Answered step by step

Verified Expert Solution

Question

1 Approved Answer

St . Steven's Hospital is a private not - for - profit entity providing health care services to citizens of a small rural community. During

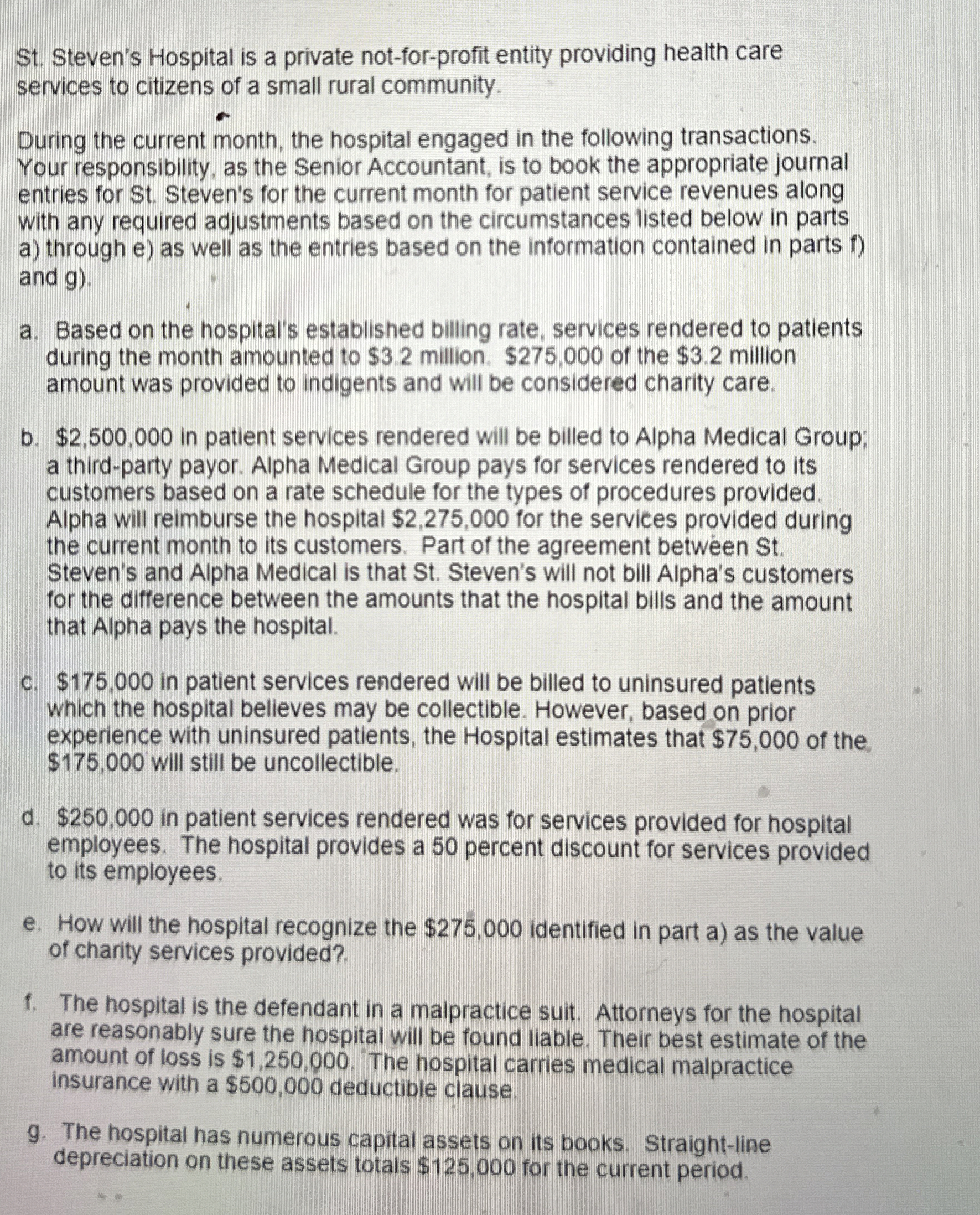

St Steven's Hospital is a private notforprofit entity providing health care

services to citizens of a small rural community.

During the current month, the hospital engaged in the following transactions.

Your responsibility, as the Senior Accountant, is to book the appropriate journal

entries for St Steven's for the current month for patient service revenues along

with any required adjustments based on the circumstances listed below in parts

a through e as well as the entries based on the information contained in parts f

and g

a Based on the hospital's established billing rate, services rendered to patients

during the month amounted to $ million. $ of the $ million

amount was provided to indigents and will be considered charity care.

b $ in patient services rendered will be billed to Alpha Medical Group;

a thirdparty payor. Alpha Medical Group pays for services rendered to its

customers based on a rate schedule for the types of procedures provided.

Alpha will reimburse the hospital $ for the services provided during

the current month to its customers. Part of the agreement between St

Steven's and Alpha Medical is that St Steven's will not bill Alpha's customers

for the difference between the amounts that the hospital bills and the amount

that Alpha pays the hospital.

c $ in patient services rendered will be billed to uninsured patients

which the hospital believes may be collectible. However, based on prior

experience with uninsured patients, the Hospital estimates that $ of the,

$ will still be uncollectible.

d $ in patient services rendered was for services provided for hospital

employees. The hospital provides a percent discount for services provided

to its employees.

e How will the hospital recognize the $ identified in part a as the value

of charity services provided?

f The hospital is the defendant in a malpractice suit. Attorneys for the hospital

are reasonably sure the hospital will be found liable. Their best estimate of the

amount of loss is $ The hospital carries medical malpractice

insurance with a $ deductible clause.

g The hospital has numerous capital assets on its books. Straightline

depreciation on these assets totals $ for the current period.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started