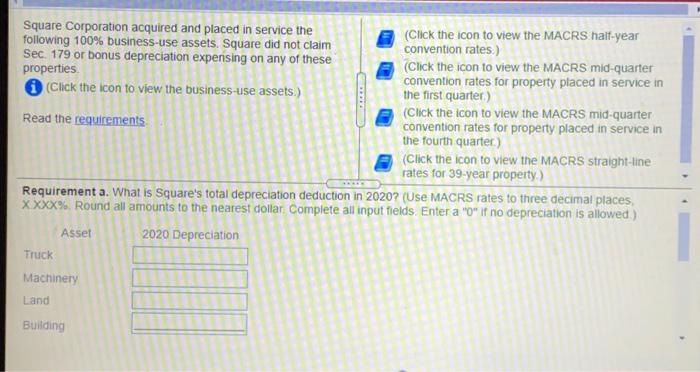

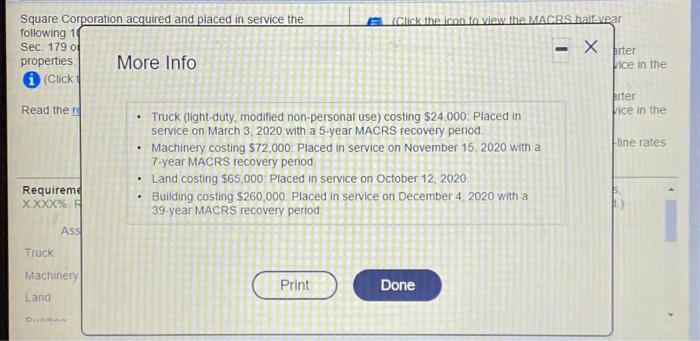

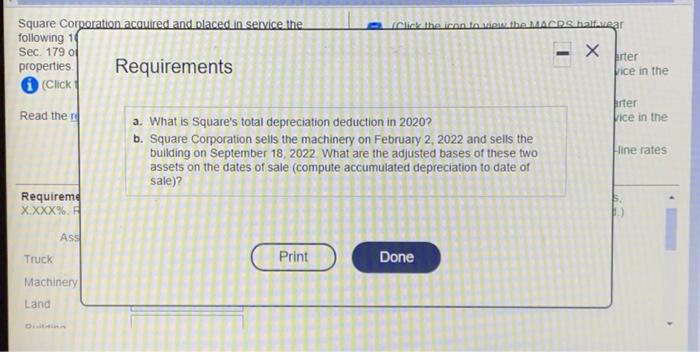

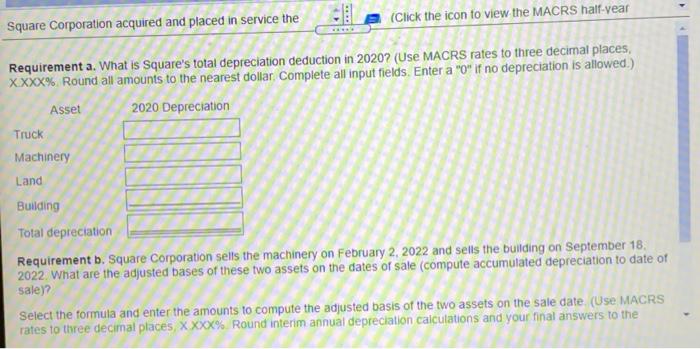

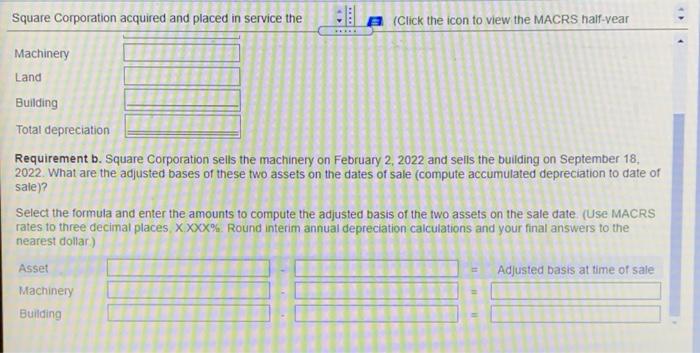

Square Corporation acquired and placed in service the (Click the icon to view the MACRS half-year following 100% business-use assets. Square did not claim convention rates.) Sec. 179 or bonus depreciation expensing on any of these (Click the icon to view the MACRS mid-quarter properties convention rates for property placed in service in (Click the icon to view the business-use assets.) the first quarter) (Click the icon to view the MACRS mid-quarter Read the requirements convention rates for property placed in service in the fourth quarter.) (Click the icon to view the MACRS straight-line rates for 39-year property.) Requirement a. What is Square's total depreciation deduction in 2020? (Use MACRS rates to three decimal places XXXX%. Round all amounts to the nearest dollar. Complete all input fields. Enter a "0" if no depreciation is allowed) Asset 2020 Depreciation Truck Machinery Land Building Click the icon to view the MACRS hai year Square Corporation acquired and placed in service the following 10 Sec 1790 properties More Info (Click - X biter - Vice in the urter Vice in the Read the Hine rates Truck (light-duty, modified non-personal use) costing $24.000 placed in service on March 3, 2020 with a 5-year MACRS recovery period Machinery costing $72,000Placed in service on November 15, 2020 with a 7-year MACRS recovery period Land costing $65,000 Placed in service on October 12, 2020 Building costing $260,000 Placed in service on December 4 2020 with a 39-year MACRS recovery period Requireme X XXX%. . ASS Truck Machinery Print Done Land Click the icon to the MACRS.haifear Square Corporation acquired and placed in service the following 10 Sec. 1790 properties Requirements (Click X rter Vice in the Read the rter Vice in the a. What is Square's total depreciation deduction in 2020? b. Square Corporation sells the machinery on February 2, 2022 and sells the building on September 18, 2022 What are the adjusted bases of these two assets on the dates of sale (compute accumulated depreciation to date of sale)? line rates Requireme X.XXX%. ASS Truck Print Done Machinery Land . Square Corporation acquired and placed in service the (Click the icon to view the MACRS half-vear Requirement a. What is Square's total depreciation deduction in 2020? (Use MACRS rates to three decimal places, XXXX% Round all amounts to the nearest dollar. Complete all input fields. Enter a "O" If no depreciation is allowed.) Asset 2020 Depreciation Truck Machinery Land Building Total depreciation Requirement b. Square Corporation sells the machinery on February 2, 2022 and sells the building on September 18, 2022. What are the adjusted bases of these two assets on the dates of sale (compute accumulated depreciation to date of sale)? Select the formula and enter the amounts to compute the adjusted basis of the two assets on the sale date. (Use MACRS rates to three decimal places, XXXX% Round interim annual depreciation calculations and your final answers to the Square Corporation acquired and placed in service the A (Click the icon to view the MACRS half-vear . . 4 Machinery Land Building Total depreciation Requirement b. Square Corporation sells the machinery on February 2, 2022 and sells the building on September 18, 2022. What are the adjusted bases of these two assets on the dates of sale (compute accumulated depreciation to date of sale)? Select the formula and enter the amounts to compute the adjusted basis of the two assets on the sale date (Use MACRS rates to three decimal places X.XXX%. Round interim annual depreciation calculations and your final answers to the nearest dollar) Asset Adjusted basis at time of sale Machinery Building