Question

Stacy Company issued five-year, 10% bonds with a face value of $10,000 on January 1, 2010. Interest is paid annually on December 31. The market

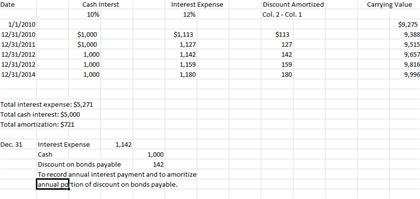

Stacy Company issued five-year, 10% bonds with a face value of $10,000 on January 1, 2010. Interest is paid annually on December 31. The market rate of interest on this date is 12%, and Stacy Company receives proceeds of $9,275 on the bond issuance. 1) Prepare a five-year table to amortize the discount using the effective interest method. 2) What is the total interest expense over the life of the bonds? cash interest payment? discount amortization? 3) Prepare the journal entry for the payment of interest and the amortization of discount on December 31, 2012 (the third year), and determine the balance sheet presentation of the bonds on that date.

Stacy Company issued five-year, 10% bonds with a face value of $10,000 on January 1, 2010. Interest is paid annually on December 31. The market rate of interest on this date is 12%, and Stacy Company receives proceeds of $9,275 on the bond issuance. 1) Prepare a five-year table to amortize the discount using the effective interest method. 2) What is the total interest expense over the life of the bonds? cash interest payment? discount amortization? 3) Prepare the journal entry for the payment of interest and the amortization of discount on December 31, 2012 (the third year), and determine the balance sheet presentation of the bonds on that date.

Above is what I've gotten so far. I think it is correct for the most part. I'm just not sure how to determine the balance sheet presentation for year 3 and I can't really find anything in my book to help me.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started