Answered step by step

Verified Expert Solution

Question

1 Approved Answer

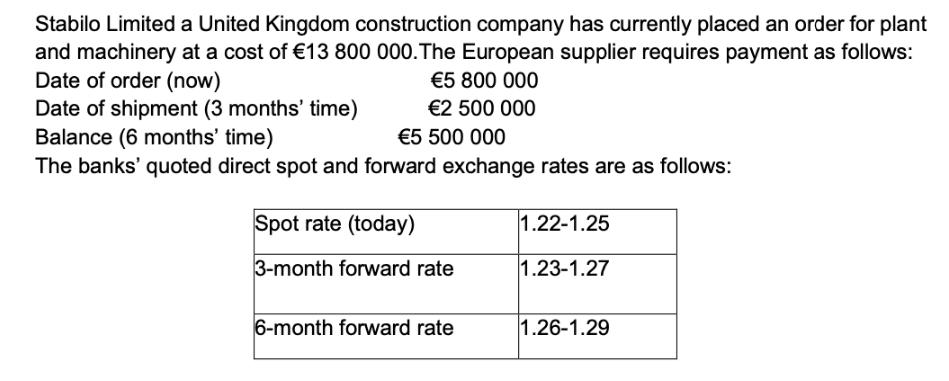

Stabilo Limited a United Kingdom construction company has currently placed an order for plant and machinery at a cost of 13 800 000. The

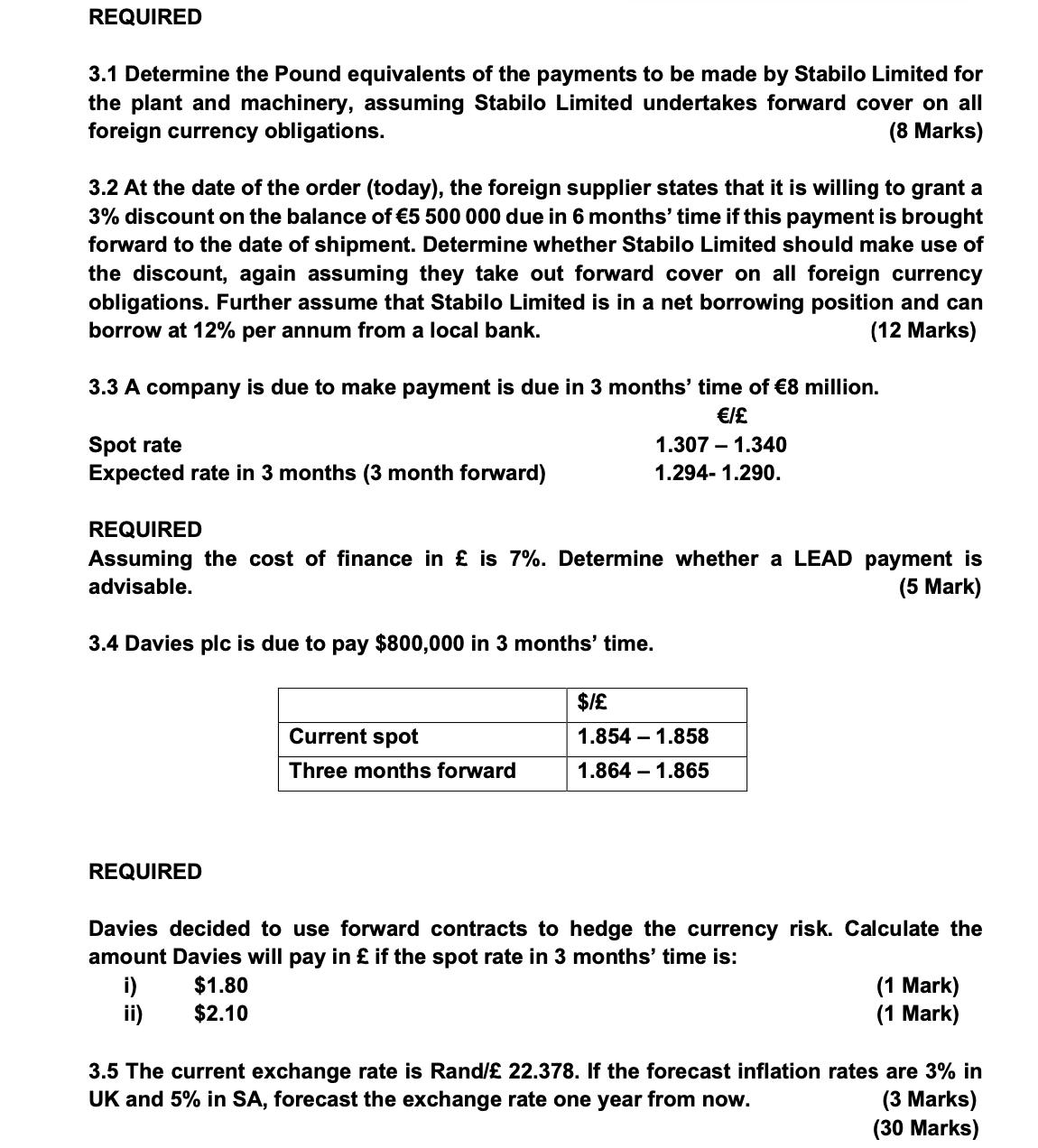

Stabilo Limited a United Kingdom construction company has currently placed an order for plant and machinery at a cost of 13 800 000. The European supplier requires payment as follows: Date of order (now) 5 800 000 Date of shipment (3 months' time) 2 500 000 Balance (6 months' time) 5 500 000 The banks' quoted direct spot and forward exchange rates are as follows: Spot rate (today) 3-month forward rate 6-month forward rate 1.22-1.25 1.23-1.27 1.26-1.29 REQUIRED 3.1 Determine the Pound equivalents of the payments to be made by Stabilo Limited for the plant and machinery, assuming Stabilo Limited undertakes forward cover on all foreign currency obligations. (8 Marks) 3.2 At the date of the order (today), the foreign supplier states that it is willing to grant a 3% discount on the balance of 5 500 000 due in 6 months' time if this payment is brought forward to the date of shipment. Determine whether Stabilo Limited should make use of the discount, again assuming they take out forward cover on all foreign currency obligations. Further assume that Stabilo Limited is in a net borrowing position and can borrow at 12% per annum from a local bank. (12 Marks) 3.3 A company is due to make payment is due in 3 months' time of 8 million. / Spot rate Expected rate in 3 months (3 month forward) REQUIRED Assuming the cost of finance in is 7%. Determine whether a LEAD payment is advisable. (5 Mark) 3.4 Davies plc is due to pay $800,000 in 3 months' time. REQUIRED 1.307 1.340 1.294- 1.290. Current spot Three months forward $/ 1.854 - 1.858 1.864 1.865 Davies decided to use forward contracts to hedge the currency risk. Calculate the amount Davies will pay in if the spot rate in 3 months' time is: i) $1.80 ii) $2.10 (1 Mark) (1 Mark) 3.5 The current exchange rate is Rand/ 22.378. If the forecast inflation rates are 3% in UK and 5% in SA, forecast the exchange rate one year from now. (3 Marks) (30 Marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

31 Pound equivalents of the payments to be made by Stabilo Limited To calculate the pound equivalents well use the forward exchange rates provided a P...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started