Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ST purchased a piece of land on 1 April 2020 to be used as its warehouse site for RM120,000. In order for ST to

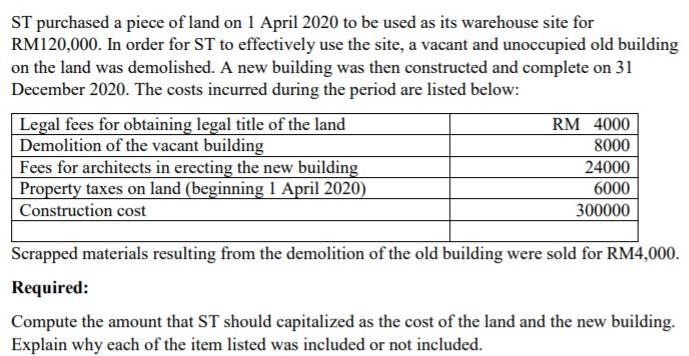

ST purchased a piece of land on 1 April 2020 to be used as its warehouse site for RM120,000. In order for ST to effectively use the site, a vacant and unoccupied old building on the land was demolished. A new building was then constructed and complete on 31 December 2020. The costs incurred during the period are listed below: Legal fees for obtaining legal title of the land Demolition of the vacant building Fees for architects in erecting the new building Property taxes on land (beginning 1 April 2020) Construction cost RM 4000 8000 24000 6000 300000 Scrapped materials resulting from the demolition of the old building were sold for RM4,000. Required: Compute the amount that ST should capitalized as the cost of the land and the new building. Explain why each of the item listed was included or not included.

Step by Step Solution

★★★★★

3.49 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

Capitalization of Land and Building Costs for ST The costs that should be capitalized by ST as the cost of the land and the new building are as follow...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started