Answered step by step

Verified Expert Solution

Question

1 Approved Answer

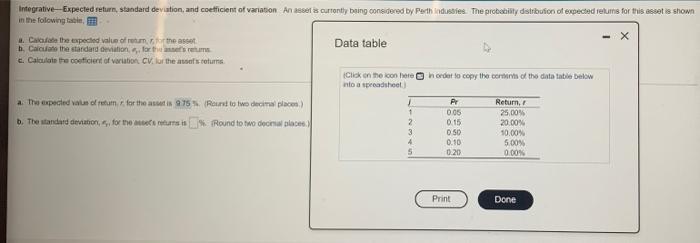

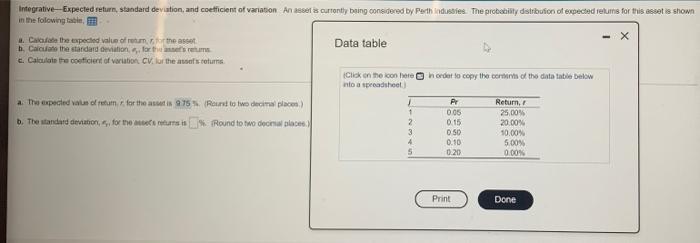

Standard Deviation for the Assets return.expected value of return is 9.75% Integrative-Expected return, standard deviation, and coefficient of variation Anas currently being considered by Perth

Standard Deviation for the Assets return.expected value of return is 9.75%

Integrative-Expected return, standard deviation, and coefficient of variation Anas currently being considered by Perth Industries. The probability distribution of expected returns for this is shown in the folowing tabi a. Calculate the expected value ofretum, or the set h. Calculate the stardardition for the retums Data table c. Calculate the coeficient of varution CV. for the auf returns Click on the con le norder to copy the corner of the datatable below into a spreadsheet a the expected as ortam for the art in a 75 Rund to two decimal place) Return 1 0.06 25.00% . The standard deviation for to meets turns in % Round to wo decinu bloce. 2 0.15 20.00% 3 050 10.00% 4 0.10 5.00% 5 0.20 0.00% PY Print Done

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started