Answered step by step

Verified Expert Solution

Question

1 Approved Answer

STANLEY'S REACTION Impressed with Roberts's arguments, Stanley decides to pursue these options first. After some thought he decides to consider altering SP's credit terms

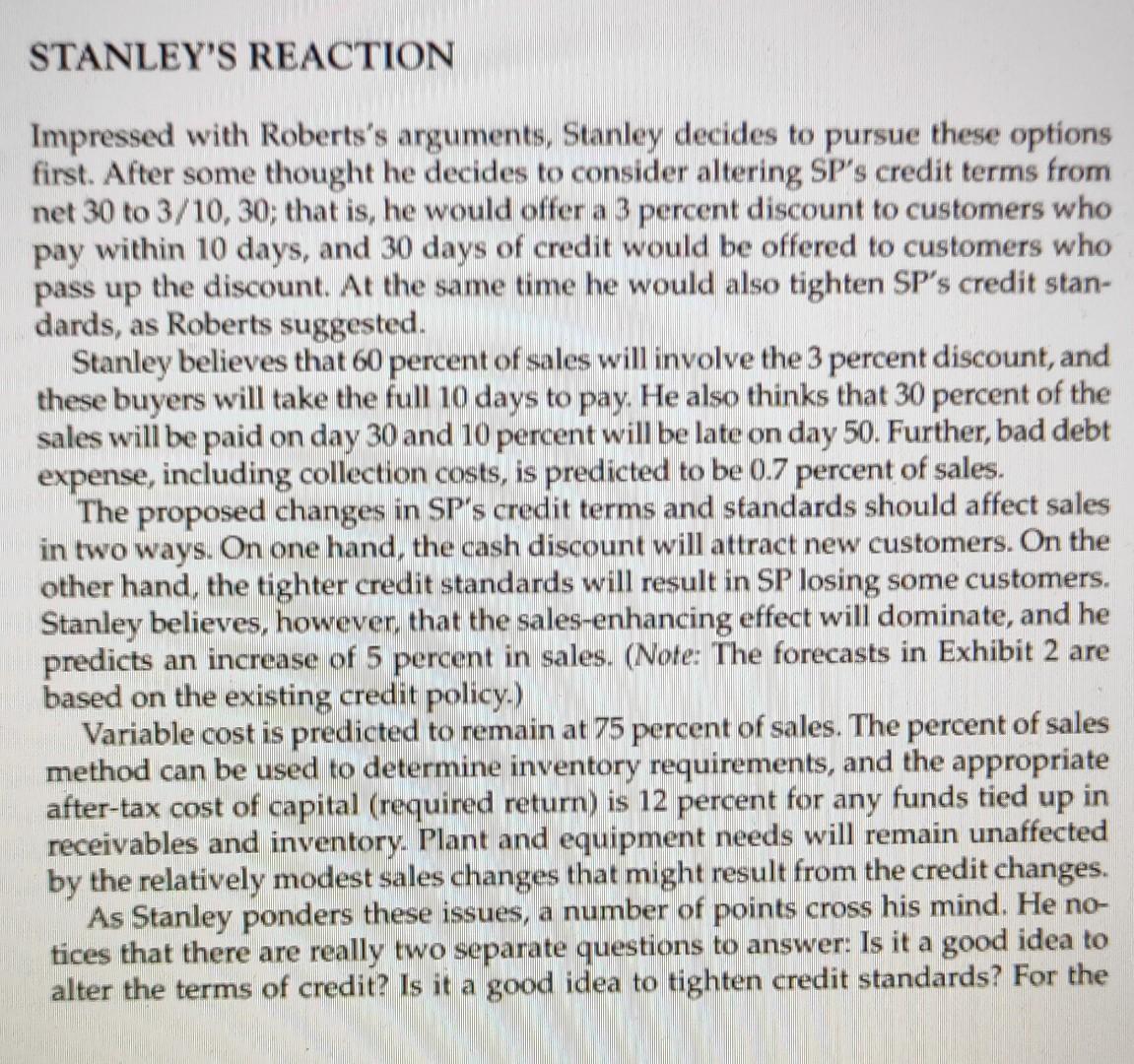

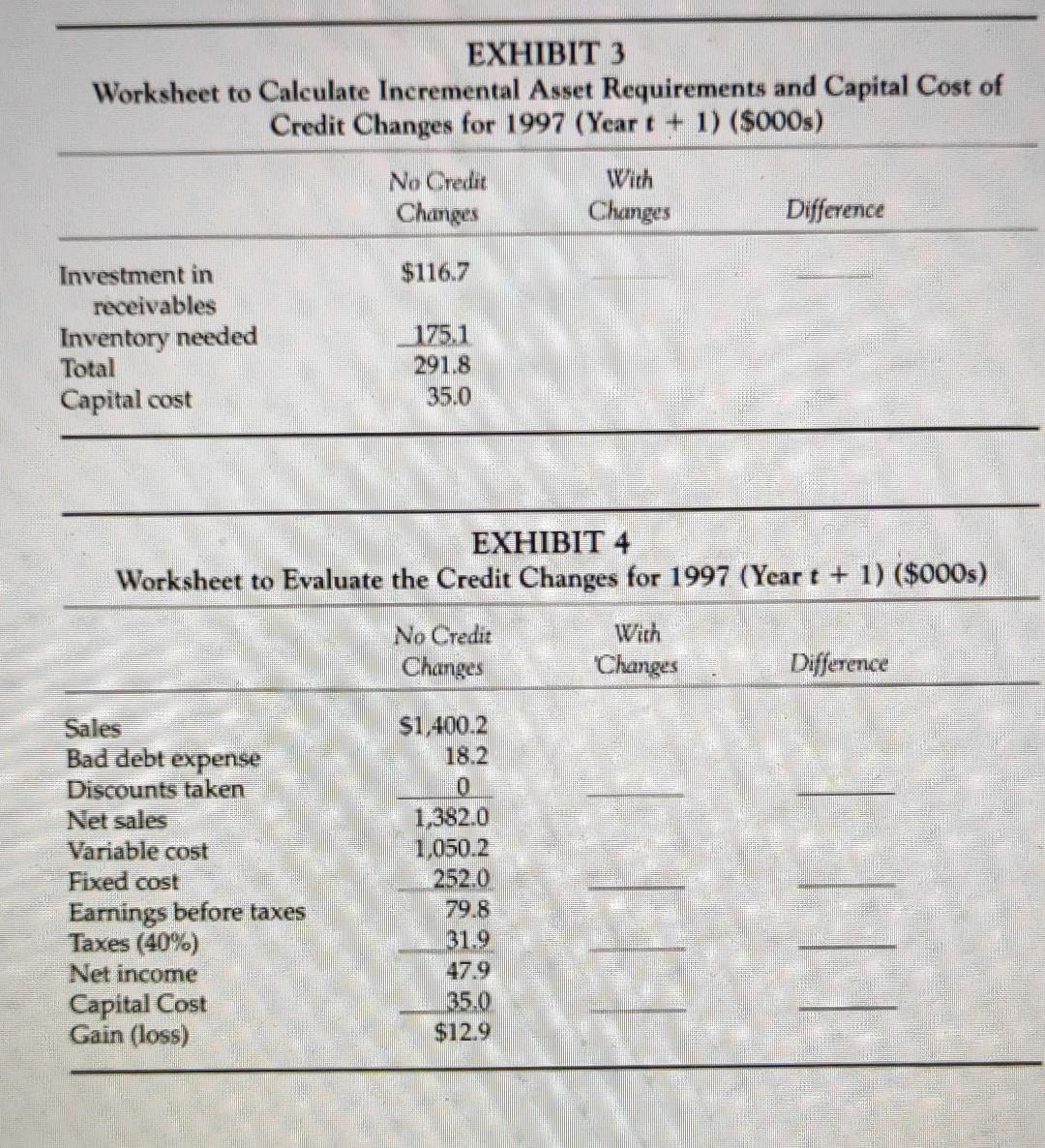

STANLEY'S REACTION Impressed with Roberts's arguments, Stanley decides to pursue these options first. After some thought he decides to consider altering SP's credit terms from net 30 to 3/10, 30; that is, he would offer a 3 percent discount to customers who pay within 10 days, and 30 days of credit would be offered to customers who pass up the discount. At the same time he would also tighten SP's credit stan- dards, as Roberts suggested. Stanley believes that 60 percent of sales will involve the 3 percent discount, and these buyers will take the full 10 days to pay. He also thinks that 30 percent of the sales will be paid on day 30 and 10 percent will be late on day 50. Further, bad debt expense, including collection costs, is predicted to be 0.7 percent of sales. The proposed changes in SP's credit terms and standards should affect sales in two ways. On one hand, the cash discount will attract new customers. On the other hand, the tighter credit standards will result in SP losing some customers. Stanley believes, however, that the sales-enhancing effect will dominate, and he predicts an increase of 5 percent in sales. (Note: The forecasts in Exhibit 2 are based on the existing credit policy.) Variable cost is