Answered step by step

Verified Expert Solution

Question

1 Approved Answer

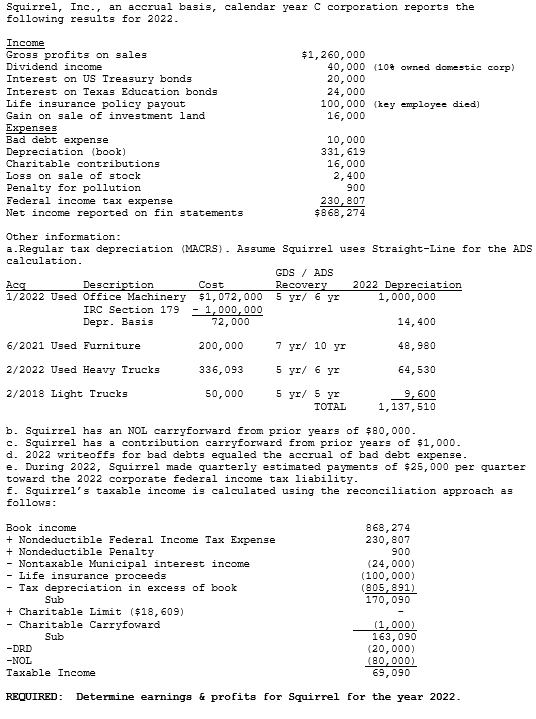

Squirrel, Inc., an accrual basis, calendar year C corporation reports the following results for 2022. Income Gross profits on sales Dividend income Interest on

Squirrel, Inc., an accrual basis, calendar year C corporation reports the following results for 2022. Income Gross profits on sales Dividend income Interest on US Treasury bonds Interest on Texas Education bonds Life insurance policy payout Gain on sale of investment land Expenses Bad debt expense Depreciation (book) Charitable contributions Loss on sale of stock Penalty for pollution Federal income tax expense Net income reported on fin statements Other information: $1,260,000 40,000 (10% owned domestic corp) 20,000 24,000 100,000 (key employee died) 16,000 10,000 331,619 16,000 2,400 900 230,807 $868,274 a. Regular tax depreciation (MACRS). Assume Squirrel uses Straight-Line for the ADS calculation. Acq Description 1/2022 Used Office Machinery GDS / ADS 2022 Depreciation 1,000,000 IRC Section 179 Depr. Basis Cost $1,072,000 - 1,000,000 Recovery 5 yr/ 6 yr 72,000 14,400 6/2021 Used Furniture 200,000 7 yr/ 10 yr 48,980 2/2022 Used Heavy Trucks 336,093 5 yr/ 6 yr 64,530 2/2018 Light Trucks 50,000 5 yr/ 5 yr TOTAL 9,600 1,137,510 b. Squirrel has an NOL carryforward from prior years of $80,000. c. Squirrel has a contribution carryforward from prior years of $1,000. d. 2022 writeoffs for bad debts equaled the accrual of bad debt expense. e. During 2022, Squirrel made quarterly estimated payments of $25,000 per quarter toward the 2022 corporate federal income tax liability. f. Squirrel's taxable income is calculated using the reconciliation approach as follows: Book income + Nondeductible Federal Income Tax Expense + Nondeductible Penalty - Nontaxable Municipal interest income -Life insurance proceeds - Tax depreciation in excess of book Sub + Charitable Limit ($18,609) Charitable Carryfoward -DRD -NOL Sub Taxable Income 868,274 230,807 900 (24,000) (100,000) (805,891) 170,090 (1,000) 163,090 (20,000) (80,000) 69,090 REQUIRED: Determine earnings & profits for Squirrel for the year 2022.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started