budget for her business venture (note: this is a spreadsheet that helps forecast income and expenses over a period of time). It used to plan for and manage the business if done correctly.

Assignment:

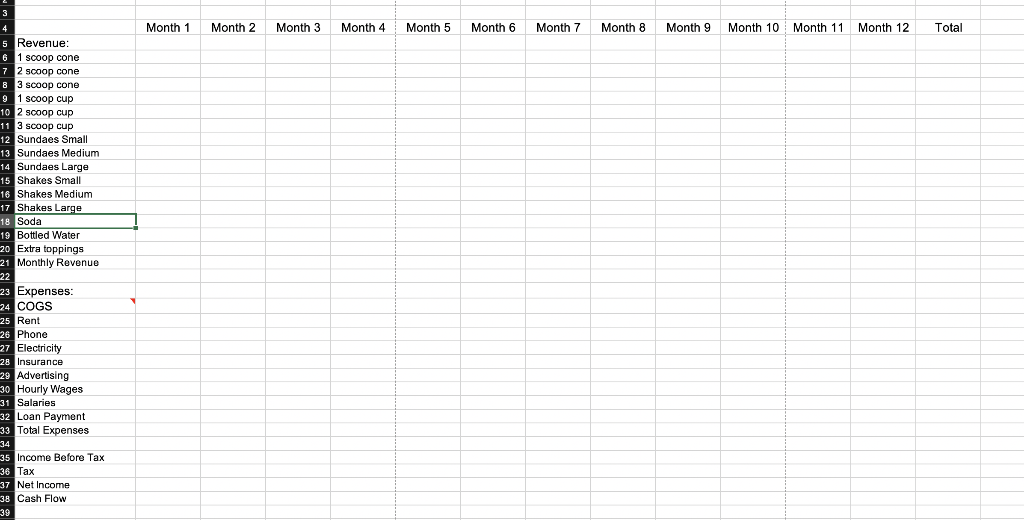

Using Microsoft Excel, construct a monthly proforma cash budget for your client for the first year of operations.

Use the file attached Excel Template - Sprinkles as your starting point. Download and use this file as the basis for your assignment. Do not make any changes to this pre-defined template items (this means start with the items that already included and that are expected in the spreadsheet). You may add your information to the existing sheets. You may add extra worksheets as needed as well update the template.

Do not use a template from a previous semester this is academic dishonesty and will be subject to disciplinary action.

-

Place the finished cash pro forma on a worksheet labeled Cash ProForma".

-

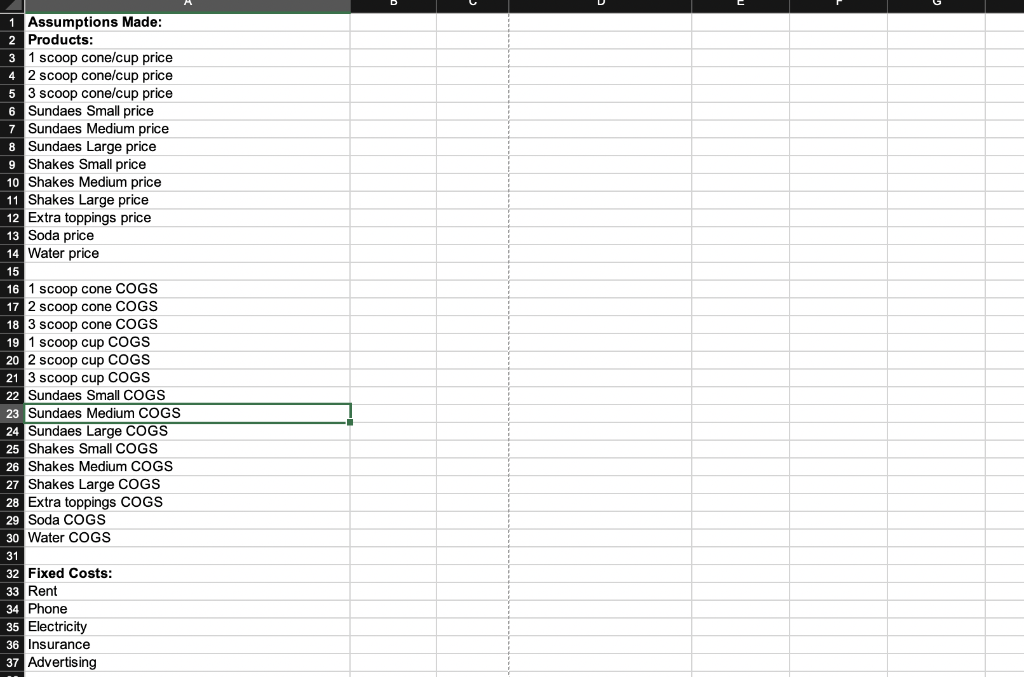

Place all your case assumptions data on a separate worksheet. Label the worksheet "Assumptions" (note: each piece of data must appear in its own cell on the Assumption sheet).

