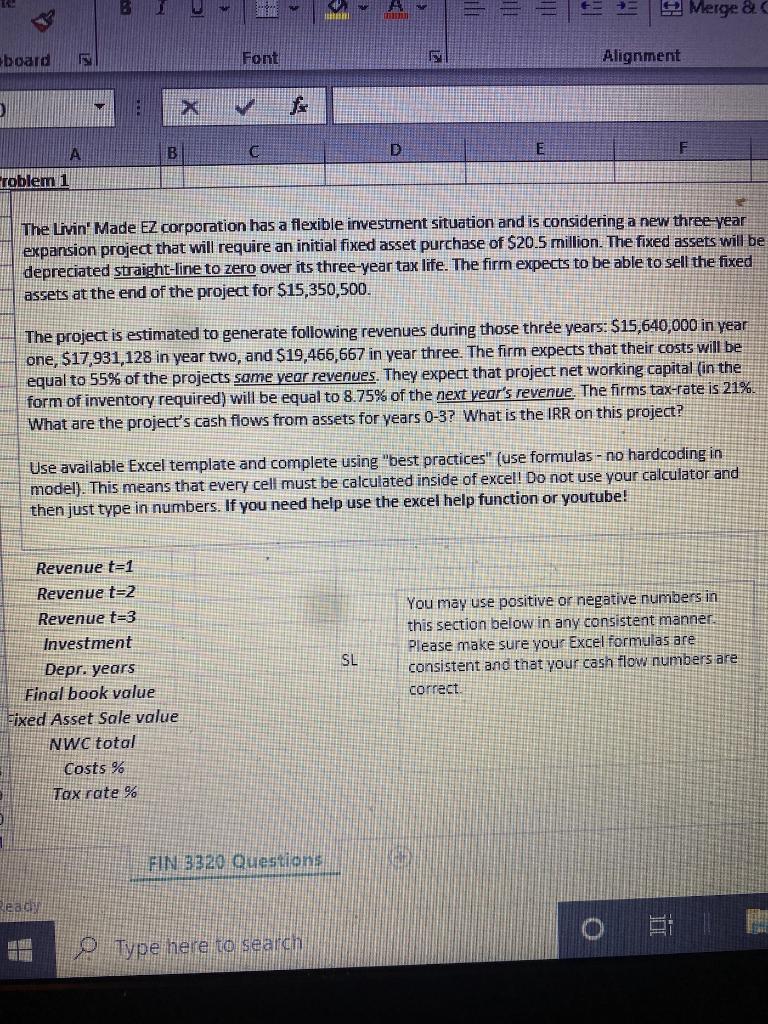

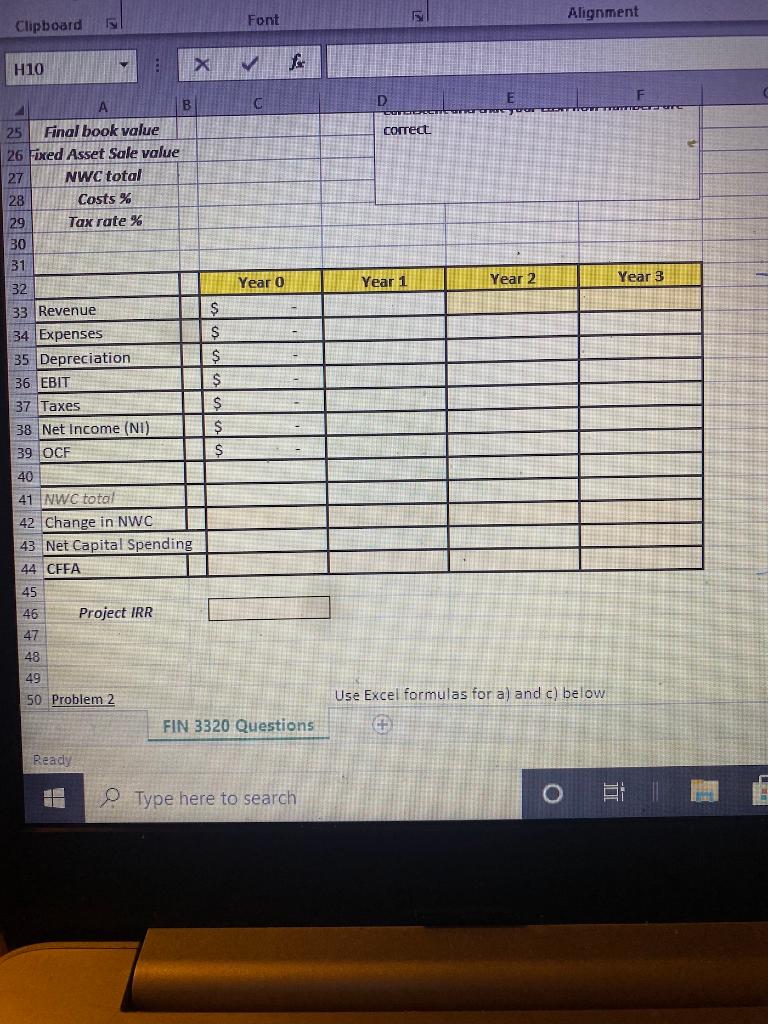

ST IM 9 Merge de board Font Alignment w X for B D E F A roblem 1 The Livin' Made EZ corporation has a flexible investment situation and is considering a new three year expansion project that will require an initial fixed asset purchase of $20.5 million. The fixed assets will be depreciated straight-line to zero over its three-year tax life. The firm expects to be able to sell the fixed assets at the end of the project for $15,350,500. The project is estimated to generate following revenues during those three years: $15,640,000 in year one, $17,931,128 in year two, and $19,466,667 in year three. The firm expects that their costs will be equal to 55% of the projects same year revenues. They expect that project net working capital (in the form of inventory required) will be equal to 8.75% of the next year's revenue. The firms tax-rate is 21%. What are the project's cash flows from assets for years 0-3? What is the IRR on this project? Use available Excel template and complete using "best practices" (use formulas - no hardcoding in model). This means that every cell must be calculated inside of excel! Do not use your calculator and then just type in numbers. If you need help use the excel help function or youtube! Revenue t=1 Revenue t=2 Revenue t=3 Investment Depr. years Final book value Fixed Asset Sale value NWC total Costs % Tax rate % You may use positive or negative numbers in this section below in any consistent manner. Please make sure your Excel formulas are consistent and that your cash flow numbers are correct SL FIN 3320 Questions Reach 0 o Type here to search Clipboard Font Alignment H10 X f C D correct Year 0 Year 2 Year 3 Year 1 B 25 Final book value 26 Fixed Asset Sale value 27 NWC total 28 Costs % 29 Tax rate % 30 31 32 33 Revenue 34 Expenses 35 Depreciation 36 EBIT 37 Taxes 38 Net Income (NI) 39 OCF 40 41 NWC total 42 Change in NWC 43 Net Capital Spending 44 CFFA $ $ $ $ $ $ $ 45 46 47 Project IRR 48 49 50 Problem 2 Use Excel formulas for a) and c) below FIN 3320 