Answered step by step

Verified Expert Solution

Question

1 Approved Answer

St. Thomas Yacht Services, Inc. had the following transactions during its first month of operations: Dec 2 Borrowed $60,000 from First Bank after signing

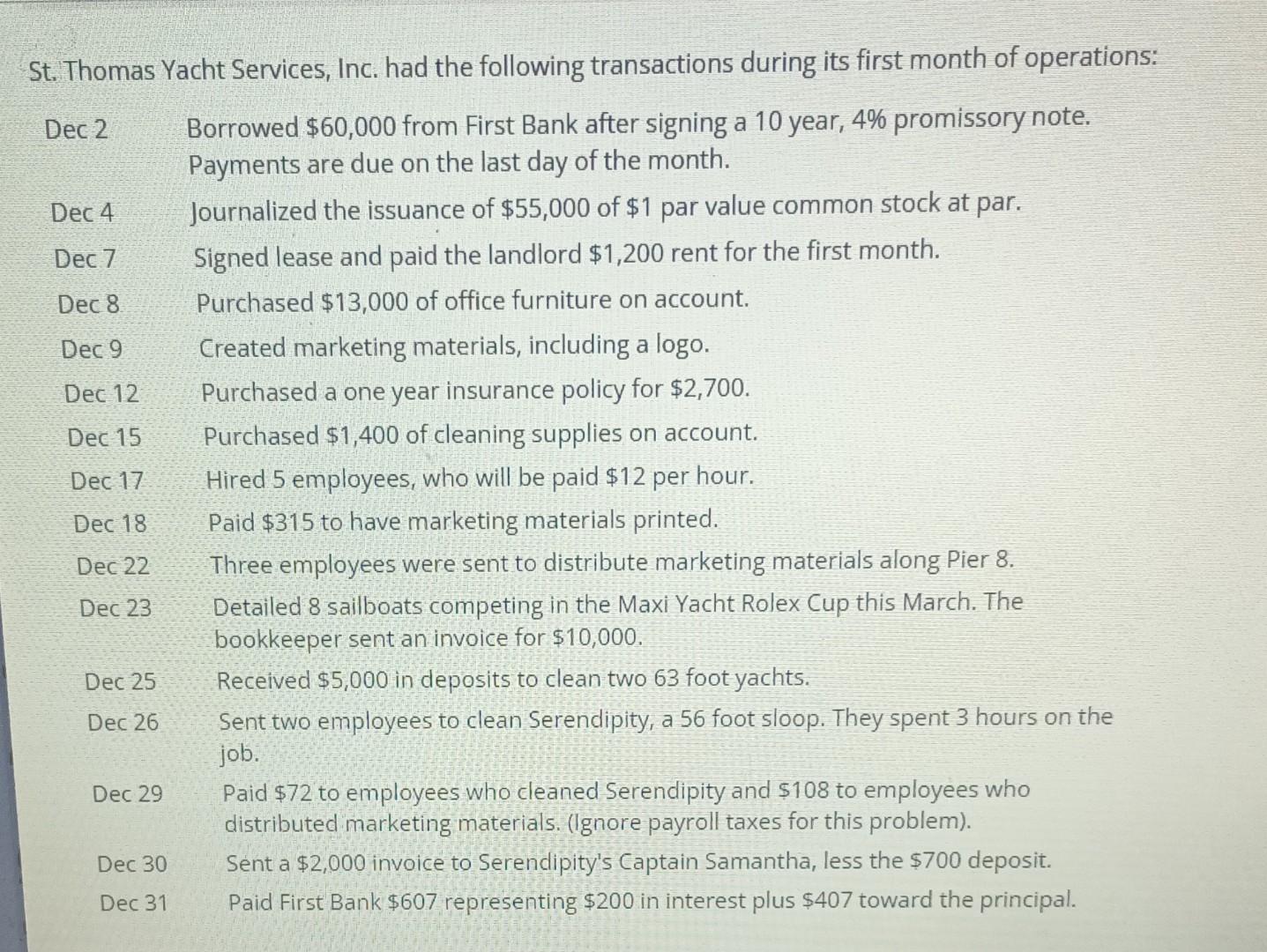

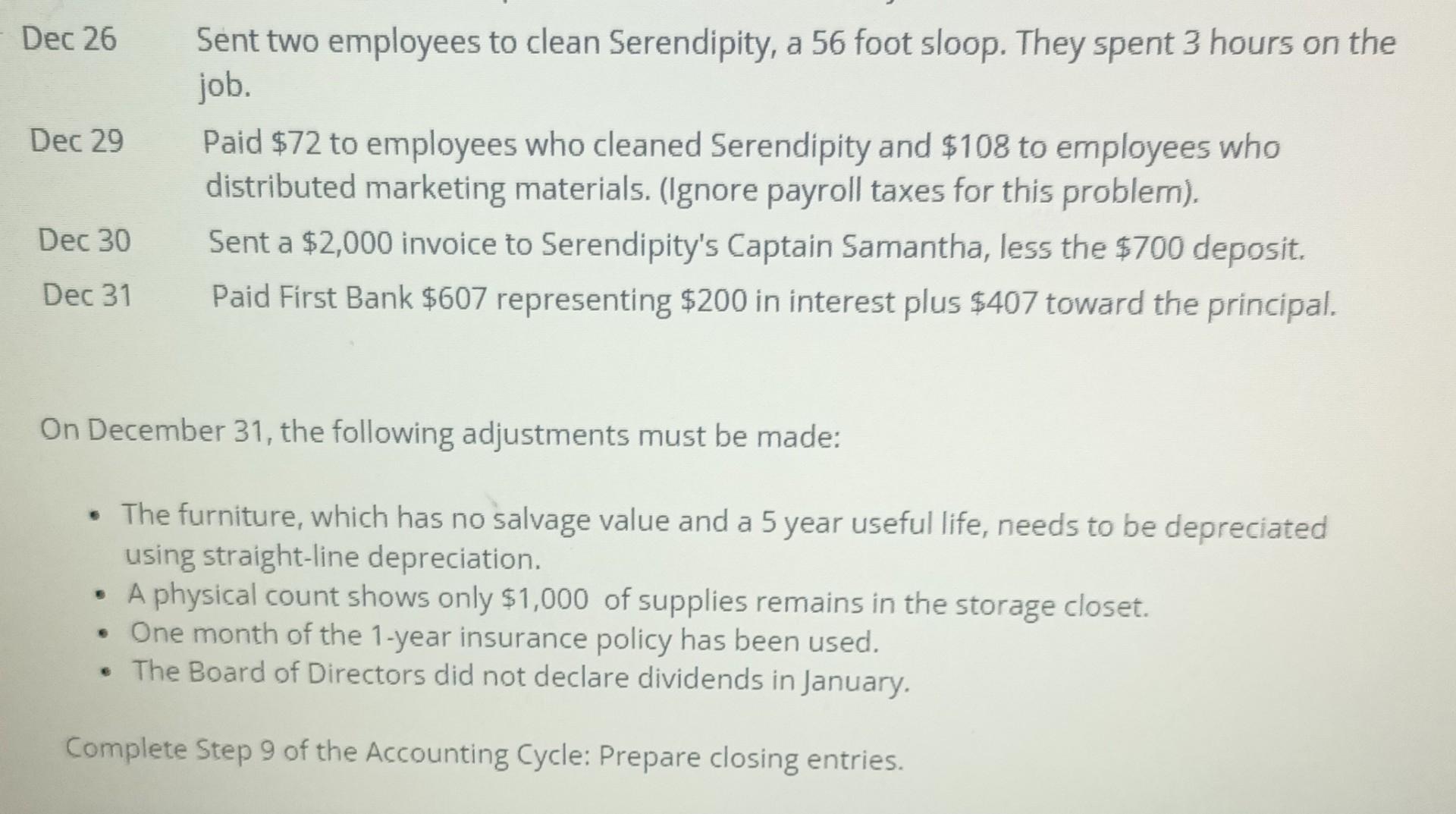

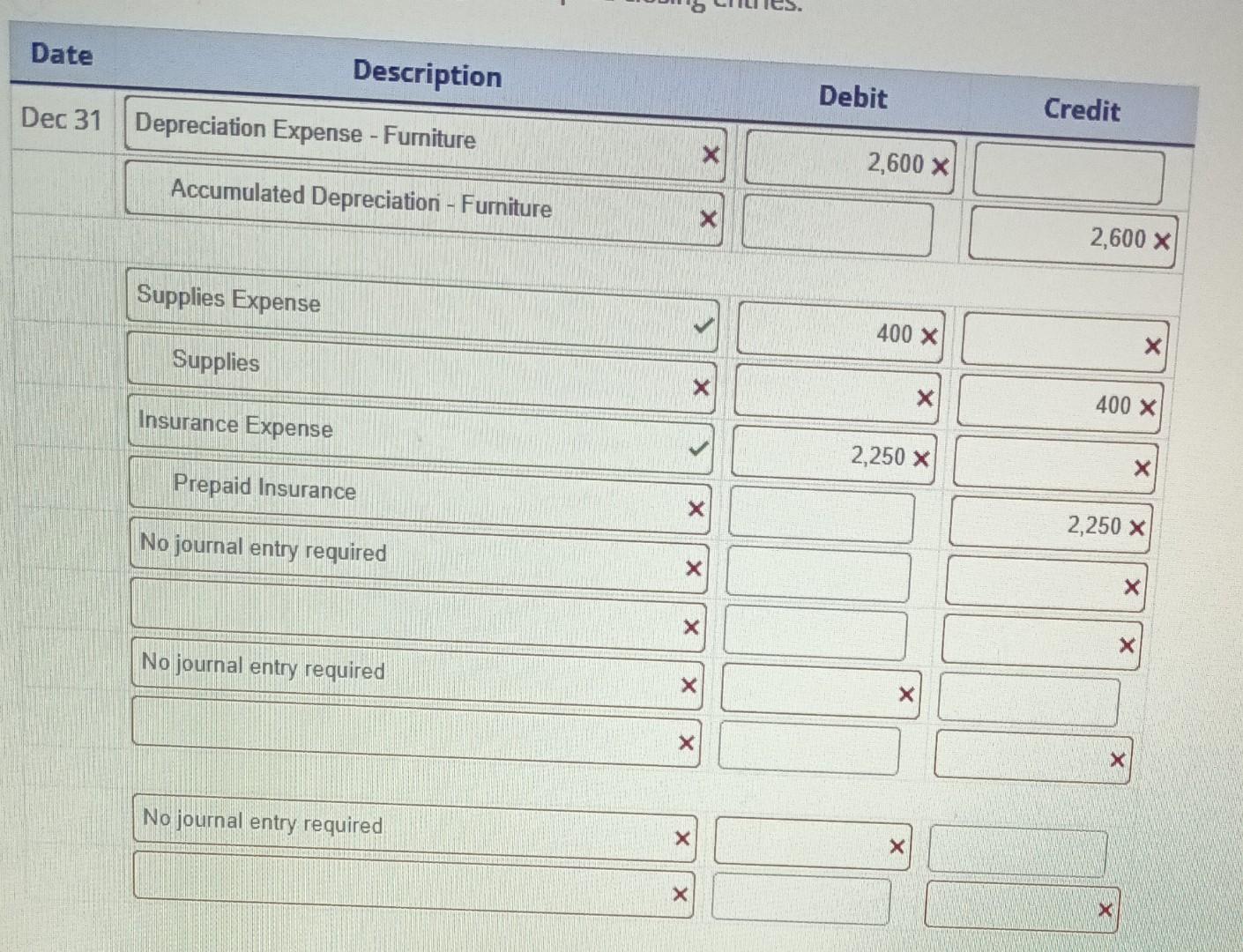

St. Thomas Yacht Services, Inc. had the following transactions during its first month of operations: Dec 2 Borrowed $60,000 from First Bank after signing a 10 year, 4% promissory note. Payments are due on the last day of the month. Journalized the issuance of $55,000 of $1 par value common stock at par. Signed lease and paid the landlord $1,200 rent for the first month. Purchased $13,000 of office furniture on account. Created marketing materials, including a logo. Purchased a one year insurance policy for $2,700. Purchased $1,400 of cleaning supplies on account. Hired 5 employees, who will be paid $12 per hour. Paid $315 to have marketing materials printed. Three employees were sent