-

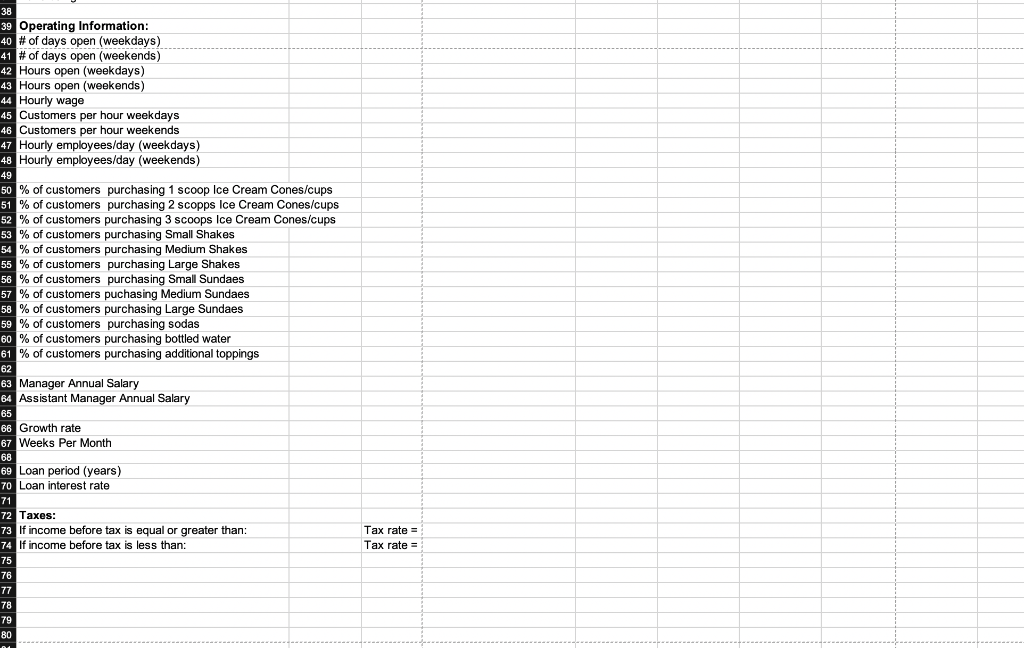

Place your start-up costs on a third worksheet labeled "Startup Costs"

-

Create two additional worksheets for your recommendations. You will choose 2 of the 3 recommendations defined at the end of this document. Label one worksheet Specialty Desserts (this will include: Banana Splits, Double Delight Brownie Fudge and Molten Lava Spectacular), or Ice Cream Cakes or Iced Coffee.

-

Appropriate Charts (graphs): You will be creating two separate charts so create and label two additional worksheets for the charts (each chart will be in its own worksheet).

1

-

Chart One Monthly Product Revenue this will show the monthly revenue for each of your five products for the entire year.

-

Chart Two Total Product Net Income - You want to track the total product net income for the year to determine any trends or projections in product sales.

-

Make sure both charts are formatted correctly (i.e. appropriate title, legend where appropriate, data series properly labeled) and they are appropriate for business use.

Information needed to complete assignment:

Sugar cones, milkshakes, sundaes, toppings, soda and bottle water.

