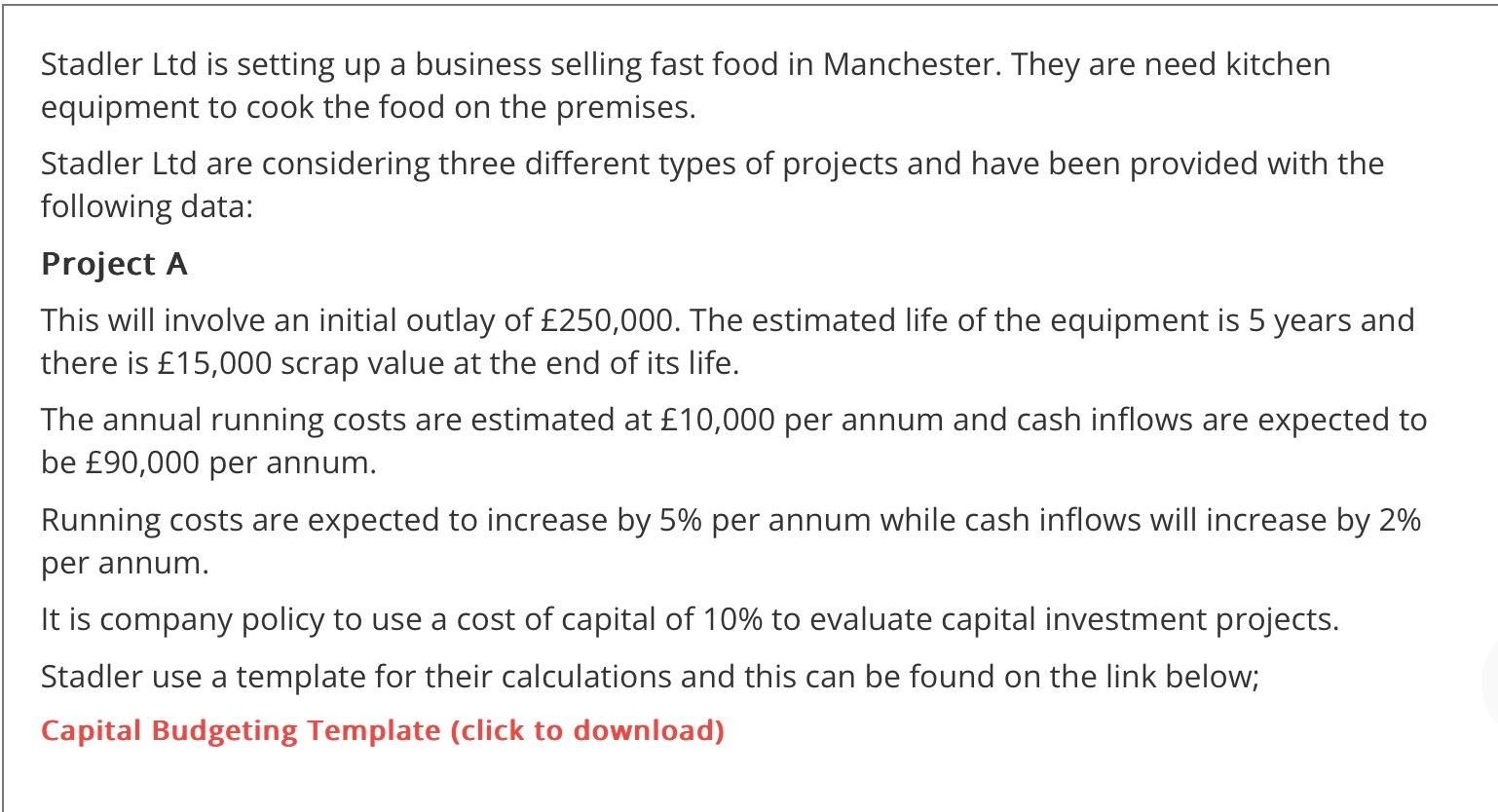

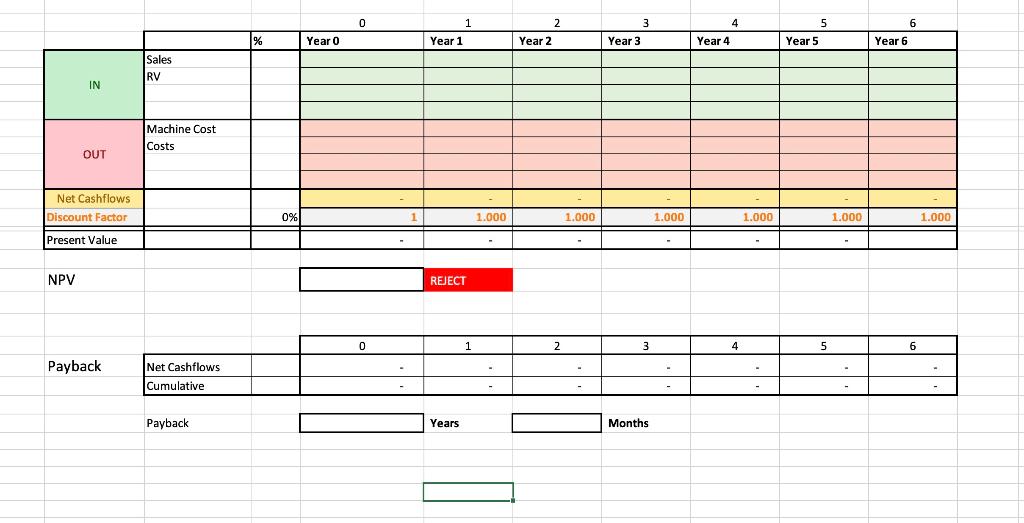

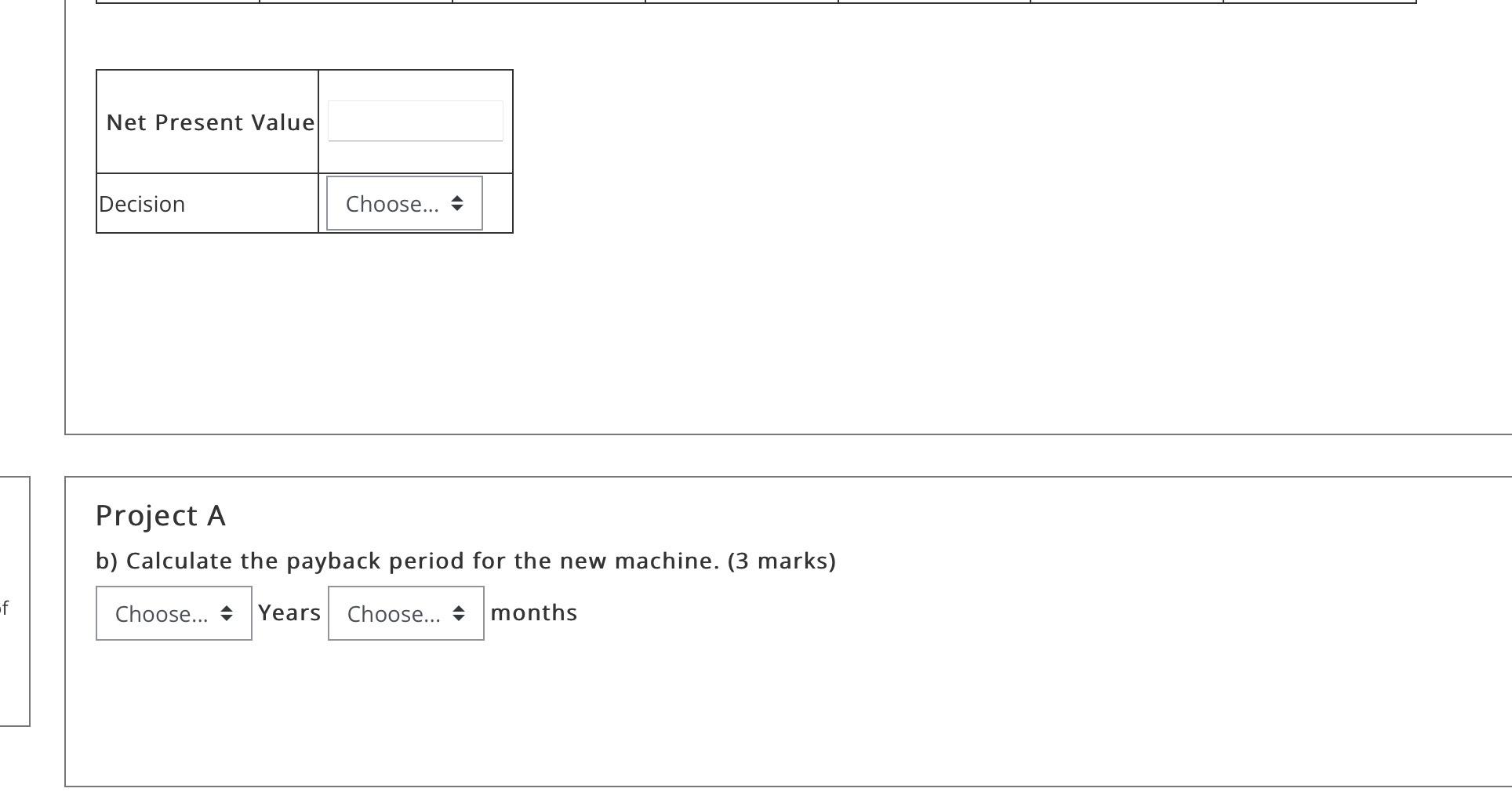

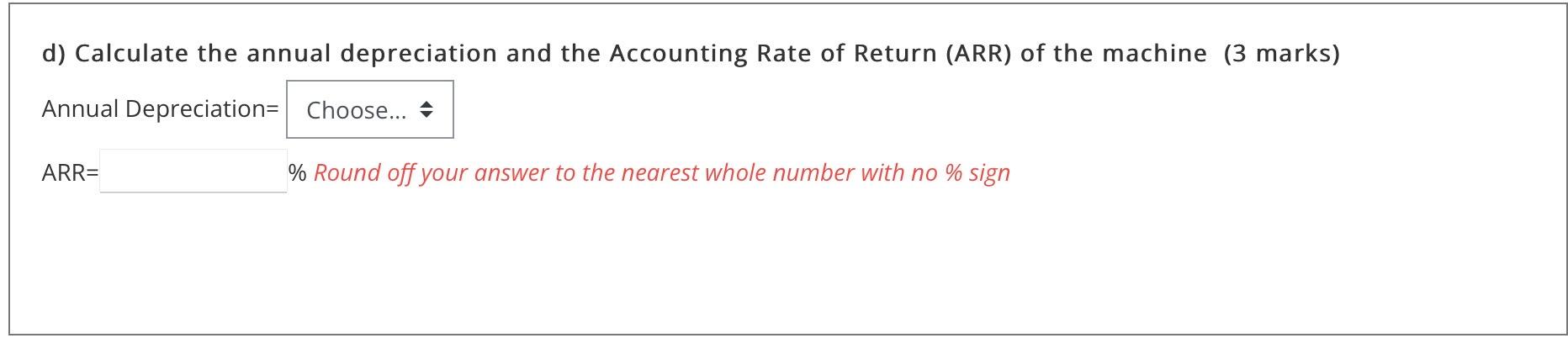

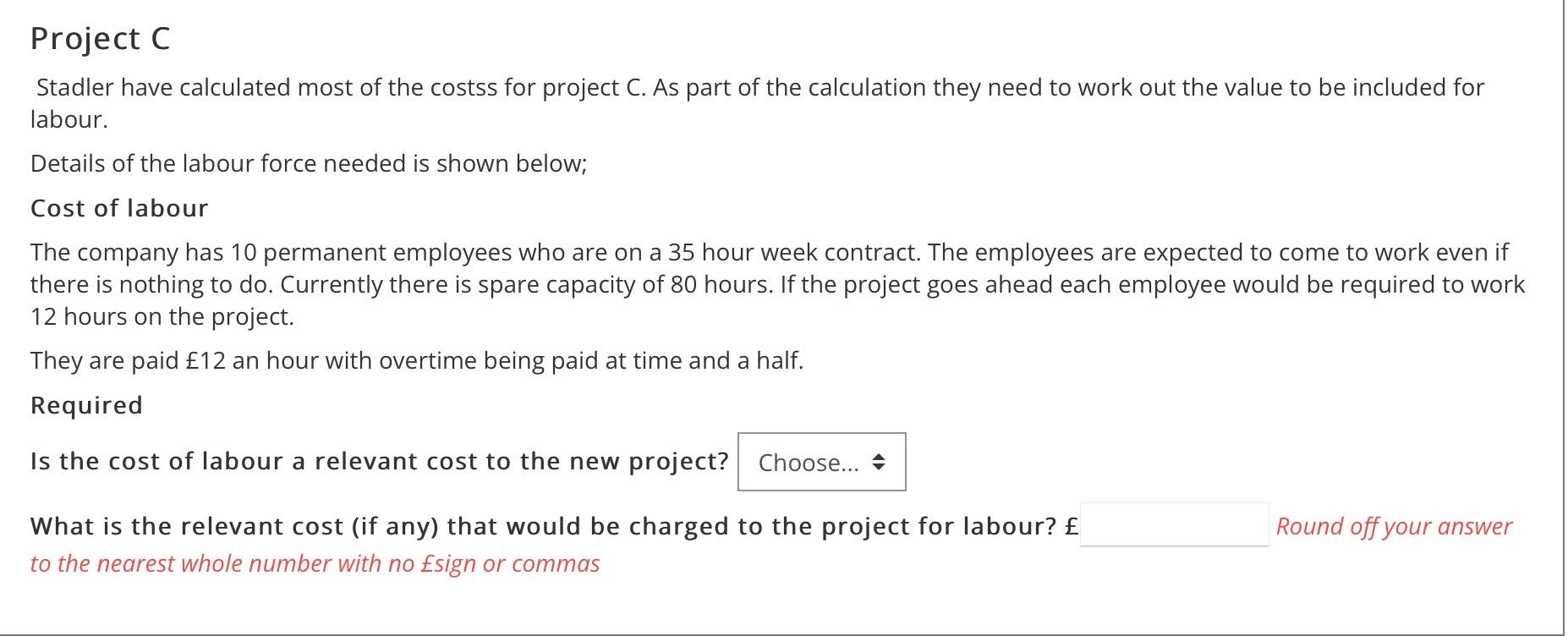

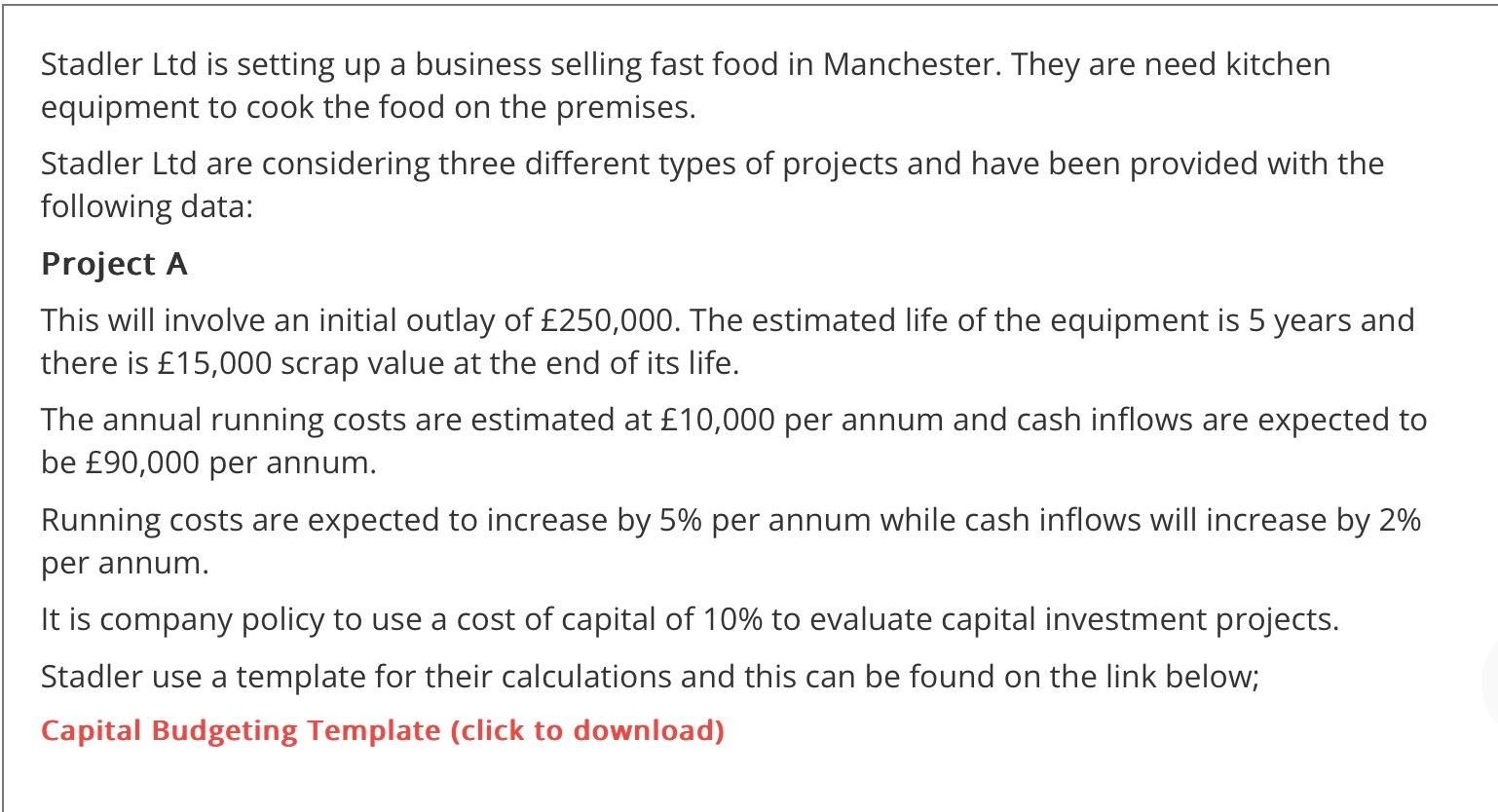

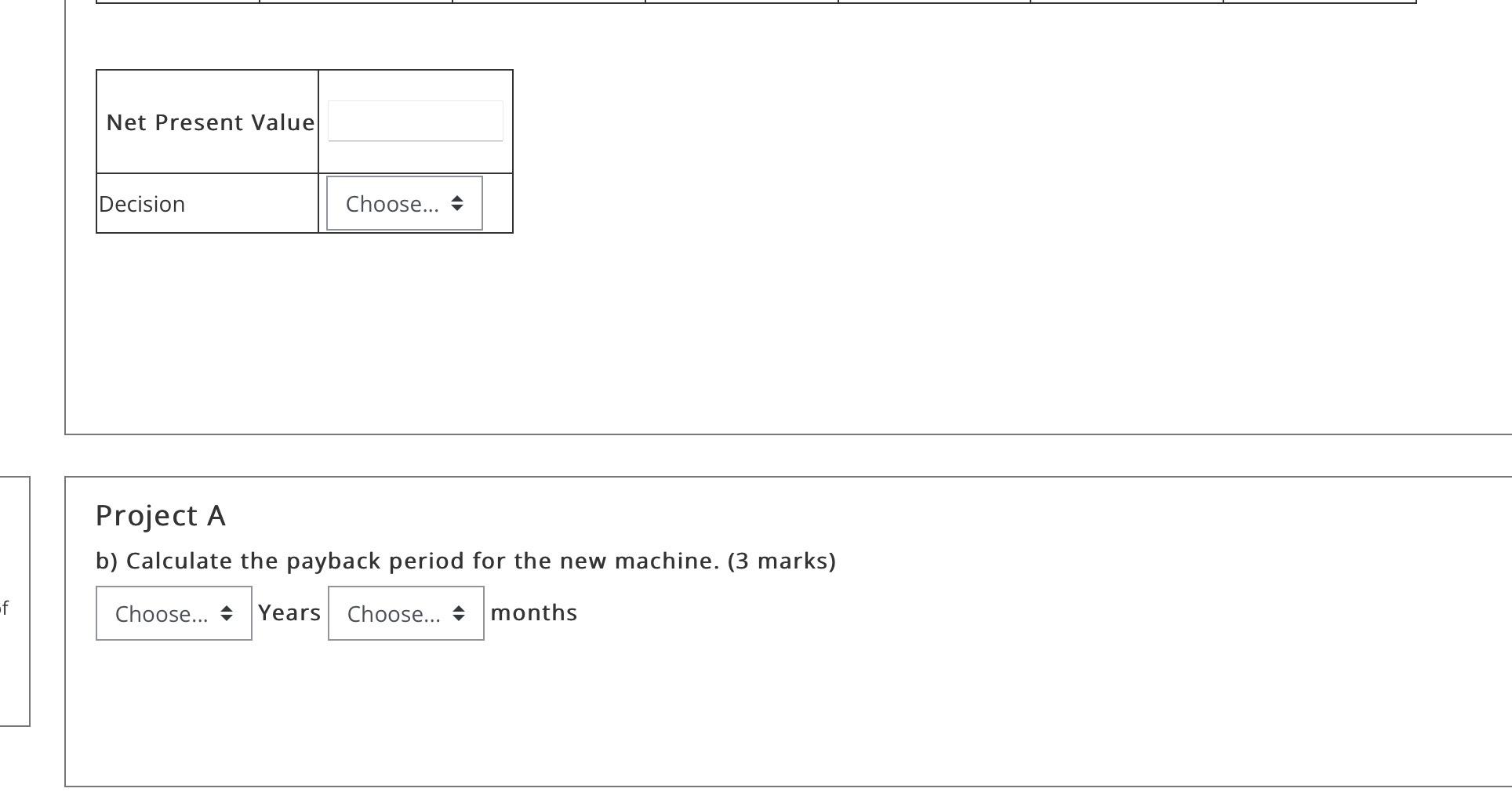

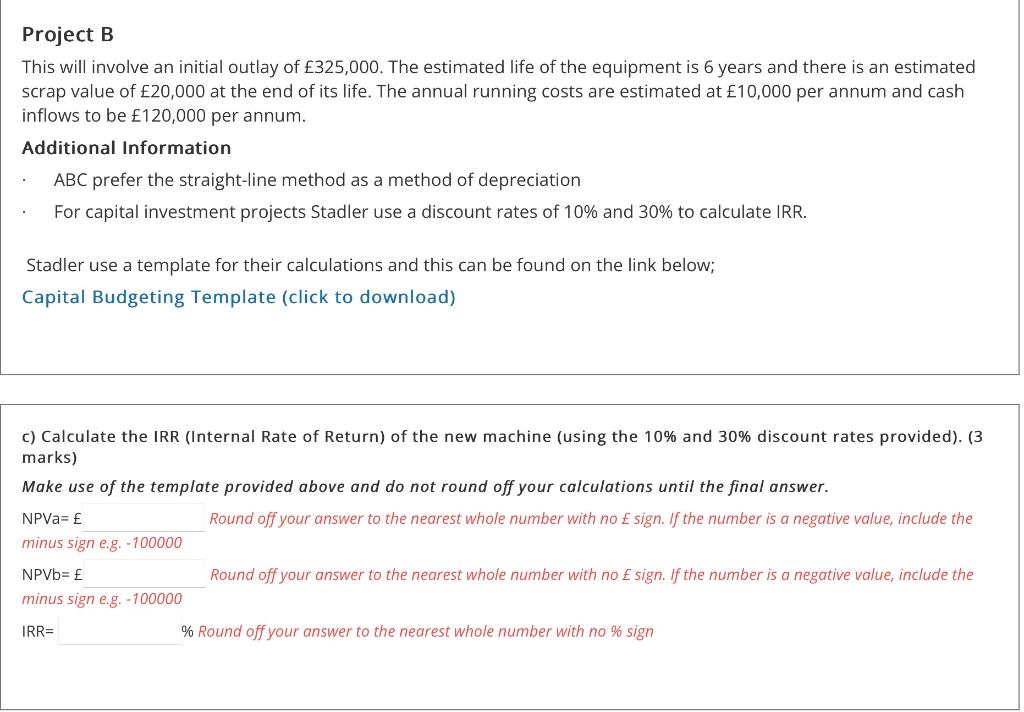

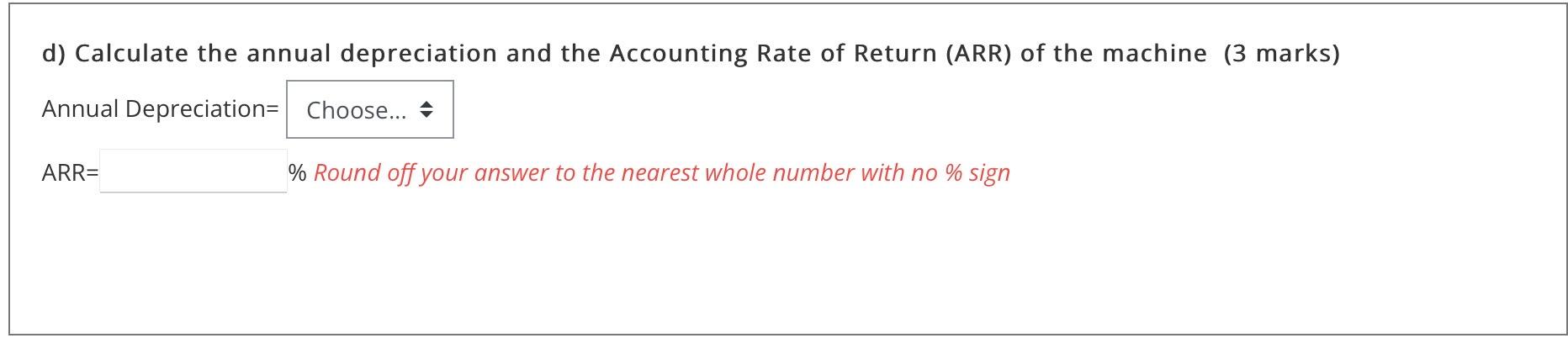

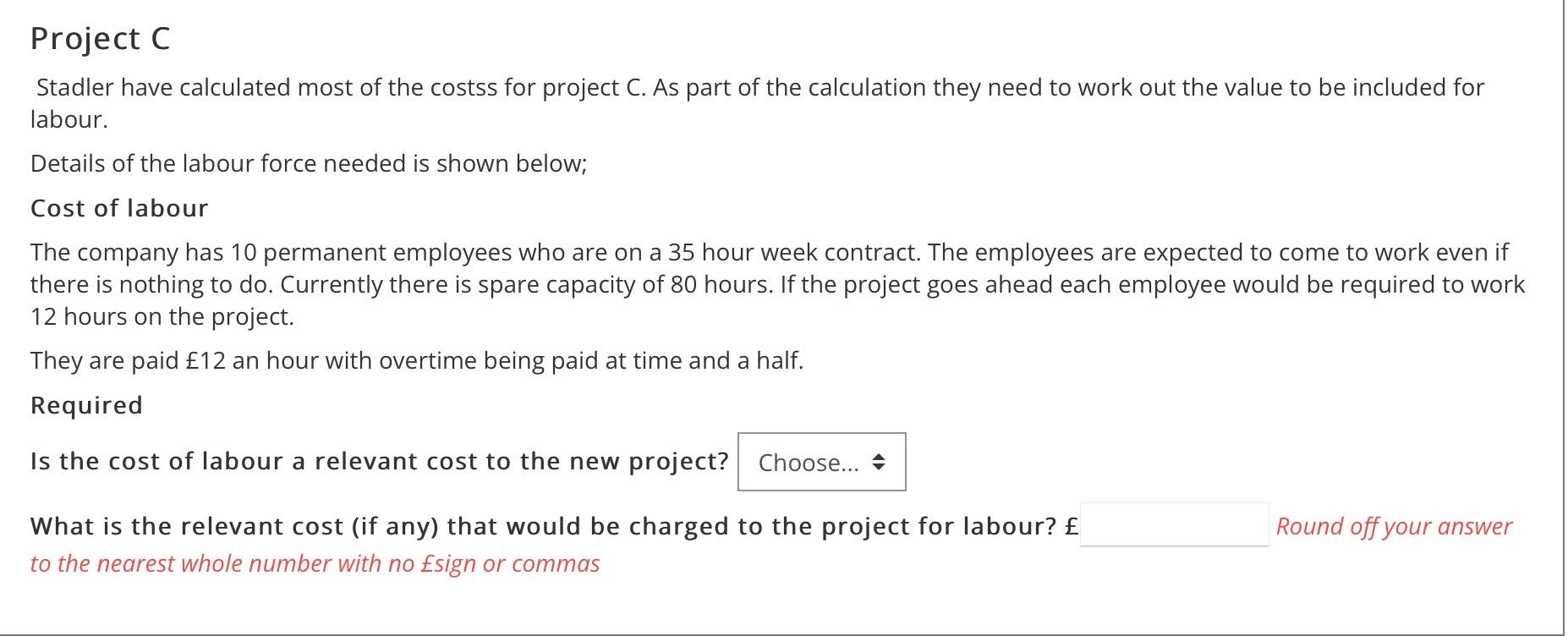

Stadler Ltd is setting up a business selling fast food in Manchester. They are need kitchen equipment to cook the food on the premises. Stadler Ltd are considering three different types of projects and have been provided with the following data: Project A This will involve an initial outlay of 250,000. The estimated life of the equipment is 5 years and there is 15,000 scrap value at the end of its life. The annual