Answered step by step

Verified Expert Solution

Question

1 Approved Answer

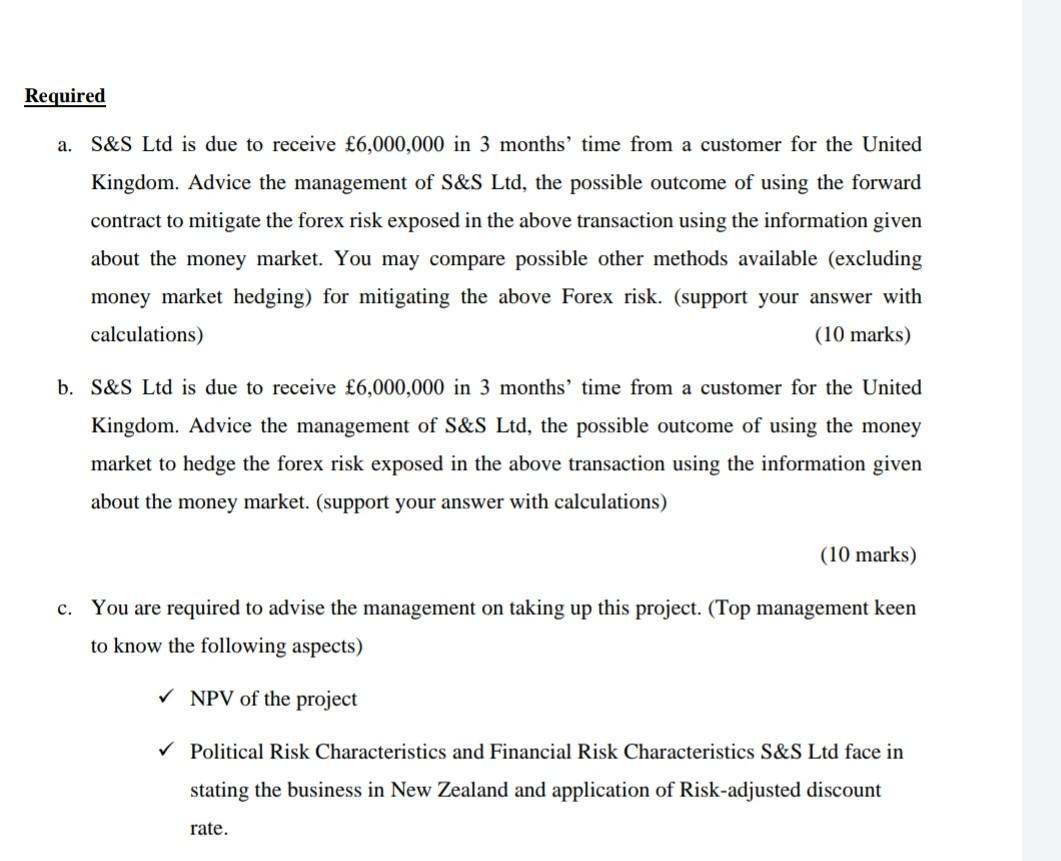

Required a. S&S Ltd is due to receive 6,000,000 in 3 months' time from a customer for the United Kingdom. Advice the management of

