Question

ssume that the discount rate is r = 0 . 03 and that the earnings impact at age 28, $3,282, remains the same from age

ssume that the discount rate is

r

= 0

.

03 and that the earnings impact at age 28,

$3,282, remains the same from age 29 until retirement at age 64. Assuming that time

begins at age 19, calculate the present value of the impact of the Pathways program on

lifetime (age 19-64) earnings. [8 marks]

(b) Assume that the discount rate is

r

= 0

.

03 and that the welfare receipt impact at age

28, $-478, remains the same from age 29 until retirement at age 64. Assuming that time

begins at age 19, calculate the present value of the impact of the Pathways program on

lifetime (age 19-64) social assistance (welfare) receipt. [8 marks]

(c) The present value of the costs of the Pathways program is $14,935 per student. Does

the present value of the benefits of the Pathways program exceed its costs? Based on

your calculations, do you recommend expanding the program? Show your w

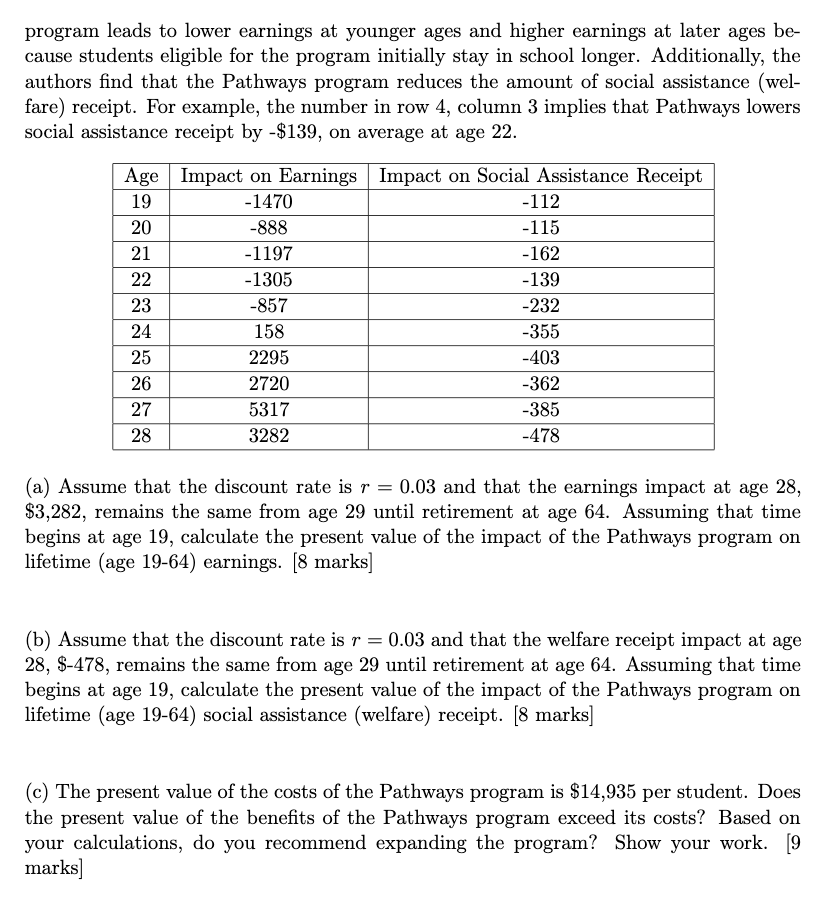

3 Cost-Benefit Analysis (25 marks] In a recent paper, Lavecchia, Oreopoulos and Brown (2020) estimate the impact of Path- ways to Education a comprehensive program for disadvantaged high school students in Toronto. The authors find that the Pathways program improves high school, postsec- ondary attainment and other labour market outcomes. The table below is copied from their paper and shows the impacts of the Pathways to Education program on earnings and social assistance (welfare) receipt. For example, the number in row 2, column 2 im- plies that, on average, Pathways reduces the earnings of students at age 19 by -$1,470. The number in row 11, column 2 implies that Pathways increases individual earnings at age 28 by $3,282. Lavecchia, Oreopoulos and Brown (2019) show that the Pathways program leads to lower earnings at younger ages and higher earnings at later ages be- cause students eligible for the program initially stay in school longer. Additionally, the authors find that the Pathways program reduces the amount of social assistance (wel- fare) receipt. For example, the number in row 4, column 3 implies that Pathways lowers social assistance receipt by -$139, on average at age 22. Age Impact on Earnings Impact on Social Assistance Receipt 19 -1470 -112 20 -888 -115 21 -1197 -162 22 -1305 -139 23 -857 -232 24 158 -355 25 2295 -403 26 2720 -362 27 5317 -385 28 3282 -478 (a) Assume that the discount rate is r = 0.03 and that the earnings impact at age 28, $3,282, remains the same from age 29 until retirement at age 64. Assuming that time begins at age 19, calculate the present value of the impact of the Pathways program on lifetime (age 19-64) earnings. [8 marks] (b) Assume that the discount rate is r = 0.03 and that the welfare receipt impact at age 28, $-478, remains the same from age 29 until retirement at age 64. Assuming that time begins at age 19, calculate the present value of the impact of the Pathways program on lifetime (age 19-64) social assistance (welfare) receipt. [8 marks] (c) The present value of the costs of the Pathways program is $14,935 per student. Does the present value of the benefits of the Pathways program exceed its costs? Based on your calculations, do you recommend expanding the program? Show your work. [9 marks] 3 Cost-Benefit Analysis (25 marks] In a recent paper, Lavecchia, Oreopoulos and Brown (2020) estimate the impact of Path- ways to Education a comprehensive program for disadvantaged high school students in Toronto. The authors find that the Pathways program improves high school, postsec- ondary attainment and other labour market outcomes. The table below is copied from their paper and shows the impacts of the Pathways to Education program on earnings and social assistance (welfare) receipt. For example, the number in row 2, column 2 im- plies that, on average, Pathways reduces the earnings of students at age 19 by -$1,470. The number in row 11, column 2 implies that Pathways increases individual earnings at age 28 by $3,282. Lavecchia, Oreopoulos and Brown (2019) show that the Pathways program leads to lower earnings at younger ages and higher earnings at later ages be- cause students eligible for the program initially stay in school longer. Additionally, the authors find that the Pathways program reduces the amount of social assistance (wel- fare) receipt. For example, the number in row 4, column 3 implies that Pathways lowers social assistance receipt by -$139, on average at age 22. Age Impact on Earnings Impact on Social Assistance Receipt 19 -1470 -112 20 -888 -115 21 -1197 -162 22 -1305 -139 23 -857 -232 24 158 -355 25 2295 -403 26 2720 -362 27 5317 -385 28 3282 -478 (a) Assume that the discount rate is r = 0.03 and that the earnings impact at age 28, $3,282, remains the same from age 29 until retirement at age 64. Assuming that time begins at age 19, calculate the present value of the impact of the Pathways program on lifetime (age 19-64) earnings. [8 marks] (b) Assume that the discount rate is r = 0.03 and that the welfare receipt impact at age 28, $-478, remains the same from age 29 until retirement at age 64. Assuming that time begins at age 19, calculate the present value of the impact of the Pathways program on lifetime (age 19-64) social assistance (welfare) receipt. [8 marks] (c) The present value of the costs of the Pathways program is $14,935 per student. Does the present value of the benefits of the Pathways program exceed its costs? Based on your calculations, do you recommend expanding the program? Show your work. [9 marks]Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started