Question

Sputnik, Inc. has the opportunity to acquire the Space Station Hotel and assume operations immediately following the closing of the transaction. The initial investment in

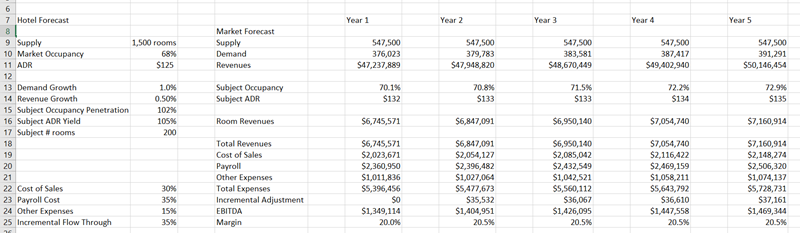

Sputnik, Inc. has the opportunity to acquire the Space Station Hotel and assume operations immediately following the closing of the transaction. The initial investment in the 200-room hotel project is estimated to be $8,000,000. The holding period for this asset is 5 full operating years following the closing of the transaction, after which the hotel will be sold based on the trailing 12 months operating cash flow. The hotel has a useful life of 10 years. Part 1: Forecast the prospective results The relevant competitive market comprises 1,500 hotel rooms (including the subject hotel) with an average annual occupancy in the year preceding your purchase of 68% and an average annual ADR of $125. The first full year following the transaction, demand is expected to grow at 1% per year and average rate is expected to grow at 0.5% per year. There is no other supply expected to enter the market during the five-year holding period. Your hotels competitive attributes warrant a market share of occupancy of 102% per year and a yield on market ADR of 105% per year. This is an all-inclusive operation, so all food, beverage and amenities are included in the room rate. Cost of sales is 30% of revenues. Payroll is 35% of revenues. Other expenses are 15%. These are the margins on the base level (i.e. year one) of revenues, however incremental revenue flow through following the base year is 35%. The operating period is a calendar year of 365 days. Estimate the 5-year EBITDA (NET INCOME/ NET PROFIT) of the hotel following the closing of the transaction.

Sputnik, Inc. has the opportunity to acquire the Space Station Hotel and assume operations immediately following the closing of the transaction. The initial investment in the 200-room hotel project is estimated to be $8,000,000. The holding period for this asset is 5 full operating years following the closing of the transaction, after which the hotel will be sold based on the trailing 12 months operating cash flow. The hotel has a useful life of 10 years. Part 1: Forecast the prospective results The relevant competitive market comprises 1,500 hotel rooms (including the subject hotel) with an average annual occupancy in the year preceding your purchase of 68% and an average annual ADR of $125. The first full year following the transaction, demand is expected to grow at 1% per year and average rate is expected to grow at 0.5% per year. There is no other supply expected to enter the market during the five-year holding period. Your hotels competitive attributes warrant a market share of occupancy of 102% per year and a yield on market ADR of 105% per year. This is an all-inclusive operation, so all food, beverage and amenities are included in the room rate. Cost of sales is 30% of revenues. Payroll is 35% of revenues. Other expenses are 15%. These are the margins on the base level (i.e. year one) of revenues, however incremental revenue flow through following the base year is 35%. The operating period is a calendar year of 365 days. Estimate the 5-year EBITDA (NET INCOME/ NET PROFIT) of the hotel following the closing of the transaction.

Based on the above excel sheet and below information need to answer the part 2 as following:

- The project will be financed by 55% debt, and 45% equity. The interest rate on the debt is 12%. The required rate of return is 15%. Tax rate is 40% in income and 25% on capital gains.

- The depreciation methodology is straight line depreciation and there will be a salvage value of the asset upon sale. Additional working capital of $300,000 will be required at the opening date.

Calculate the NPV and IRR of the project and comment whether it is a good investment.

Year 1 Year 2 Year 3 Year 4 Year 5 1.500 rooms 68% Market Forecast Supply Demand Revenues 547,500 376,023 $47,237,889 547,500 379,783 $47,948,820 547,500 383,581 $48,670,449 547,500 387,417 $49,402,940 547,500 391,291 $50,146,454 $125 Subject Occupancy Subject ADR 70.1% $132 70.8% $133 71.5% $133 72.2% $134 22.9% $135 6 7 Hotel Forecast 8 9 Supply 10 Market Occupancy 11 ADR 12 13 Demand Growth 14 Revenue Growth 15 Subject Occupancy Penetration 16 Subject ADR Yield 17 Subject #rooms 18 19 20 21 22 Cost of Sales 23 Payroll Cost 24 Other Expenses 25 Incremental Flow Through 1.0% 0.50% 102% 105% 200 Room Revenues $6,745,571 $6,847,091 $6,950,140 $7,054,740 $7,160,914 30% 35% 15% 35% Total Revenues Cost of Sales Payroll Other Expenses Total Expenses Incremental Adjustment EBITDA Margin S6,745,571 $2,023,671 $2,360,950 $1,011,836 $5,396,456 SO $1,349,114 20.0% 56,847,091 $2,054,127 $2,396,482 $1,027,064 $5,477,673 $35,532 $1,404,951 20.5% $6,950,140 $2,085,042 $2,432,549 $1,042,521 $5,560,112 $36,067 $1,426,095 20.5% 57,054,740 $2,116,422 $2,469,159 $1,058,211 $5,643,792 $36,610 $1,447,558 20.5% $7,160,914 $2,148,274 $2,506,320 $1,074,137 $5,728,731 $37,161 $1,469,344 20.5% Year 1 Year 2 Year 3 Year 4 Year 5 1.500 rooms 68% Market Forecast Supply Demand Revenues 547,500 376,023 $47,237,889 547,500 379,783 $47,948,820 547,500 383,581 $48,670,449 547,500 387,417 $49,402,940 547,500 391,291 $50,146,454 $125 Subject Occupancy Subject ADR 70.1% $132 70.8% $133 71.5% $133 72.2% $134 22.9% $135 6 7 Hotel Forecast 8 9 Supply 10 Market Occupancy 11 ADR 12 13 Demand Growth 14 Revenue Growth 15 Subject Occupancy Penetration 16 Subject ADR Yield 17 Subject #rooms 18 19 20 21 22 Cost of Sales 23 Payroll Cost 24 Other Expenses 25 Incremental Flow Through 1.0% 0.50% 102% 105% 200 Room Revenues $6,745,571 $6,847,091 $6,950,140 $7,054,740 $7,160,914 30% 35% 15% 35% Total Revenues Cost of Sales Payroll Other Expenses Total Expenses Incremental Adjustment EBITDA Margin S6,745,571 $2,023,671 $2,360,950 $1,011,836 $5,396,456 SO $1,349,114 20.0% 56,847,091 $2,054,127 $2,396,482 $1,027,064 $5,477,673 $35,532 $1,404,951 20.5% $6,950,140 $2,085,042 $2,432,549 $1,042,521 $5,560,112 $36,067 $1,426,095 20.5% 57,054,740 $2,116,422 $2,469,159 $1,058,211 $5,643,792 $36,610 $1,447,558 20.5% $7,160,914 $2,148,274 $2,506,320 $1,074,137 $5,728,731 $37,161 $1,469,344 20.5%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started