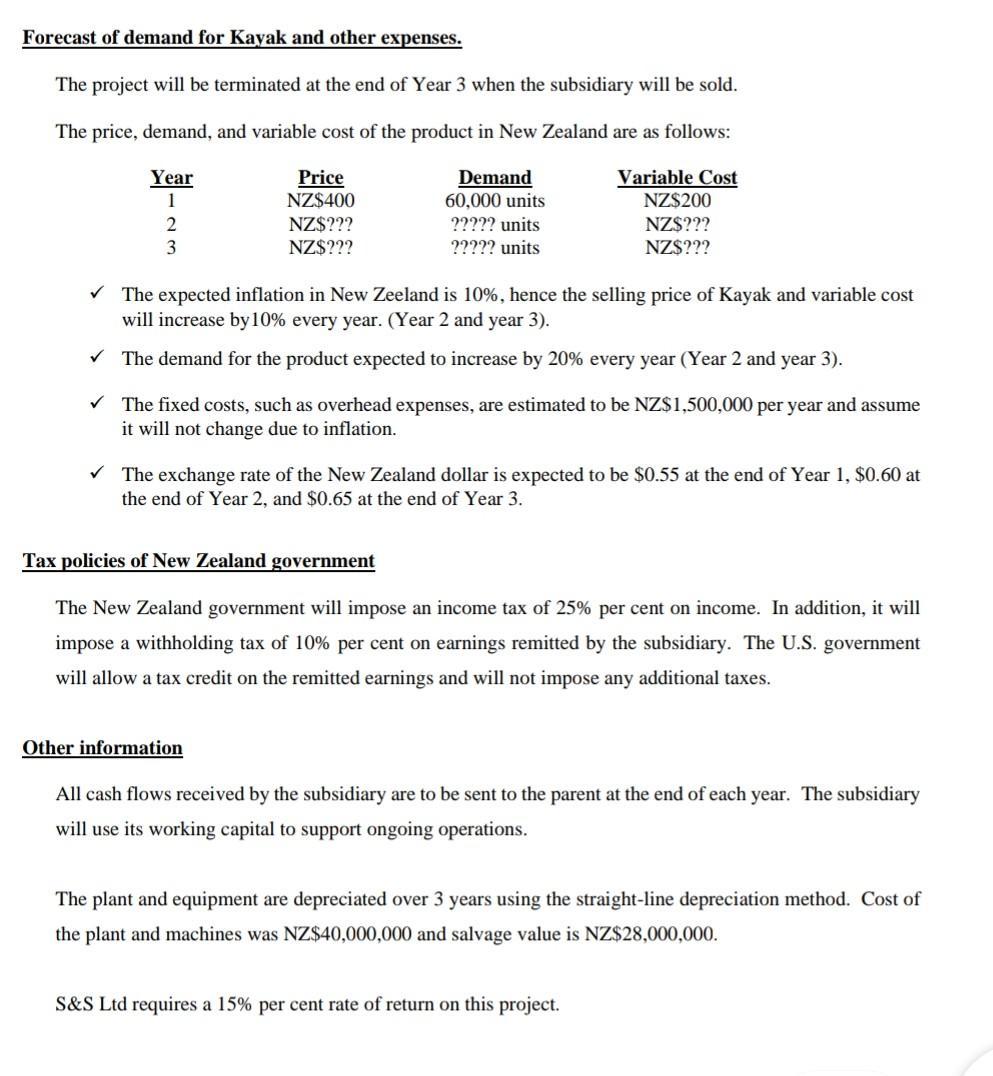

Required a. S&S Ltd is due to receive 6,000,000 in 3 months' time from a customer for the United Kingdom. Advice the management of S&S Ltd, the possible outcome of using the forward contract to mitigate the forex risk exposed in the above transaction using the information given about the money market. You may compare possible other methods available (excluding money market hedging) for mitigating the above Forex risk. (support your answer with calculations) (10 marks) b. S&S Ltd is due to receive 6,000,000 in 3 months' time from a customer for the United Kingdom. Advice the management of S&S Ltd, the possible outcome of using the money market to hedge the forex risk exposed in the above transaction using the information given about the money market. (support your answer with calculations) (10 marks) c. You are required to advise the management on taking up this project. (Top management keen to know the following aspects) V NPV of the project V Political Risk Characteristics and Financial Risk Characteristics S&S Ltd face in stating the business in New Zealand and application of Risk-adjusted discount rate. Forecast of demand for Kayak and other expenses. The project will be terminated at the end of Year 3 when the subsidiary will be sold. The price, demand, and variable cost of the product in New Zealand are as follows: Price NZ$400 Year Demand 60,000 units Variable Cost 1 NZ$200 NZ$??? NZ$??? 2 NZ$??? ????? units 3 NZ$??? ????? units V The expected inflation in New Zeeland is 10%, hence the selling price of Kayak and variable cost will increase by10% every year. (Year 2 and year 3). V The demand for the product expected to increase by 20% every year (Year 2 and year 3). V The fixed costs, such as overhead expenses, are estimated to be NZ$1,500,000 per year and assume it will not change due to inflation. V The exchange rate of the New Zealand dollar is expected to be $0.55 at the end of Year 1, $0.60 at the end of Year 2, and $0.65 at the end of Year 3. Tax policies of New Zealand government The New Zealand government will impose an income tax of 25% per cent on income. In addition, it will impose a withholding tax of 10% per cent on earnings remitted by the subsidiary. The U.S. government will allow a tax credit on the remitted earnings and will not impose any additional taxes. Other information All cash flows received by the subsidiary are to be sent to the parent at the end of each year. The subsidiary will use its working capital to support ongoing operations. The plant and equipment are depreciated over 3 years using the straight-line depreciation method. Cost of the plant and machines was NZ$40,000,000 and salvage value is NZ$28,000,000. S&S Ltd requires a 15% per cent rate of return on this project.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

SOLUTION a Using forward contract to hedge forex exposure When SS Ltd will enter into a 3 month forward contract for selling 6000000 at the rate of 06731 This will eliminate the forex exposure faced b...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started