Product Selling Prices:

I scoop Cup or Sugar Cone - $2.25 2 scoops Cup or Sugar Cone - $3.25 3 scoops Cup or Sugar Cone $4.25

I scoop Sugar Cone - $2.25 2 scoops Sugar Cone - $3.25 3 scoops Sugar Cone $4.25

Small Shake $2.95 Medium Shake - $3.75 Large Shake $4.50

Small Sundae (1 topping) - $2.55 Medium Sundae (1 topping) - $3.55 Large Sundae (1 topping) - $4.65

Additional topping: .50 per topping

Soda -$1.25 a bottle Bottled Water - $1.00 a bottle

Cost of Goods Sold:

Ice Cream Cones (Ice cream ingredients and cone) cost $1.10 for 1 scoop and .20 cents extra for each additional scoop Ice cream Cups (Ice cream ingredients and cup) cost $1.25 and .20 cents per extra for each additional scoop

Small Shake cost $1.40 Medium Shake cost $1.55 1 Large Shake cost $1.75 Small Sundae cost $1.20

Medium Sundae cost $1.50 Large Sundae cost $1.75 Additional Toppings cost $.10

Sodas cost about $.7 per 16 oz. bottle Water cost $.6 per 16oz bottle

The building rent is $2500 per month. Phone will cost about $100 per month. Electricity should cost about $800 a month. Insurance will be $850 a month. Advertising and promotion will be $500 a month.

Operating Hours:

Sprinkles will be open seven days a week.

Sprinkles will serve ice cream products all day and will be open from 11am 8 pm on weekdays (Monday Thursday, Sunday). Friday Saturday 11am 11pm

Employees:

-

Two hourly employees on Friday, Saturday and Sunday.

-

One hourly employee needed during Monday - Thursday.

-

Either an assistant manager or manager is required during the Sprinkles Operating hours.

-

Your client will be the manager and draw a salary of $35,000 per year (including benefits). She will work during the busiest times and fill in for the assistant manager. Approximately 40%.

-

The assistant manager will receive a salary of $22,400 per year(including benefits). Approximately 60%.

-

Hourly workers will be paid $8.75 an hour.

Demand Rate:

-

Monday - Thursday the owner expects 10 customers per hour.

-

Friday - Sunday the owner expects an average of 20 customers per hour..

1

Product demand on average:

o 1/2 of all customers will buy 1 scoop Ice Cream Cones o 1/2 of all customers will buy 2 scoop Ice Cream Cones o 1/3 of all customer will buy 3 scoop Ice Cream Cones o 1/2 of all customers will buy 1 scoop Ice Cream cups o 1/2 of all customers will buy 2 scoop Ice Cream cups o 1/3 of all customer will buy 3 scoop Ice Cream cups

o 1/4 of all customers will buy Medium Shakes o 1/4 of all customers will buy Large Shakes o 1/2 of all customers will buy Small shakes o 1/4 of all customers will buy a Large Sundae o 1/3 of all customers will buy a Medium Sundae o 1/4 of all customers will buy Small Sundae

o 3/4 of all customers will buy a Soda o 1/4 of all customers will buy a Bottled Water o 1/4 of all customers will buy an additional topping

Start-up costs

Kitchen equipment: $10,250 Cash register and sales equipment: $1,350 Initial inventory: $4,500 Pre-opening marketing: $1,500 Store fixtures (chairs, tables etc.): $4,500 Oil paintings of your clients momma and grandma to hang on the wall: $350 Licenses: $1,025 Security deposit: $4,500 First Insurance Payment: $750

Your client has $8,000 and plans to borrow the rest from the bank with a five-year loan at 2.5% interest. You are to calculate the monthly loan payment using the appropriate financial function.

Assume a tax rate of 21% if Income Before Taxes (IBT) is equal to or is greater than $13,500. Assume a tax rate of 13% if IBT is less than $13,500. You are to calculate the monthly tax payment using the appropriate logical function.

Assume that sales will grow at an average of 1.50% per month. Assume that each month contains 4.2 weeks.

Recommendations:

Show your client how these recommendations would affect the bottom line by recreating the pro forma for each scenario, and applying the data analysis to determine profitability.

1

You do not have to start from scratch, but note, these are completely independent pro formas. They must update accordingly from the data worksheets.

Plan on showing your analysis and discussing the proforma changes that occur under each new scenario and how it affects profitability.

Use a formatted text box (not a comment) to explain your recommendations under each new pro forma. This will be approximately a 2-3 paragraph endeavor.

Scenario One: What if Analysis for adding flavored ice coffees.

Your client is unsure if she should sell flavored ice coffees. She thinks she can sell a coffee to every second customer and it seems to be lucrative because the coffee sells for $3.75 each and costs him only $1.60 to purchase.

