Answered step by step

Verified Expert Solution

Question

1 Approved Answer

SSS Problem Twelve - 4 (Net And Taxable income, Tax Payable) For its taxation year ending December 31, 2014, the condensed Income Statement of Manipee

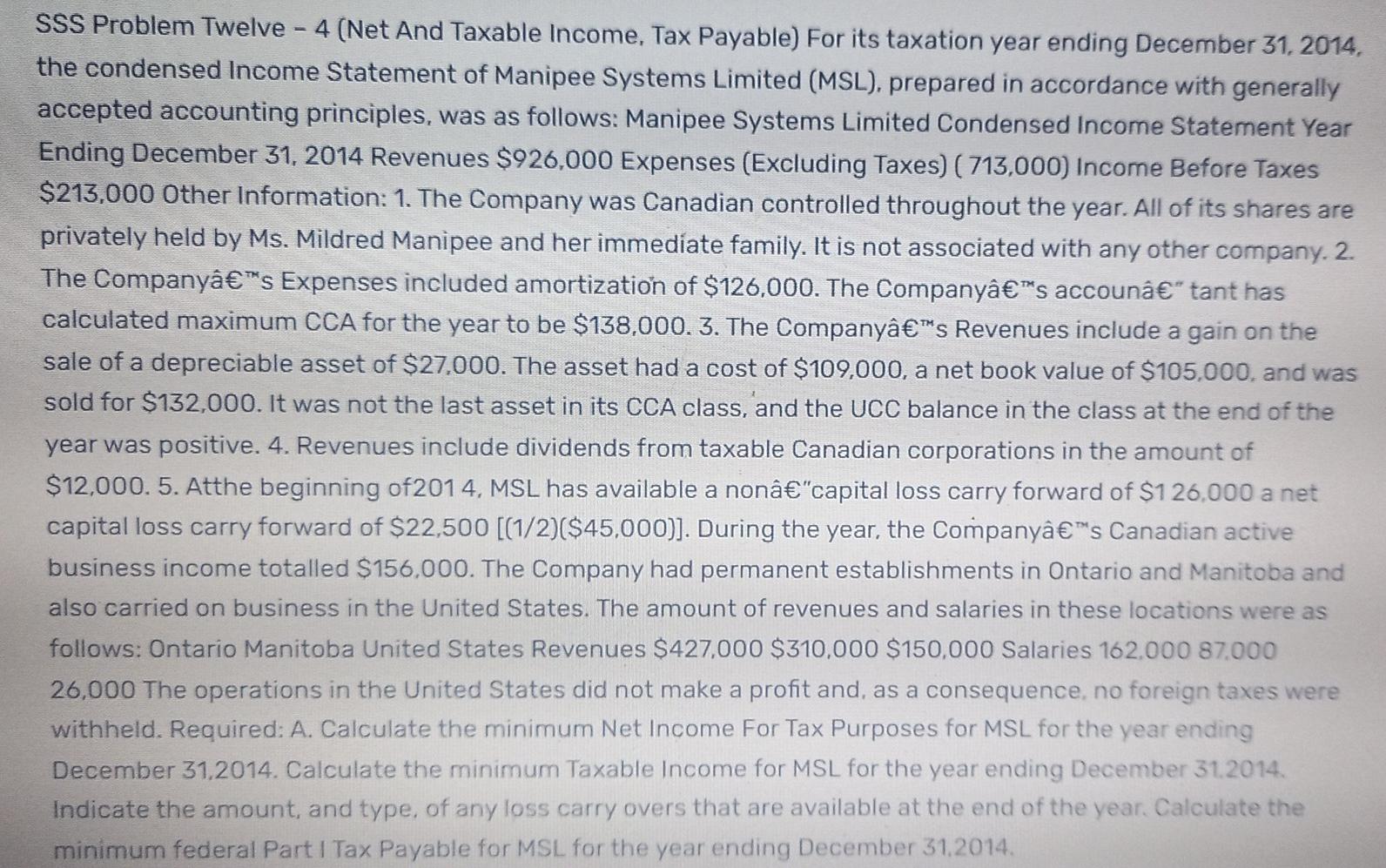

SSS Problem Twelve - 4 (Net And Taxable income, Tax Payable) For its taxation year ending December 31, 2014, the condensed Income Statement of Manipee Systems Limited (MSL), prepared in accordance with generally accepted accounting principles, was as follows: Manipee Systems Limited Condensed Income Statement Year Ending December 31, 2014 Revenues $926,000 Expenses (Excluding Taxes) (713,000) Income Before Taxes $213,000 Other Information: 1. The Company was Canadian controlled throughout the year. All of its shares are privately held by Ms. Mildred Manipee and her immediate family. It is not associated with any other company. 2. The Companys Expenses included amortization of $126,000. The Companys accoun" tant has calculated maximum CCA for the year to be $138,000. 3. The Companys Revenues include a gain on the sale of a depreciable asset of $27,000. The asset had a cost of $109,000, a net book value of $105,000, and was sold for $132,000. It was not the last asset in its CCA class, and the UCC balance in the class at the end of the year was positive. 4. Revenues include dividends from taxable Canadian corporations in the amount of $12,000.5. Atthe beginning of2014, MSL has available a non"capital loss carry forward of $126.000 a net capital loss carry forward of $22,500 [(1/2)($45,000)]. During the year, the Companys Canadian active business income totalled $156,000. The Company had permanent establishments in Ontario and Manitoba and also carried on business in the United States. The amount of revenues and salaries in these locations were as follows: Ontario Manitoba United States Revenues $427,000 $310,000 $150,000 Salaries 162.000 87.000 26,000 The operations in the United States did not make a profit and, as a consequence, no foreign taxes were withheld. Required: A. Calculate the minimum Net Income For Tax Purposes for MSL for the year ending December 31,2014. Calculate the minimum Taxable income for MSL for the year ending December 31, 2014 Indicate the amount, and type, of any loss carry overs that are available at the end of the year. Calculate the minimum federal Part I Tax Payable for MSL for the year ending December 31, 