Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Stamp service revenue from stamps sold to licensees $5,000,000 Cost of redemptions $3,400,000 If all the stamps sold in 2015 were presented for redemption

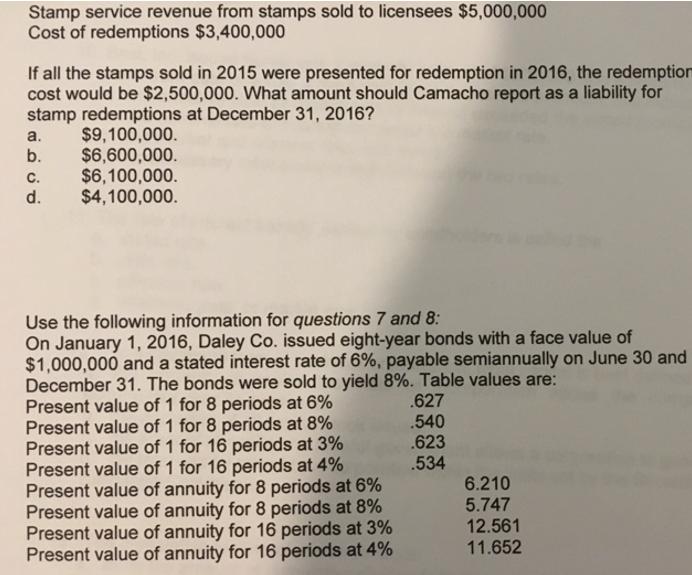

Stamp service revenue from stamps sold to licensees $5,000,000 Cost of redemptions $3,400,000 If all the stamps sold in 2015 were presented for redemption in 2016, the redemption cost would be $2,500,000. What amount should Camacho report as a liability for stamp redemptions at December 31, 2016? $9,100,000. $6,600,000. $6,100,000. $4,100,000. a. b. . d. Use the following information for questions 7 and 8: On January 1, 2016, Daley Co. issued eight-year bonds with a face value of $1,000,000 and a stated interest rate of 6%, payable semiannually on June 30 and December 31. The bonds were sold to yield 8%. Table values are: Present value of 1 for 8 periods at 6% Present value of 1 for 8 periods at 8% Present value of 1 for 16 periods at 3% Present value of 1 for 16 periods at 4% Present value of annuity for 8 periods at 6% Present value of annuity for 8 periods at 8% Present value of annuity for 16 periods at 3% Present value of annuity for 16 periods at 4% .627 .540 .623 .534 6.210 5.747 12.561 11.652

Step by Step Solution

★★★★★

3.40 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Answer Camacho report as a liability for stamp redemptions at December 31 2016 610000...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started