Unfortunately your client is afraid that he would cannibalize his soft drink sales with the coffee customers (one soft drink less for every coffee sold). It will cost him $5,250 to purchase the equipment and insurance costs would rise by another $155 per month due to the hot equipment needed to make the coffee.

What is your recommendation: Should your client offer flavored coffee to her customers?

Scenario Two: What if Analysis

Your client would like to consider adding ice cream cakes to the list of items available for sale. She is wanting to offer cakes with customized cake, ice cream decorations.

She thinks she can sell 20 small cakes a week and 25 large cakes a week. It seems to be lucrative because the small cake is $16.95 and the large cake is $23.95. Costs are $5.45 per small cake and $7.40 per large cake.

It will cost her $3,250 to purchase the equipment and insurance costs would rise by another $255 per month due to the hot equipment needed to make the cakes.

What is your recommendation? Would it be profitable to sell the cakes?

Bonus Scenario Three: What if Analysis - Optional 10pts. You may choose to complete this bonus scenerio. It is optional.

Your client would like to consider adding three specialty sundaes (Banana Split, Molten Lava Explosion, Nutty Chocolate Brownie.

1

She thinks she can sell a specialty sundae to half the customers per day and it seems to be lucrative because these sundaes sell for 4.75 each and costs him only $1.85 to make.

Unfortunately, your client is afraid that she would cannibalize his regular sundae sales. It will cost her $3,250 to purchase the equipment and insurance costs would rise by another $255 per month due to the hot equipment needed to make the brownies and molten cake.

For this scenario create and use a pivot table to explain your recommendation along with the other scenario criteria instructions.