running costs are estimated at 10,000 per annum and cash inflows are expected to be 90,000 per annum. Running costs are expected to increase by 5% per annum while cash inflows will increase by 2% per annum. It is company policy to use a cost of capital of 10% to evaluate capital investment projects. Stadler use a template for their calculations and this can be found on the link below; Capital Budgeting Template (click to download) NPV REJCT Payback Years Months Project A b) Calculate the payback period for the new machine. ( 3 marks) Years months Project B This will involve an initial outlay of 325,000. The estimated life of the equipment is 6 years and there is an estimated scrap value of 20,000 at the end of its life. The annual running costs are estimated at 10,000 per annum and cash inflows to be 120,000 per annum. Additional Information ABC prefer the straight-line method as a method of depreciation For capital investment projects Stadler use a discount rates of 10% and 30% to calculate IRR. Stadler use a template for their calculations and this can be found on the link below; Capital Budgeting Template (click to download) c) Calculate the IRR (Internal Rate of Return) of the new machine (using the 10% and 30% discount rates provided). (3 marks) Make use of the template provided above and do not round off your calculations until the final answer. NPVa = Round off your answer to the nearest whole number with no sign. If the number is a negative value, include the minus sign e.g. -100000 NPVb= Round off your answer to the nearest whole number with no sign. If the number is a negative value, include the minus sign e.g. -100000 IRR= \% Round off