St. David's Hospital in Austin, Texas has a target capital structure of 35 percent debt and 65 percent equity. Its cost of equity (fund

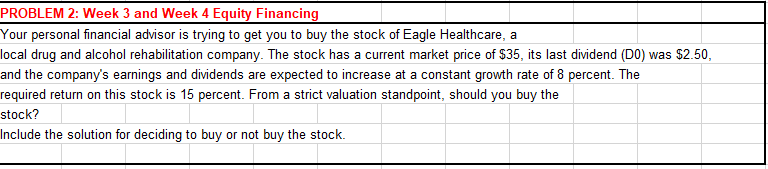

St. David's Hospital in Austin, Texas has a target capital structure of 35 percent debt and 65 percent equity. Its cost of equity (fund capital) estimate is 13.5 percent and its cost of debt is 7 percent. If it has a 35% tax rate, what is the hospital's corporate cost of capital? PROBLEM 2: Week 3 and Week 4 Cost of Capital The capital structure for HCA is provided below. If the firm has a 5% after tax cost of debt, 9% commerical loan rate, a 11.5% cost of preferred stock, an 15% cost of common stock, and given the dollar amounts provided below, what is the firm's weighted average cost of capital (WACC)? Capital Structure (in K's) Weighted Costs Weights Individual Costs Bonds $ 1,083 5.00% Commercial Loans $ 2,845 9.00% Preferred Stock $ 268 11.50% Common Stock $ 3,681 15.00% PROBLEM 2: Week 3 and Week 4 Equity Financing Your personal financial advisor is trying to get you to buy the stock of Eagle Healthcare, a local drug and alcohol rehabilitation company. The stock has a current market price of $35, its last dividend (DO) was $2.50, and the company's earnings and dividends are expected to increase at a constant growth rate of 8 percent. The required return on this stock is 15 percent. From a strict valuation standpoint, should you buy the stock? Include the solution for deciding to buy or not buy the stock.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started