predicted to remain at 75 percent of sales. The percent of sales method can be used to determine inventory requirements, and the appropriate after-tax cost of capital (required return) is 12 percent for any funds tied up in receivables and inventory. Plant and equipment needs will remain unaffected by the relatively modest sales changes that might result from the credit changes. As Stanley ponders these issues, a number of points cross his mind. He no- tices that there are really two separate questions to answer: Is it a good idea to alter the terms of credit? Is it a good idea to tighten credit standards? For the EXHIBIT 3 Worksheet to Calculate Incremental Asset Requirements and Capital Cost of Credit Changes for 1997 (Year t + 1) ($000s) Investment in receivables Inventory needed Total Capital cost Sales Bad debt expense Discounts taken Net sales Variable cost Fixed cost No Credit Changes $116.7 Earnings before taxes Taxes (40%) Net income Capital Cost Gain (loss) 175.1 291.8 35.0 EXHIBIT 4 Worksheet to Evaluate the Credit Changes for 1997 (Year t + 1) ($000s) No Credit Changes $1,400.2 18.2 With Changes 1,382.0 1,050.2 252.0 79.8 31.9 47.9 35.0 $12.9 With Changes Difference 11 Difference

Step by Step Solution

★★★★★

3.29 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

The credit agreement is a legally binding contract between the bank and the business It sets out the terms and conditions under which the bank loans money to the business including the interest and pr...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started