your answer to the nearest whole number with no \% sign d) Calculate the annual depreciation and the Accounting Rate of Return (ARR) of the machine (3 marks) Annual Depreciation = ARR= % Round off your answer to the nearest whole number with no \% sign Stadler have calculated most of the costss for project C. As part of the calculation they need to work out the value to be included for labour. Details of the labour force needed is shown below; Cost of labour The company has 10 permanent employees who are on a 35 hour week contract. The employees are expected to come to work even if there is nothing to do. Currently there is spare capacity of 80 hours. If the project goes ahead each employee would be required to work 12 hours on the project. They are paid 12 an hour with overtime being paid at time and a half. Required Is the cost of labour a relevant cost to the new project? What is the relevant cost (if any) that would be charged to the project for labour? f Round off your answer to the nearest whole number with no sign or commas Stadler Ltd is setting up a business selling fast food in Manchester. They are need kitchen equipment to cook the food on the premises. Stadler Ltd are considering three different types of projects and have been provided with the following data: Project A This will involve an initial outlay of 250,000. The estimated life of the equipment is 5 years and there is 15,000 scrap value at the end of its life. The annual running costs are estimated at 10,000 per annum and cash inflows are expected to be 90,000 per annum. Running costs are expected to increase by 5% per annum while cash inflows will increase by 2% per annum. It