Answered step by step

Verified Expert Solution

Question

1 Approved Answer

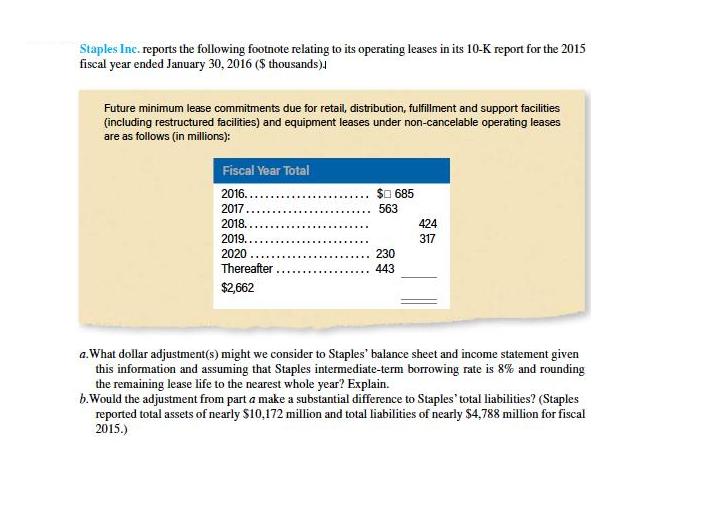

Staples Inc. reports the following footnote relating to its operating leases in its 10-K report for the 2015 fiscal year ended January 30, 2016

Staples Inc. reports the following footnote relating to its operating leases in its 10-K report for the 2015 fiscal year ended January 30, 2016 ($ thousands). Future minimum lease commitments due for retail, distribution, fulfillment and support facilities (including restructured facilities) and equipment leases under non-cancelable operating leases are as follows (in millions): Fiscal Year Total 2016.. 2017 2018. 2019. 2020 Thereafter $2,662 $0 685 563 230 443 424 317 a. What dollar adjustment(s) might we consider to Staples' balance sheet and income statement given this information and assuming that Staples intermediate-term borrowing rate is 8% and rounding the remaining lease life to the nearest whole year? Explain. b. Would the adjustment from part a make a substantial difference to Staples' total liabilities? (Staples reported total assets of nearly $10,172 million and total liabilities of nearly $4,788 million for fiscal 2015.)

Step by Step Solution

★★★★★

3.35 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

a The adjustment to Staples balance sheet would be to add the present value of the future minimum le...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started