to distribute marketing materials along Pier 8. Detailed 8 sailboats competing in the Maxi Yacht Rolex Cup this March. The bookkeeper sent an invoice for $10,000. Received $5,000 in deposits to clean two 63 foot yachts. Sent two employees to clean Serendipity, a 56 foot sloop. They spent 3 hours on the job. Dec 4 Dec 7 Dec 8 Dec 9 Dec 12 Dec 15 Dec 17 Dec 18 Dec 22 Dec 23 Dec 25 Dec 26 Dec 29 Dec 30 Dec 31 Paid $72 to employees who cleaned Serendipity and $108 to employees who distributed marketing materials. (Ignore payroll taxes for this problem). Sent a $2,000 invoice to Serendipity's Captain Samantha, less the $700 deposit. Paid First Bank $607 representing $200 in interest plus $407 toward the principal. Dec 26 Dec 29 Dec 30 Dec 31 Sent two employees to clean Serendipity, a 56 foot sloop. They spent 3 hours on the job. Paid $72 to employees who cleaned Serendipity and $108 to employees who distributed marketing materials. (Ignore payroll taxes for this problem). Sent a $2,000 invoice to Serendipity's Captain Samantha, less the $700 deposit. Paid First Bank $607 representing $200 in interest plus $407 toward the principal. On December 31, the following adjustments must be made: The furniture, which has no salvage value and a 5 year useful life, needs to be depreciated using straight-line depreciation. A physical count shows only $1,000 of supplies remains in the storage closet. One month of the 1-year insurance policy has been used. The Board of Directors did not declare dividends in January. Complete Step 9 of the Accounting Cycle: Prepare closing entries. Date Dec 31 Description Depreciation Expense - Furniture Accumulated Depreciation - Furniture Supplies Expense Supplies Insurance Expense Prepaid Insurance No journal entry required No journal entry required No journal entry required X X X Debit 2,600 x 400 X X 2,250 x X Credit 2,600 x 400 X 2,250 x X X X X

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer 02Dec Cash 50000 Notes payable 07Dec rent expense 1200 Cash 1200 12Dec Prepaid insu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started