2014. SSS Problem Twelve - 4 (Net And Taxable income, Tax Payable) For its taxation year ending December 31, 2014, the condensed Income Statement of Manipee Systems Limited (MSL), prepared in accordance with generally accepted accounting principles, was as follows: Manipee Systems Limited Condensed Income Statement Year Ending December 31, 2014 Revenues $926,000 Expenses (Excluding Taxes) (713,000) Income Before Taxes $213,000 Other Information: 1. The Company was Canadian controlled throughout the year. All of its shares are privately held by Ms. Mildred Manipee and her immediate family. It is not associated with any other company. 2. The Companys Expenses included amortization of $126,000. The Companys accoun" tant has calculated maximum CCA for the year to be $138,000. 3. The Companys Revenues include a gain on the sale of a depreciable asset of $27,000. The asset had a cost of $109,000, a net book value of $105,000, and was sold for $132,000. It was not the last asset in its CCA class, and the UCC balance in the class at the end of the year was positive. 4. Revenues include dividends from taxable Canadian corporations in the amount of $12,000.5. Atthe beginning of2014, MSL has available a non"capital loss carry forward of $126.000 a net capital loss carry forward of $22,500 [(1/2)($45,000)]. During the year, the Companys Canadian active business income totalled $156,000. The Company had permanent establishments in Ontario and Manitoba and also carried on business in the United States. The amount of revenues and salaries in these locations were as follows: Ontario Manitoba United States Revenues $427,000 $310,000 $150,000 Salaries 162.000 87.000 26,000 The operations in the United States did not make a profit and, as a consequence, no foreign taxes were withheld. Required: A. Calculate the minimum Net Income For Tax Purposes for MSL for the year ending December 31,2014. Calculate the minimum Taxable income for MSL for the year ending December 31, 2014 Indicate the amount, and type, of any loss carry overs that are available at the end of the year. Calculate the minimum federal Part I Tax Payable for MSL for the year ending December 31, 2014

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To solve this problem we will calculate the Minimum Net Income for Tax Purposes NITP the Taxable Income the loss carryovers available and the minimum ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started