PART A

PART B

PART C

3 Month 1 Month 2 Month 3 Month 1 Month 2 Month 3 Month 4 Month 5 Month 6 Month 7 Month & Month 7 Month 8 Month 9 Month 10 Month 11 Month 12 Total 4 5 Revenue: 6 1 scoop cone 7 2 scoop cone 8 3 scoop cone 9 1 scoop cup 10 2 scoop cup 11 3 scoop cup 12 Sundaes Small 13 Sundaes Medium 14 Sundaes Large 15 Shakes Small 16 Shakes Medium 17 Shakes Large 18 Soda 19 Bottled Water 20 Extra toppings 21 Monthly Revenue 22 23 Expenses: 24 COGS 25 Rent 26 Phone 27 Electricity 28 Insurance 29 Advertising 30 Hourly Wages 31 Salaries 32 Loan Payment 33 Total Expenses 34 35 Income Before Tax 36 Tax 37 Net Income 38 Cash Flow 39 Assumptions Made: 2 Products: 3 1 scoop cone/cup price 4 2 scoop cone/cup price 5 3 scoop cone/cup price 6 Sundaes Small price 7 Sundaes Medium price 8 Sundaes Large price 9 Shakes Small price 10 Shakes Medium price 11 Shakes Large price 12 Extra toppings price 13 Soda price 14 Water price 15 16 1 scoop cone COGS 17 2 scoop cone COGS 18 3 scoop cone COGS 19 1 scoop cup COGS 20 2 scoop cup COGS 21 3 scoop cup COGS 22 Sundaes Small COGS 23 Sundaes Medium COGS 24 Sundaes Large COGS 25 Shakes Small COGS 26 Shakes Medium COGS 27 Shakes Large COGS 28 Extra toppings COGS 29 Soda COGS 30 Water COGS 31 32 Fixed Costs: 33 Rent 34 Phone 35 Electricity 36 Insurance 37 Advertising 38 39 Operating Information: 40 # of days open (weekdays) 41 # of days open (weekends) 42 Hours open (weekdays) 43 Hours open (weekends) 44 Hourly wage 45 Customers per hour weekdays 46 Customers per hour weekends 47 Hourly employees/day (weekdays) 48 Hourly employees/day (weekends) 49 50 % of customers purchasing 1 scoop Ice Cream Cones/cups 51 % of customers purchasing 2 scopps Ice Cream Cones/cups 52 % of customers purchasing 3 scoops Ice Cream Cones/cups 53 % of customers purchasing Small Shakes 54 % of customers purchasing Medium Shakes 55 % of customers purchasing Large Shakes 56 % of customers purchasing Small Sundaes 57 % of customers puchasing Medium Sundaes 58 % of customers purchasing Large Sundaes 59 % of customers purchasing sodas 60% of customers purchasing bottled water 61 % of customers purchasing additional toppings 62 63 Manager Annual Salary 64 Assistant Manager Annual Salary 65 66 Growth rate 67 Weeks Per Month 68 69 Loan period (years) 70 Loan interest rate 71 72 Taxes: 73 If income before tax is equal or greater than: 74 If income before tax is less than: 75 76 77 Tax rate = Tax rate = 78 79 BO 0 A20 fix B D E F G H j L Start Up Costs: Kitchen equipment Sales equipment (cash register, etc.) Initial inventory Pre-opening marketing 7 Diner fixtures (chairs, tables etc.) Oil painting Licenses Security deposit Initial insurance payment Total Owner's Equity Cash Reserves 6 Loan Amount 7 8 0 21 22 25 27 29 3 Month 1 Month 2 Month 3 Month 1 Month 2 Month 3 Month 4 Month 5 Month 6 Month 7 Month & Month 7 Month 8 Month 9 Month 10 Month 11 Month 12 Total 4 5 Revenue: 6 1 scoop cone 7 2 scoop cone 8 3 scoop cone 9 1 scoop cup 10 2 scoop cup 11 3 scoop cup 12 Sundaes Small 13 Sundaes Medium 14 Sundaes Large 15 Shakes Small 16 Shakes Medium 17 Shakes Large 18 Soda 19 Bottled Water 20 Extra toppings 21 Monthly Revenue 22 23 Expenses: 24 COGS 25 Rent 26 Phone 27 Electricity 28 Insurance 29 Advertising 30 Hourly Wages 31 Salaries 32 Loan Payment 33 Total Expenses 34 35 Income Before Tax 36 Tax 37 Net Income 38 Cash Flow 39 Assumptions Made: 2 Products: 3 1 scoop cone/cup price 4 2 scoop cone/cup price 5 3 scoop cone/cup price 6 Sundaes Small price 7 Sundaes Medium price 8 Sundaes Large price 9 Shakes Small price 10 Shakes Medium price 11 Shakes Large price 12 Extra toppings price 13 Soda price 14 Water price 15 16 1 scoop cone COGS 17 2 scoop cone COGS 18 3 scoop cone COGS 19 1 scoop cup COGS 20 2 scoop cup COGS 21 3 scoop cup COGS 22 Sundaes Small COGS 23 Sundaes Medium COGS 24 Sundaes Large COGS 25 Shakes Small COGS 26 Shakes Medium COGS 27 Shakes Large COGS 28 Extra toppings COGS 29 Soda COGS 30 Water COGS 31 32 Fixed Costs: 33 Rent 34 Phone 35 Electricity 36 Insurance 37 Advertising 38 39 Operating Information: 40 # of days open (weekdays) 41 # of days open (weekends) 42 Hours open (weekdays) 43 Hours open (weekends) 44 Hourly wage 45 Customers per hour weekdays 46 Customers per hour weekends 47 Hourly employees/day (weekdays) 48 Hourly employees/day (weekends) 49 50 % of customers purchasing 1 scoop Ice Cream Cones/cups 51 % of customers purchasing 2 scopps Ice Cream Cones/cups 52 % of customers purchasing 3 scoops Ice Cream Cones/cups 53 % of customers purchasing Small Shakes 54 % of customers purchasing Medium Shakes 55 % of customers purchasing Large Shakes 56 % of customers purchasing Small Sundaes 57 % of customers puchasing Medium Sundaes 58 % of customers purchasing Large Sundaes 59 % of customers purchasing sodas 60% of customers purchasing bottled water 61 % of customers purchasing additional toppings 62 63 Manager Annual Salary 64 Assistant Manager Annual Salary 65 66 Growth rate 67 Weeks Per Month 68 69 Loan period (years) 70 Loan interest rate 71 72 Taxes: 73 If income before tax is equal or greater than: 74 If income before tax is less than: 75 76 77 Tax rate = Tax rate = 78 79 BO 0 A20 fix B D E F G H j L Start Up Costs: Kitchen equipment Sales equipment (cash register, etc.) Initial inventory Pre-opening marketing 7 Diner fixtures (chairs, tables etc.) Oil painting Licenses Security deposit Initial insurance payment Total Owner's Equity Cash Reserves 6 Loan Amount 7 8 0 21 22 25 27 29

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started