Answered step by step

Verified Expert Solution

Question

1 Approved Answer

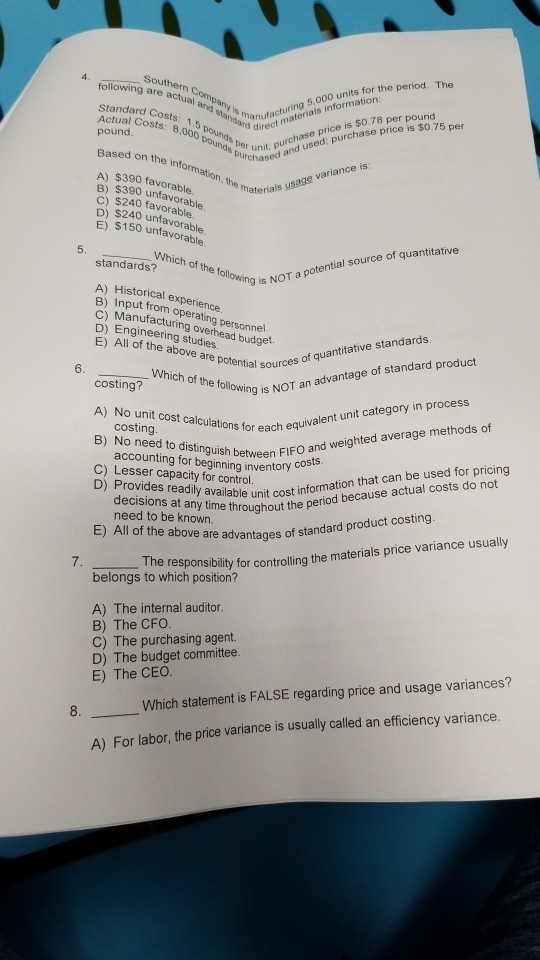

Standard Costs: 1 Actual Costs: 8,000 ounds per unit: Pu an Southern Company is ma e actual arvd standard di anufacturing 5,000 units for direct

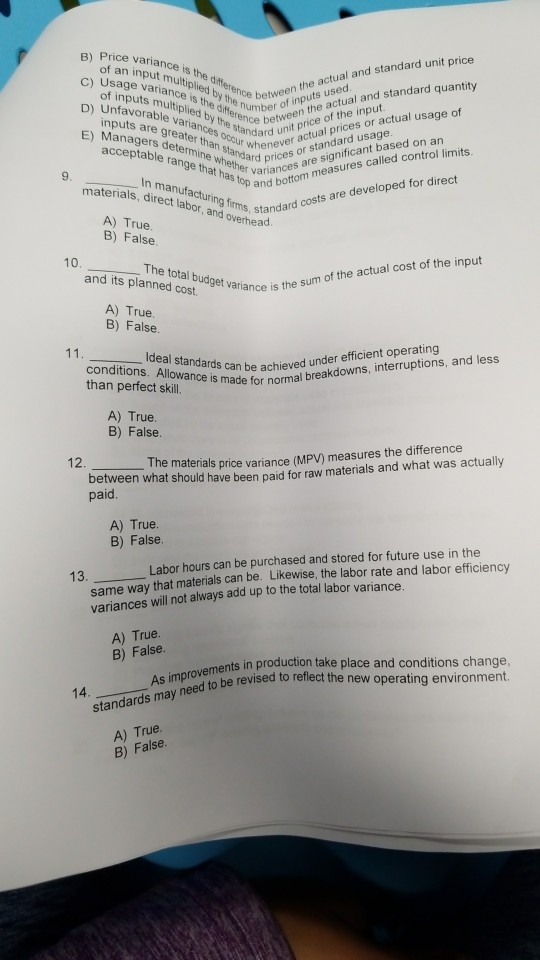

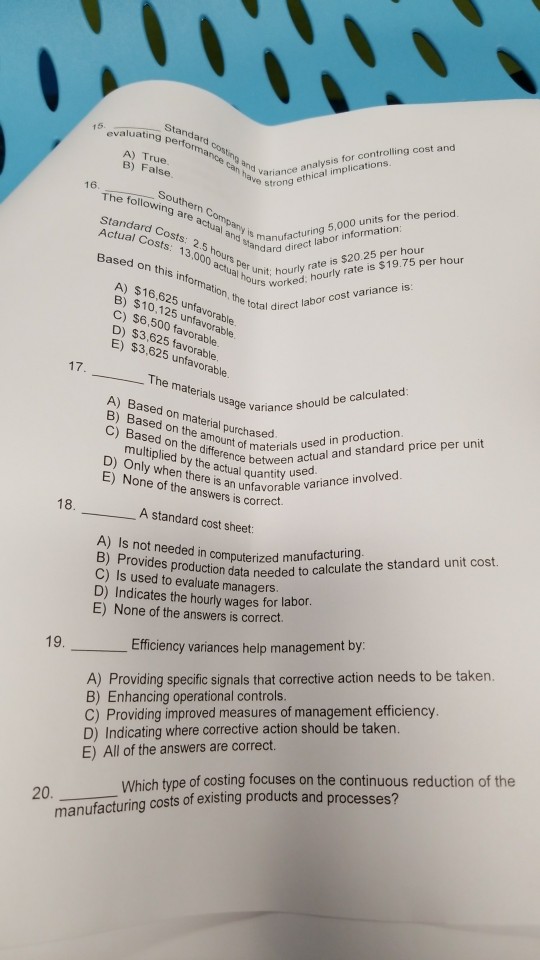

Standard Costs: 1 Actual Costs: 8,000 ounds per unit: Pu an Southern Company is ma e actual arvd standard di anufacturing 5,000 units for direct materials information e period is $0.78 per pound urchase price is $0.75 per pounds purd Based on the information, the mate chased and used; A) $390 favorable. B) $390 unfavorable C) $240 favorable D) $240 unfavorable. E) $150 unfavorable. erials usage variance is 5. Which of the following standards? 9 is NOT a potential source of quantitat A) Historical experience B) Input from operating personnel. C) Manufacturing overhead budget D) Engineering studies E) All of the above are so htial sources of quantitative standards 6 Which of the following costing? A) No unit cost calculations B) No need to dis N ng is NOT an advantage of standard product wFd weighted average methods of available unit cost information that can be used for pricing throughout the period because actual costs do not equiva S for each equivalent unit category in proces C) Lesenting for be Dj Provides readily capacity for control. nning inventory costs decisions at any time pe need to be known. E) All of the above are advantages of sta 7. Th onsibility for controlling the materials price variance usually belongs to which position'? A) The internal auditor. B) The CFO C) The purchasing agent D) The budget committee E) The CEO. Which statement is FALSE regarding price and usage variances? r labor, the price variance is usually called an efficiency variance A) Fo

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started