Question

Standup Paddleboarding (SUP) has been growing in popularity over the past five years, and Superior SUP Ltd. has benefitted from the trend. The company produces

Standup Paddleboarding (SUP) has been growing in popularity over the past five years, and Superior SUP Ltd. has benefitted from the trend. The company produces SUP accessories: a board bag to shield the boards from UV rays when the board is stored outside, a lightweight aluminum paddle, and leashes worn around the ankle to ensure the paddleboard and rider are not separated. Sven Swift, the only shareholder of Superior SUP Ltd., has been very conservative in managing the growth of the business. Sven expects the favorable trend for paddleboarding to continue and is considering options to grow the business. In particular, Sven has been attending trade shows over the past year and has become aware of a growing demand for carbon paddles which are lighter and more responsive than the aluminum paddles used by most beginning riders.

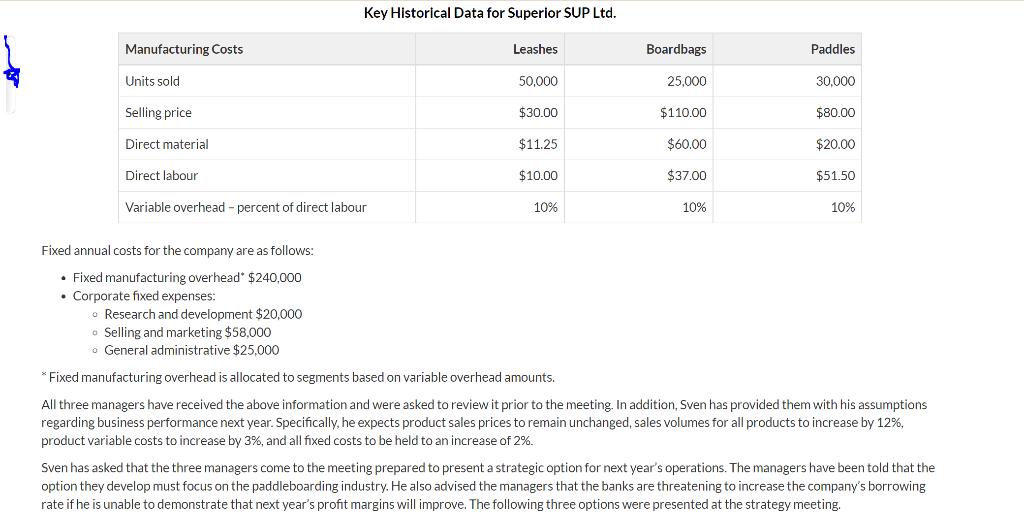

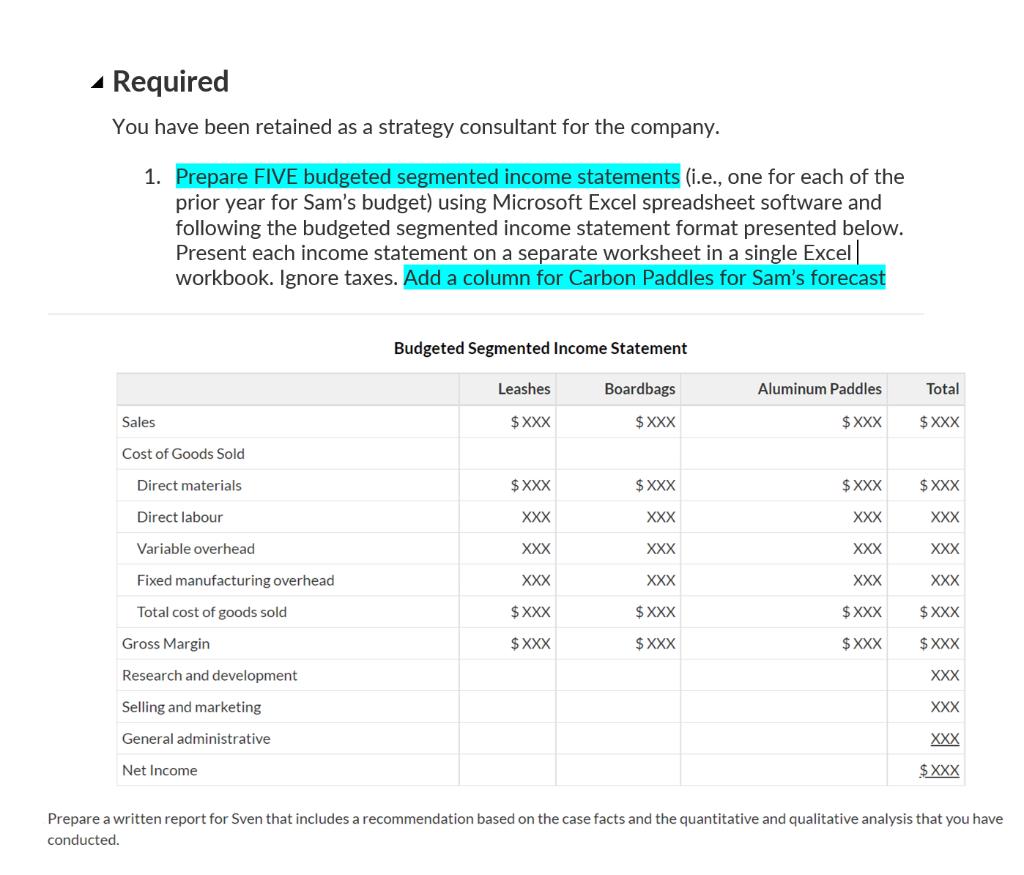

Sven has scheduled a meeting with his senior managers to discuss options for the business. He has also compiled some key historical financial data regarding volume, sales prices, and production costs of the three products sold to date and carbon paddles that may be sold in the future. Planning was perfect in the prior year (as is only possible in a case study!) and the assumption is that there is no inventory at the beginning and end of the year. The prior-year data is presented below:

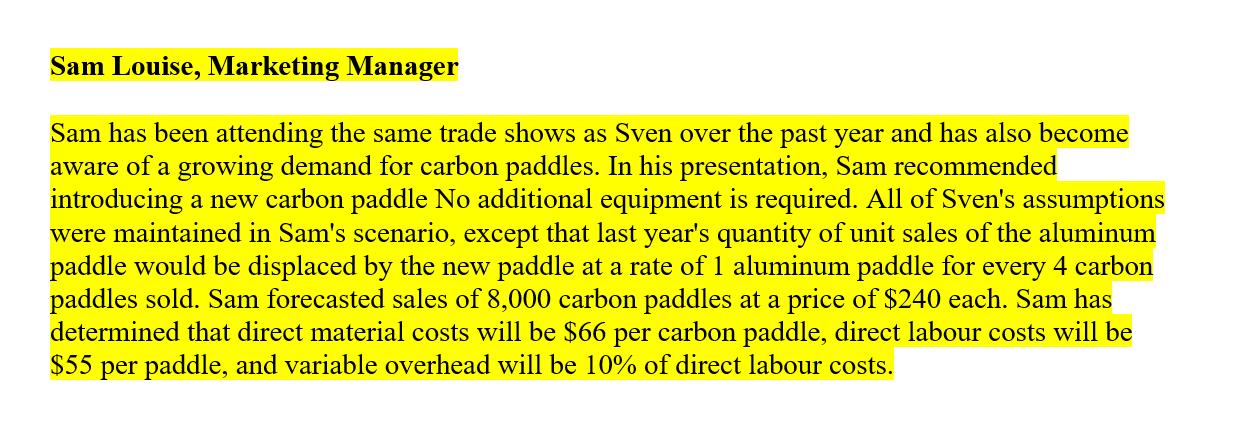

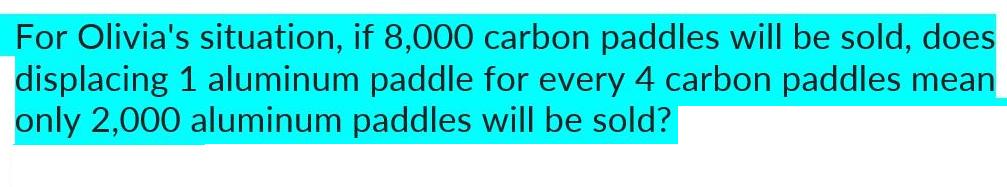

