Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Conceptual Framework The following extract is taken from the article A tale of 'prudence by Steve Cooper, which you were required to read as

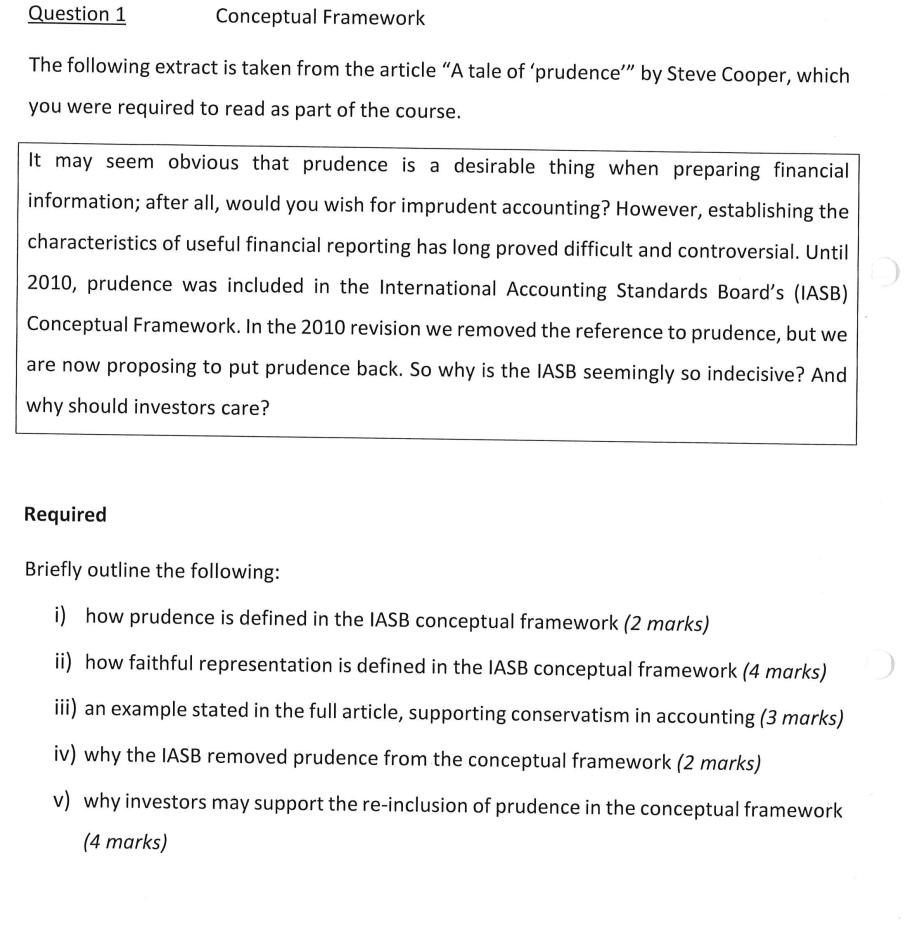

Conceptual Framework The following extract is taken from the article "A tale of 'prudence"" by Steve Cooper, which you were required to read as part of the course. Question 1 It may seem obvious that prudence is a desirable thing when preparing financial information; after all, would you wish for imprudent accounting? However, establishing the characteristics of useful financial reporting has long proved difficult and controversial. Until 2010, prudence was included in the International Accounting Standards Board's (IASB) Conceptual Framework. In the 2010 revision we removed the reference to prudence, but we are now proposing to put prudence back. So why is the IASB seemingly so indecisive? And why should investors care? Required Briefly outline the following: i) how prudence is defined in the IASB conceptual framework (2 marks) ii) how faithful representation is defined in the IASB conceptual framework (4 marks) iii) an example stated in the full article, supporting conservatism in accounting (3 marks) iv) why the IASB removed prudence from the conceptual framework (2 marks) v) why investors may support the re-inclusion of prudence in the conceptual framework (4 marks)

Step by Step Solution

★★★★★

3.51 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

i Prudence in the IASB Conceptual Framework is defined as the exercise of caution when making judgme...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started