is company policy to use a cost of capital of 10% to evaluate capital investment projects. Stadler use a template for their calculations and this can be found on the link below; Capital Budgeting Template (click to download) NPV REJCT Payback Years Months Project A b) Calculate the payback period for the new machine. ( 3 marks) Years months Project B This will involve an initial outlay of 325,000. The estimated life of the equipment is 6 years and there is an estimated scrap value of 20,000 at the end of its life. The annual running costs are estimated at 10,000 per annum and cash inflows to be 120,000 per annum. Additional Information ABC prefer the straight-line method as a method of depreciation For capital investment projects Stadler use a discount rates of 10% and 30% to calculate IRR. Stadler use a template for their calculations and this can be found on the link below; Capital Budgeting Template (click to download) c) Calculate the IRR (Internal Rate of Return) of the new machine (using the 10% and 30% discount rates provided). (3 marks) Make use of the template provided above and do not round off your calculations until the final answer. NPVa = Round off your answer to the nearest whole number with no sign. If the number is a negative value, include the minus sign e.g. -100000 NPVb= Round off your answer to the nearest whole number with no sign. If the number is a negative value, include the minus sign e.g. -100000 IRR= \% Round off your answer to the nearest whole number with no \% sign d) Calculate the annual depreciation and the Accounting Rate of Return (ARR) of the machine (3 marks) Annual Depreciation = ARR= % Round off your answer to the nearest whole number with no \% sign Stadler have calculated most of the costss for project C. As part of the calculation they need to work out the value to be included for labour. Details of the labour force needed is shown below; Cost of labour The company has 10 permanent employees who are on a 35 hour week contract. The employees are expected to come to work even if there is nothing to do. Currently there is spare capacity of 80 hours. If the project goes ahead each employee would be required to work 12 hours on the project. They are paid 12 an hour with overtime being paid at time and a half. Required Is the cost of labour a relevant cost to the new project? What is the relevant cost (if any) that would be charged to the project for labour? f Round off your answer to the nearest whole number with no sign or commas