Answered step by step

Verified Expert Solution

Question

1 Approved Answer

St ep Instructions 1 ) Start Excel. Download and open the file named Exp 2 2 _ Excel _ Ch 0 2 _ ML 1

St ep Instructions

Start Excel. Download and open the file named ExpExcelChMLPayroll.xlsx Grader has automatically added your last name to the beginning of the filename.

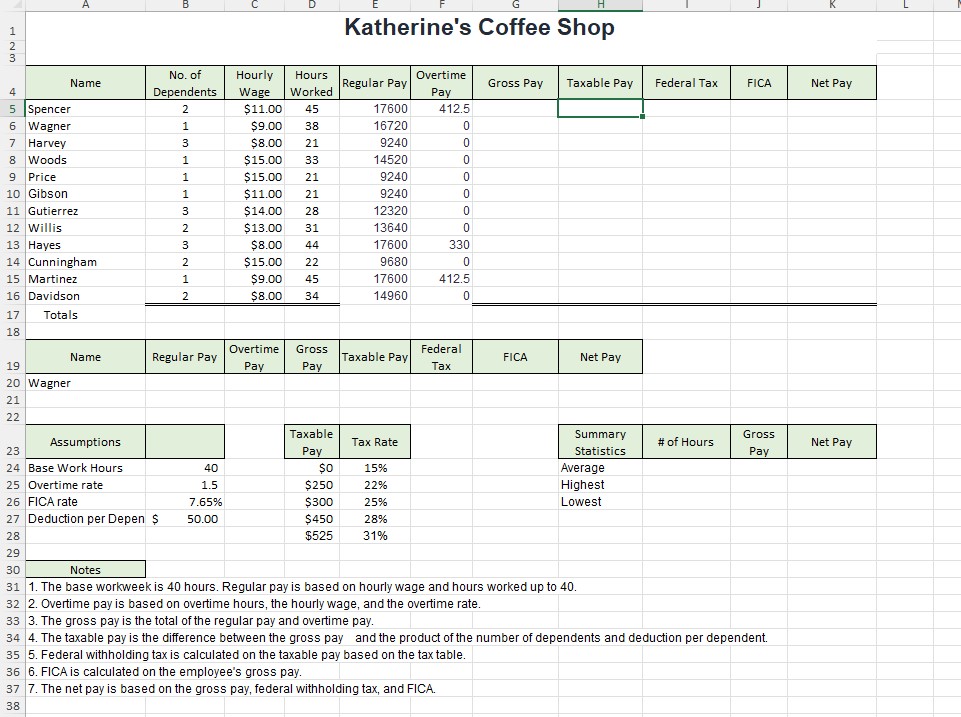

Use IF functions to calculate the regular pay and overtime pay in columns E and F based on a regular hour workweek. Be sure to use the appropriate absolute or mixed cell references. Pay overtime only for overtime hours. Note employees receive their hourly wage for overtime hours worked. Calculate the gross pay in cell G based on the regular and overtime pay. Spencers regular pay is $ With five overtime hours, Spencers overtime pay is $

Create a formula in cell H to calculate the taxable pay. Multiply the number of dependents by the deduction per dependent and subtract that from the gross pay. With two dependents, Spencers taxable pay is $

Insert a VLOOKUP function in cell I to identify and calculate the federal withholding tax. With a taxable pay of $ Spencers tax rate is and the withholding tax is $ The VLOOKUP function returns the applicable tax rate, which you must then multiply by the taxable pay.

Calculate FICA in cell J based on gross pay and the FICA rate, and calculate the net pay in cell K Copy all formulas down their respective columns. Be sure to preserve the existing formatting in the document. Based on the hours Spencer worked he paid $ to FICA and had a weekly net pay of $

Use Quick Analysis tools to calculate the total regular pay, overtime pay, gross pay, taxable pay, withholding tax, FICA, and net pay on row On a Mac, this step must be completed using the AutoSum feature on the ribbon.

Apply Accounting Number Format to the range C:C Apply Accounting Number Format to the first row of monetary data and to the total row. Apply the Comma style to the monetary values for the other employees.

Insert appropriate functions to calculate the average, highest, and lowest values in the Summary Statistics area the range I:K of the worksheet. Format the # of hours calculations as Number format with one decimal and the remaining calculations with Accounting Number Format.

Use the XLOOKUP function to look up the employee name in cell AWagner in the payroll data and return the specified information in row Ensure the return array includes overtime pay, gross pay, taxable pay, federal tax, FICA and net pay.

Save and close the workbook. Submit the file as directed.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started