Manufacturing Costs Units sold Key Historical Data for Superior SUP Ltd. Selling price Direct material Direct labour Variable overhead - percent of direct labour Fixed annual costs for the company are as follows: Fixed manufacturing overhead* $240,000 Corporate fixed expenses: Leashes 50,000 $30.00 $11.25 $10.00 10% Boardbags 25,000 $110.00 $60.00 $37.00 10% Paddles 30,000 $80.00 $20.00 $51.50 10% Research and development $20,000 Selling and marketing $58,000 o General administrative $25,000 *Fixed manufacturing overhead is allocated to segments based on variable overhead amounts. All three managers have received the above information and were asked to review it prior to the meeting. In addition, Sven has provided them with his assumptions regarding business performance next year. Specifically, he expects product sales prices to remain unchanged, sales volumes for all products to increase by 12%, product variable costs to increase by 3%, and all fixed costs to be held to an increase of 2%. Sven has asked that the three managers come to the meeting prepared to present a strategic option for next year's operations. The managers have been told that the option they develop must focus on the paddleboarding industry. He also advised the managers that the banks are threatening to increase the company's borrowing rate if he is unable to demonstrate that next year's profit margins will improve. The following three options were presented at the strategy meeting.

Step by Step Solution

3.45 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

File Paste H1 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 A Ready Hom...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started