Questions + Ready Type here to search o 1 Ei ST IM 9 Merge de board Font Alignment w X for B D E F A roblem 1 The Livin' Made EZ corporation has a flexible investment situation and is considering a new three year expansion project that will require an initial fixed asset purchase of $20.5 million. The fixed assets will be depreciated straight-line to zero over its three-year tax life. The firm expects to be able to sell the fixed assets at the end of the project for $15,350,500. The project is estimated to generate following revenues during those three years: $15,640,000 in year one, $17,931,128 in year two, and $19,466,667 in year three. The firm expects that their costs will be equal to 55% of the projects same year revenues. They expect that project net working capital (in the form of inventory required) will be equal to 8.75% of the next year's revenue. The firms tax-rate is 21%. What are the project's cash flows from assets for years 0-3? What is the IRR on this project? Use available Excel template and complete using "best practices" (use formulas - no hardcoding in model). This means that every cell must be calculated inside of excel! Do not use your calculator and then just type in numbers. If you need help use the excel help function or youtube! Revenue t=1 Revenue t=2 Revenue t=3 Investment Depr. years Final book value Fixed Asset Sale value NWC total Costs % Tax rate % You may use positive or negative numbers in this section below in any consistent manner. Please make sure your Excel formulas are consistent and that your cash flow numbers are correct SL FIN 3320 Questions Reach 0 o Type here to search Clipboard Font Alignment H10 X f C D correct Year 0 Year 2 Year 3 Year 1 B 25 Final book value 26 Fixed Asset Sale value 27 NWC total 28 Costs % 29 Tax rate % 30 31 32 33 Revenue 34 Expenses 35 Depreciation 36 EBIT 37 Taxes 38 Net Income (NI) 39 OCF 40 41 NWC total 42 Change in NWC 43 Net Capital Spending 44 CFFA $ $ $ $ $ $ $ 45 46 47 Project IRR 48 49 50 Problem 2 Use Excel formulas for a) and c) below FIN 3320 Questions + Ready Type here to search o 1 Ei