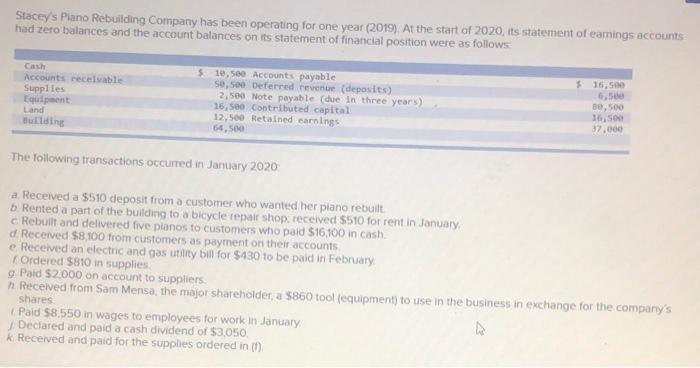

Stacey's Piano Rebuilding Company has been operating for one year (2019). At the start of 2020, its statement of earnings accounts had zero balances and the account balances on its statement of financial position were as follows Cash Accounts receivable Supplies Equipment Land $ 10,500 Accounts payable 50,500 Deferred revenue (deposits) 2,500 Note payable (due in three years) 16,50 Contributed capital 12,500 Retained carnings 64.500 16,500 6,50 B0, 500 16,500 37.000 The following transactions occurred in January 2020 a Received a $510 deposit from a customer who wanted her piano rebuilt b. Rented a part of the building to a bicycle repair shop, received $510 for rent in January Rebuilt and delivered five pianos to customers who paid 516,100 in cash d. Received $8,100 from customers as payment on their accounts e Received an electric and gas utility bill for $430 to be paid in February Ordered $810 in supplies g Paid $2.000 on account to suppliers. n. Received from Sam Mensa, the major shareholder, a $860 tool (equipment) to use in the business in exchange for the company's shares Paid $8,550 in wages to employees for work in January Declared and paid a cash dividend of $3,050, * Received and paid for the supplies ordered in Stacey's Piano Rebuilding Company has been operating for one year (2019). At the start of 2020, its statement of earnings accounts had zero balances and the account balances on its statement of financial position were as follows Cash Accounts receivable Supplies Equipment Land $ 10,500 Accounts payable 50,500 Deferred revenue (deposits) 2,500 Note payable (due in three years) 16,50 Contributed capital 12,500 Retained carnings 64.500 16,500 6,50 B0, 500 16,500 37.000 The following transactions occurred in January 2020 a Received a $510 deposit from a customer who wanted her piano rebuilt b. Rented a part of the building to a bicycle repair shop, received $510 for rent in January Rebuilt and delivered five pianos to customers who paid 516,100 in cash d. Received $8,100 from customers as payment on their accounts e Received an electric and gas utility bill for $430 to be paid in February Ordered $810 in supplies g Paid $2.000 on account to suppliers. n. Received from Sam Mensa, the major shareholder, a $860 tool (equipment) to use in the business in exchange for the company's shares Paid $8,550 in wages to employees for work in January Declared and paid a cash dividend of $3,050, * Received and paid for the supplies ordered in