Answered step by step

Verified Expert Solution

Question

1 Approved Answer

st K Aggressive versus conservative seasonal funding strategy Dynabase Tool has forecast its total funding requirements for the coming year as shown in the

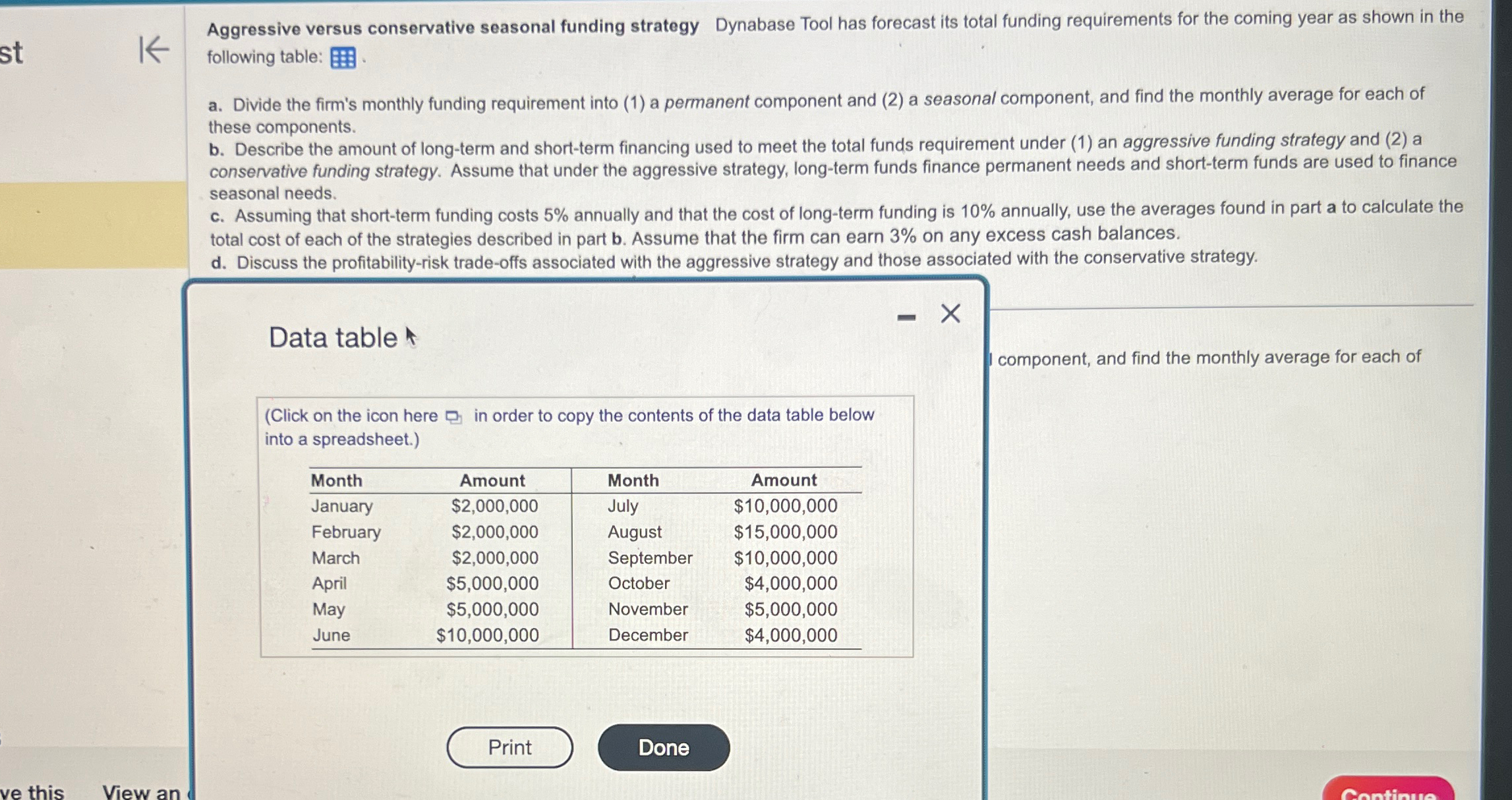

st K Aggressive versus conservative seasonal funding strategy Dynabase Tool has forecast its total funding requirements for the coming year as shown in the following table: a. Divide the firm's monthly funding requirement into (1) a permanent component and (2) a seasonal component, and find the monthly average for each of these components. b. Describe the amount of long-term and short-term financing used to meet the total funds requirement under (1) an aggressive funding strategy and (2) a conservative funding strategy. Assume that under the aggressive strategy, long-term funds finance permanent needs and short-term funds are used to finance seasonal needs. c. Assuming that short-term funding costs 5% annually and that the cost of long-term funding is 10% annually, use the averages found in part a to calculate the total cost of each of the strategies described in part b. Assume that the firm can earn 3% on any excess cash balances. d. Discuss the profitability-risk trade-offs associated with the aggressive strategy and those associated with the conservative strategy. ve this View an Data table (Click on the icon here in order to copy the contents of the data table below into a spreadsheet.) Month January Amount $2,000,000 Month July Amount $10,000,000 February $2,000,000 August $15,000,000 March $2,000,000 September $10,000,000 April $5,000,000 October $4,000,000 May $5,000,000 November $5,000,000 June $10,000,000 December $4,000,000 Print Done component, and find the monthly average for each of Continue

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started